Home > Chemicals & Materials > Specialty Chemicals > Custom Synthesis > Hydrazine Hydrate Market

Hydrazine Hydrate Market Size

- Report ID: GMI844

- Published Date: Dec 2016

- Report Format: PDF

Hydrazine Hydrate Market Size

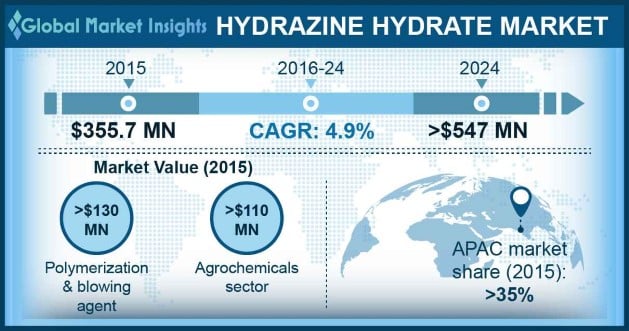

Hydrazine Hydrate Market size generated around USD 355.7 million in 2015 and is forecast to witness gains at CAGR of 4.9% to 2024. Rising demand of polymer foams in polymer industry will have a great influence on the product business throughout the forecast timeframe.

Its application in a wide range of products which includes food containers, foamed core pipes, vinyl sheets, and structural foam wood grain furniture will propel the hydrazine hydrate market growth. The global polymer foam market volume was recorded at over 2,000 kilo tons in 2015 and will have a decent growth at CAGR above 4% from 2016 to 2024. The growth in the end-user industries such as building & construction, packaging, automotive, and furniture & bedding industries will drive the market for polymer foams in the coming eight years.

The growing need for agrochemicals owing to demand for better quality agricultural product for food and other purposes is another factor that will drive the global hydrazine hydrate market in next few years. Higher growth rate of the global population in comparison to the growth in arable lands is a matter of concern.

As per the World Bank, farmers all around the world need to increase their crop yield by almost 50% per hectare by the end of 2050. This will encourage the market for agrochemicals in the forecast period. The global agrochemical industry recorded a revenue of over USD 70 billion in 2015 and is anticipated to grow at a CAGR more than 6% from 2016 to 2024. The extensive use of hydrazine hydrate for manufacturing of several insecticides, pesticides and fungicides owing to its chemical nature will boost the hydrazine hydrate demand. Hydrazine also finds application in foliar treatment of potatoes to prevent them from sprouting during storage.

| Report Attribute | Details |

|---|---|

| Base Year: | 2015 |

| Hydrazine Hydrate Market Size in 2015: | 355.7 Million (USD) |

| Forecast Period: | 2016 to 2024 |

| Forecast Period 2016 to 2024 CAGR: | 4.9% |

| 2024 Value Projection: | 547.6 Million (USD) |

| Historical Data for: | 2013 to 2015 |

| No. of Pages: | 105 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | End-User and Region |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

The prospective trend of using hydrazine hydrate fuel cells will open a range of opportunities for the hydrazine hydrate market in upcoming years. For instance, Daihatsu Motor Co. Ltd, in Japan, has made hydrazine hydrate-based fuel cells with output density close to that of hydrogen fuel cells. The absence of carbon dioxide in the emission has a positive effect on the application of these fuel cells and growing R&D in this field will create a healthy market in future.

However, the toxic nature of the chemical will pose a threat to the market growth as a result of several environmental and industry usage norms imposed by OSHA and National Institute for Occupational Safety and Health (NIOSH), USA. Experimental results showing the carcinogenic properties of hydrazine hydrate will also restrain the market growth from 2016 to 2024. It has been classified as Group 2B by the International Agency for Research on Cancer (IARC). Furthermore, disposal of the wastes is also an environmental concern and is expected to hamper the hydrazine hydrate market growth in the forecast timeframe.