Download free PDF

Anti-inflammatory Drugs Market – By Drug Class, By Indication, By Route of Administration, By Type, By Distribution Channel - Global Forecast, 2026-2035

Report ID: GMI5976

|

Published Date: February 2026

|

Report Format: PDF

Download Free PDF

Authors: Mariam Faizullabhoy, Smita Palkar

Premium Report Details

Base Year: 2025

Companies covered: 16

Tables & Figures: 247

Countries covered: 19

Pages: 152

Download Free PDF

Anti-inflammatory Drugs Market

Get a free sample of this report

Get a free sample of this report Anti-inflammatory Drugs Market

Is your requirement urgent? Please give us your business email

for a speedy delivery!

Anti-inflammatory Drugs Market Size

The global anti-inflammatory drugs market was valued at USD 132.1 billion in 2025. The market is expected to grow from USD 141.3 billion in 2026 to USD 293.4 billion in 2035, growing at a CAGR of 8.5% during the forecast period, according to the latest report published by Global Market Insights Inc.

The anti‑inflammatory drugs market growth can be attributed to the rising prevalence of chronic inflammatory and autoimmune disorders.According to NIH, over 50 million Americans (8% of the U.S. population) are affected by autoimmune diseases, and current data suggests that the prevalence of autoimmune diseases is rising. Epidemiological studies have shown that the incidence of global autoimmune diseases has risen yearly by 19.1%, with rheumatological diseases such as Sjogren’s and lupus rising 7.1% per year. Also, increasing aging populations and lifestyle‑related conditions such as obesity and cardiovascular disease further add to the inflammation‑driven disease burden, stimulating the need for pharmacological intervention.

Advancements in immunology and molecular biology, combined with targeted therapy development, continue to stimulate market expansion. The growing shift from conventional non‑steroidal anti‑inflammatory drugs and corticosteroids toward targeted biologics, small‑molecule inhibitors, and monoclonal antibodies has significantly enhanced treatment outcomes. The anti‑inflammatory drugs market focus on the prevention and treatment of acute and chronic inflammation‑driven disorders, encompassing a broad range of therapeutic classes such as NSAIDs, corticosteroids, biologics, and targeted small molecules. These treatments are aimed at reducing inflammation, alleviating symptoms, preventing disease progression, and improving life outcomes. The market benefits from strong reimbursement frameworks and sustained research investment, particularly in immunology‑focused drug development.

Key players in the anti‑inflammatory drugs market include AbbVie, Johnson & Johnson, Pfizer, Novartis, Amgen, Sanofi, AstraZeneca, Bristol‑Myers Squibb, GlaxoSmithKline, Eli Lilly, F. Hoffmann‑La Roche, and Sun Pharmaceutical Industries. These players actively drive innovation and market growth. They continue to strengthen their market position through robust research and development pipelines, label expansions, biosimilar strategies, and strategic collaborations aimed at addressing the long‑term global burden of inflammatory diseases.

