Home > Chemicals & Materials > Specialty Chemicals > Custom Synthesis > Glycol Ether Market

Glycol Ether Market Size

- Report ID: GMI3269

- Published Date: Apr 2019

- Report Format: PDF

Glycol Ether Market Size

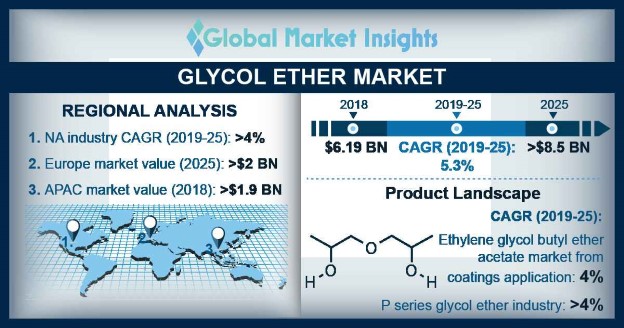

Glycol Ether Market size crossed USD 6 billion in 2018, registering a CAGR of 5.3% and may expect consumption at over 2.9 million tons by 2025. Increasing usage in personal care, cleaners, paints & coatings, pharmaceutical, and printing industries should drive the global market. Rise in water-based coatings demand will augment product requirement, as it is used as a coalescing agent in these coatings. This in consequence will drive industry growth from personal care and printing inks sectors.

Glycol ether is widely used in personal care products and cosmetics in the formulation of skin & hair products, shampoos, personal cleanliness products, and bath products. Global cosmetics business may surpass $450 million by 2025, with gains at over 4.5%. Rise in per-capita disposable income along with change in lifestyle with increasing demand for skin care products owing to varying climatic conditions should boost industry growth. Rapid rise in personal care sector due to increasing consumer consciousness regarding health hygiene may accelerate the glycol ether market share.

| Report Attribute | Details |

|---|---|

| Base Year: | 2018 |

| Glycol Ether Market Size in 2018: | 6 Billion (USD) |

| Forecast Period: | 2019 to 2025 |

| Forecast Period 2019 to 2025 CAGR: | 5.3% |

| 2025 Value Projection: | 8.5 Billion (USD) |

| Historical Data for: | 2014 to 2018 |

| No. of Pages: | 400 |

| Tables, Charts & Figures: | 649 |

| Segments covered: | Product and Region |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

Increasing economic growth of glycol ethers market will augment printing inks demand owing to its widespread usage in publishing print products such as books, newspapers, journals, technical printed material and magazines. Global printing inks segment demand is projected to reach $25 billion up to 2025 on account of growing demand from corrugated cardboards, and flexible packaging applications. Glycol ether is widely utilized in printing inks manufacturing owing to its quick drying nature and compatibility with high speed roll to roll yardage printing.

Rise in consumer consciousness and changing sociological perceptions towards environment sustainability will boost glycol ether market demand in automotive sector. In 2018, China accounted for about 30% of the global vehicle sales. Rising demand for nontoxic coatings & shifting consumer perceptions towards improved technological changes, vehicle color coupled with growing automobile business will stimulate the paints and coating business demand.

They are widely used in protection against external environmental factors such as UV radiation and acid rain which will further stimulate the market growth.

Glycol ether is restricted in consumer goods due to stringent regulations from FDA and EU. The complex nature of organic materials & its compatibility with inorganic substances with respect to toxicity, effervescence, & fume makes it difficult to conduct systematic research towards safety and efficiency, which is mainly hindering the glycol ether market growth. Low level and direct exposure of the product in humans can result in conjunctivitis, upper respiratory track irritation, headache, temporary corneal clouding, and nausea.