Home > Automotive > Mobility > Recreational Vehicles > MEA Utility Terrain Vehicles Market

MEA Utility Terrain Vehicles Market Size

- Report ID: GMI3415

- Published Date: Jun 2019

- Report Format: PDF

MEA Utility Terrain Vehicles Market Size

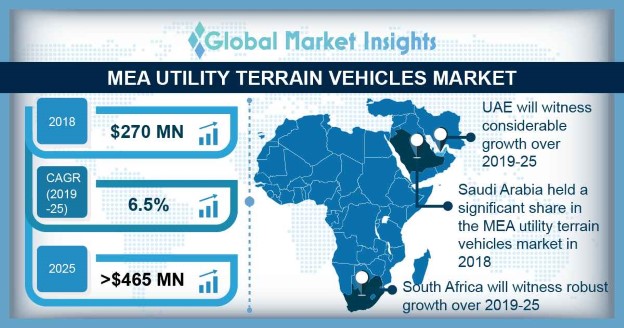

MEA Utility Terrain Vehicles Market size valued at around USD 270 million in 2018 and is estimated to exhibit over 6.5% CAGR from 2019 to 2025.

Increasing preferences of infrastructure contractors and planners for deploying easily operable vehicles on construction sites will propel the MEA utility terrain vehicles (UTV) market size over the study timeframe. Rising investments for infrastructure development and modernization of agricultural transportation are prominently supporting the industry share. For instance, in 2016, Egypt implemented investments in construction and building sector rose to USD 1.4 billion with an increase of over 3% as compared with 2015.

| Report Attribute | Details |

|---|---|

| Base Year: | 2018 |

| MEA Utility Terrain Vehicles (UTV) Market Size in 2018: | 270 Million (USD) |

| Forecast Period: | 2019 to 2025 |

| Forecast Period 2019 to 2025 CAGR: | 6.5% |

| 2025 Value Projection: | 465 Million (USD) |

| Historical Data for: | 2014 to 2018 |

| No. of Pages: | 135 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | Displacement, Application and Region |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

Rising demand for innovative green buildings and modern amenities will support the infrastructure expansion till 2025. Increasing adoption of green revolution technologies is prominently contributing towards developing agricultural sector, further supporting the MEA utility terrain vehicles market share. Significant growth in the agriculture productivity is attributed to increasing utilization of modernized farming equipment and transportation vehicles. For instance, in 2017, Saudi Arabia agricultural output rose to USD 17.5 billion with an increase of over 1.05% as compared with 2016.

Growing demand for utilizing advanced side by side vehicles equipped with comfortable seating arrangements and improved passenger capacities are significantly expanding the MEA utility terrain vehicles market size. Incorporation of advanced interior cockpits and air conditioning systems are primarily improving the passenger comfort and vehicle handling efficiency. Side by side vehicles offering enhanced durability and safety are gaining a higher visibility in construction sector.

Increasing disposable income along with proliferating economic conditions are providing potential opportunities for recreation activities, further strengthening the market size. For instance, in 2017, disposable income in UAE rose to 329.14 billion with an increase of over 7.8% as compared with 2016. Moreover, rising recreational spending is significantly inducing the increased youth participation in outdoor leisure activities.

Provision of finance assistance policies and promotional deals offered will escalate the product penetration over the study timeframe. Rising tourism industry is positively impacting the GDP, further enhancing the MEA utility terrain vehicles market size. For instance, in 2018, travel industry in UAE rose to USD 44.8 billion with an increase of over 2.4% as compared with 2017.