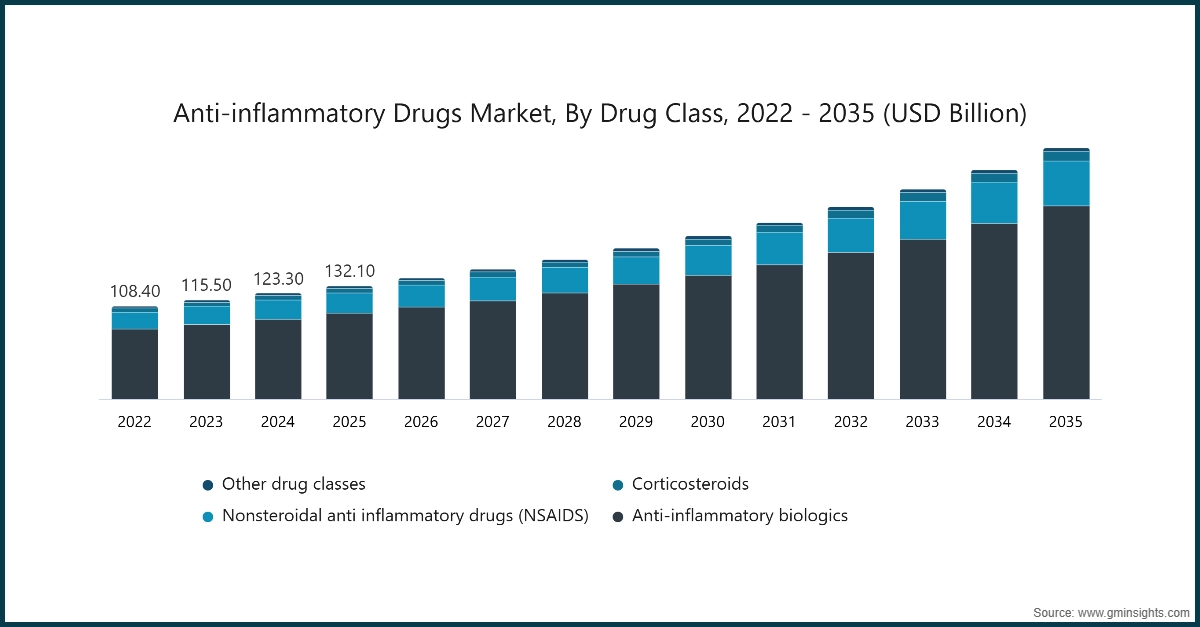

Between 2022 and 2024, the anti‑inflammatory drugs market experienced steady and sustained growth, driven by the expanding adoption of biologics and precision‑based immunotherapies. During this period, the global market increased from approximately USD 108.4 billion in 2022 to over USD 123.3 billion in 2024, supported by rising prescription volumes, lifecycle expansions of established biologics, and the introduction of next‑generation anti‑inflammatory agents, reinforced by the increasing diagnosis rates of autoimmune diseases and broader access to advanced therapies across both developed and emerging markets.

11% market share

Collective market share is 45%

Anti-inflammatory Drugs Market Trends

Anti-inflammatory Drugs Market Analysis

Learn more about the key segments shaping this market

Download Free PDF

Based on the drug class, the global market is segmented into anti-inflammatory biologics, non-steroidal anti-inflammatory drugs (NSAIDS), corticosteroids, and other drug classes. The anti-inflammatory biologics segment dominated the market with a significant market share of 75.5% in 2025 and is anticipated to grow at a CAGR of 8.6% over the forecast years.

Based on the indications, the anti-inflammatory drugs market is classified into rheumatologic diseases, dermatological diseases, gastrointestinal diseases, respiratory diseases, neurological disorders, and other indications. The rheumatologic diseases segment accounted for the highest market revenue of USD 38.7 billion in 2025.

Based on the route of administration, the anti-inflammatory drugs market is classified into oral, topical, parenteral, and other routes of administration. The parenteral segment dominated the market in 2025 and is anticipated to witness growth at a CAGR of 8.3%.

Based on the type, the anti-inflammatory drugs market is classified into prescription and over the counter (OTC). The prescription segment dominated the market in 2025 with a revenue of USD 77.2 billion.

Based on the distribution channel, the anti-inflammatory drugs market is classified into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment held a market share of 45.3% in 2025 and is projected to grow at a CAGR of 8.2% during the analysis period.

North America Anti-inflammatory Drugs Market

Looking for region specific data?

