Home > Animal Health & Nutrition > Feed Additives > Europe Inactive Dry Yeast Market

Europe Inactive Dry Yeast Market Analysis

- Report ID: GMI4871

- Published Date: Nov 2020

- Report Format: PDF

Europe Inactive Dry Yeast Market Analysis

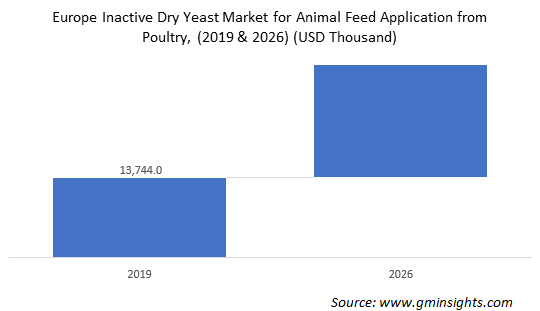

Europe inactive dry yeast market for animal feed application from poultry utilization is estimated to reach over USD 39 million with a CAGR of over 6% by 2026. The product is widely used as poultry feed additive as a source of protein and vitamin in the poultry industry, which helps in boosting the immune system.

Poultry applications consists of broiler, layer, and turkey. Europe is among the major growing regions in terms of layer feed. Whereas, in 2018, the regional broiler feed production was 55 kilo tons as compared to 32.5 kilo tons of layer feed in 2018. Need for a high value protein vitamin product to enhance the poultry health & quality is augmenting the product demand.

The Europe poultry market size accounted for over 13.5 million tons in 2016 and is poised to surpass 15.10 million tons by 2024. Shifting consumer preferences toward dietic nutrition and high protein consumption will favor the poultry market and production in Europe. The Europe poultry market accounted for 14.01 million tons in 2019 and is expected to reach 15.1 million tonnes by 2024. The growing influence toward nutrition security, which ensures efficient protein and calorie supply has led to the development of sustainable policies, including the EU policy paper, to boost livestock production, in turn, favoring Europe inactive dry yeast market for animal feed application.

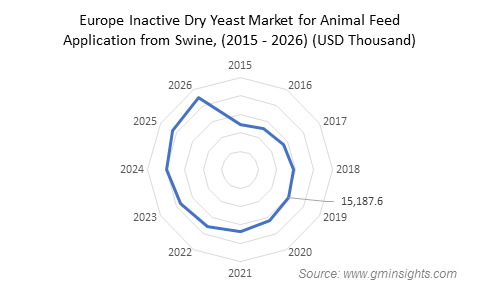

Europe inactive dry yeast market for animal feed application from swine utilization is anticipated to reach over USD 22.5 million by 2026. Europe is the second largest pork producer in the world second to Asia-Pacific. Prophylactic properties of the product resulting in increased animal resistance to diseases and improved performance is fueling the product penetration in Europe. Favorable properties including high palatability which aids in stimulating the feed intake is likely to propel the business growth through swine applications. Moreover, the product offers high protein content, superior amino acid balance, and high levels of Vitamin B, thereby supporting the product adoption rate. Thus, fostering Europe inactive dry yeast industry for animal feed application demand.

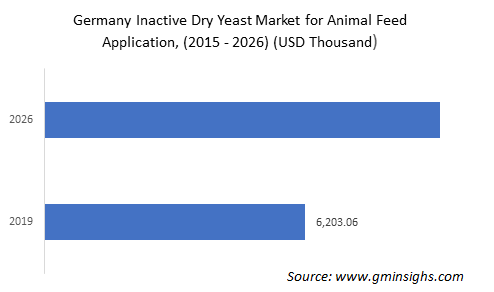

Europe inactive dry yeast market for animal feed application from Germany is estimated to reach over USD 9 million with a CAGR of over 6% through 2026. Germany is the largest consumer of inactive dried yeast in Europe. Large manufacturing capacity along with high consumer spending on quality meat products is driving the business expansion in Germany.

Germany’s meat supply per capita was 87.8 kg in 2017, which is among the highest in the region. Whereas, favorable regulations pertaining to improving the feed quality should fuel industry growth. Other key factors such as increasing diseases in animals along with rise in consumer health consciousness will support the product demand over the projected timeframe.

Furthermore, Germany is the leading pork producer in Europe with about 26 million live swine in 2019. With the rising awareness about the inactive dry yeast in aiding the growth performance, boosting immunity, nutrients digestibility, and increasing meat quality of growing pigs should drive the German industry significantly. Moreover, with the outbreak of bird flu in Germany owing to which about 16,100 turkeys and 70,000 chickens were culled in Germany in November 2020. Furthermore, outbreak of such flu will also augment the demand for feed products including inactive dry yeast to boost the immune system of the animals. Thus, these aforementioned factors should boost Europe inactive dry yeast market for animal feed application statistics.