Download Free PDF

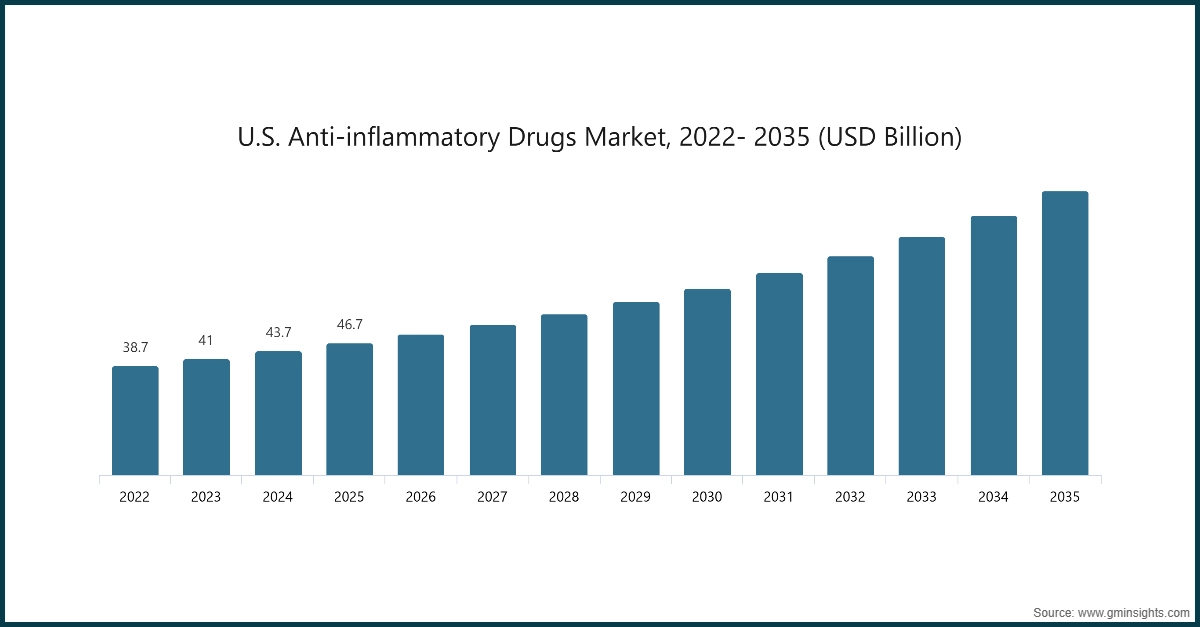

The North America anti-inflammatory drugs market dominated the market with a market share of 39.1% in 2025.

The U.S. anti-inflammatory drugs market was valued at USD 38.7 billion and USD 41 billion in 2022 and 2023, respectively. The market size reached USD 46.7 billion in 2025, growing from USD 43.7 billion in 2024.

Europe Anti-inflammatory Drugs Market

Europe market accounted for USD 36.6 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

Germany dominates the Europe anti-inflammatory drugs market, showcasing strong growth potential.

Asia Pacific Anti-inflammatory Drugs Market

The Asia Pacific market is anticipated to grow at the highest CAGR of 8.8% during the analysis timeframe.

China anti-inflammatory drugs market is estimated to grow with a significant CAGR, in the Asia Pacific market.

Latin American Anti-inflammatory Drugs Market

Brazil leads the Latin American market, exhibiting remarkable growth during the analysis period.

Middle East and Africa Anti-inflammatory Drugs Market

Saudi Arabia market is expected to experience substantial growth in the Middle East and Africa market.

Anti-inflammatory Drugs Market Share

The global anti‑inflammatory drugs market is fragmented, with a group of leading biopharmaceutical companies accounting for a substantial portion of total revenue, while innovation continues to emerge from specialized and mid‑sized players. The top five companies, Johnson & Johnson, AbbVie, Sanofi, Novartis, and F. Hoffmann‑La Roche, collectively account for approximately 45% of the global market, supported by extensive immunology portfolios, strong research and development infrastructure, and well‑established global commercialization networks. These players dominate key therapeutic segments such as rheumatoid arthritis, inflammatory bowel disease, psoriasis, and asthma through blockbuster biologics, next‑generation monoclonal antibodies, and targeted small‑molecule therapies.

The market landscape is further shaped by strategic acquisitions, partnering agreements, and licensing collaborations, enabling companies to accelerate pipeline development, expand indications, and enhance geographic reach, particularly in emerging markets. Leading firms continue to invest heavily in advanced biologics, cytokine inhibitors, and precision immunology platforms, while actively pursuing lifecycle management strategies including label expansions, formulation innovations, and biosimilar entry. At the same time, smaller biotechnology companies and niche immunology specialists contribute to competitive intensity by developing novel mechanisms of action, oral targeted therapies, and differentiated delivery platforms.

Anti-inflammatory Drugs Market Companies

Prominent players operating in the anti-inflammatory drugs industry are as mentioned below:

Johnson & Johnson

Johnson & Johnson holds a leading position in the global anti‑inflammatory drugs market, supported by its strong immunology franchise and advanced biologic platforms targeting chronic inflammatory and autoimmune conditions. Continuous investments in clinical research, lifecycle management, combined with a robust global commercialization network.

AbbVie

AbbVie maintains a strong competitive position in the anti‑inflammatory drugs market through its deep focus on immunology and precision‑based therapies. The company’s portfolio, anchored by Skyrizi and Rinvoq, successfully addresses inflammatory bowel disease, rheumatoid arthritis, psoriatic disease, and other immune‑mediated disorders.

F. Hoffmann-La Roche

F. Hoffmann‑La Roche plays a significant role in the anti‑inflammatory drugs market, leveraging its expertise in biologics, personalized medicine, and immunology‑driven research. The company’s key anti‑inflammatory therapy, Actemra (tocilizumab), is widely used in rheumatoid arthritis and systemic inflammatory conditions, benefiting from Roche’s strong diagnostic‑therapeutic integration capabilities.

Anti-inflammatory Drugs Industry News

The anti-inflammatory drugs market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2022 – 2035 for the following segments:

Click here to Buy Section of this Report

Market, By Drug Class

Market, By Indication

Market, By Route of Administration

Market, By Type

Market, By Distribution Channel

The above information is provided for the following regions and countries: