Home > Automotive > Automotive Technology > Automotive Sensors > Automotive NFC Market

Automotive NFC Market Analysis

- Report ID: GMI398

- Published Date: May 2019

- Report Format: PDF

Automotive NFC Market Analysis

The 212 Kbit/S automotive NFC market is expected to grow at a CAGR of over 30% during the forecast time period. The 212 Kbit/S NFC tags have been extensively used in various mid-range and high-end automotive as they provide optimum data transmission speeds to automotive electronic components. The companies are focusing on increasing the memory capacity of 212 Kbit/S NFC tags, which has enabled the creation of a wide range of 212 NFC devices with its inbuilt memory ranging from 96 Kbytes to 1 Mbyte. These products provide read access control and write access control functionalities to prevent any unauthorized access emanating through external sources. The 212 Kbit/S devices are gradually losing their market share to 424 Kbit/S NFC tags as they are offering higher data transmission rates.

The 106 Kbit/S automotive NFC devices attained a CAGR of over 16% during the projected time period due to its high degree of compatibility with other automotive components. The automotive NFC tags with 106 Kbit/S speeds have been widely used in the lower end automobiles as their electronic components require lower data transmission speeds. The OEMs and automotive suppliers are constantly working to increase the storage capacity of 106 Kbit/S NFC tags. These memory enhancement efforts are focused on increasing their use in various sophisticated applications and add new security functionalities, promoting their adoption in various advanced automotive functionalities.

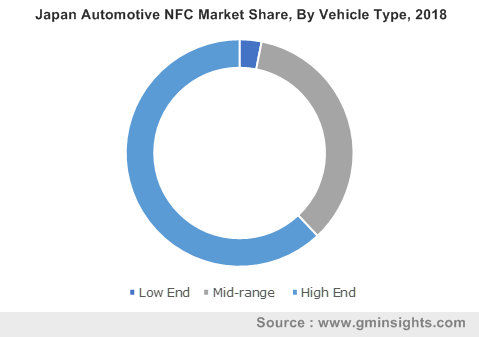

The mid-range vehicle segment in automotive NFC market will grow at a CAGR of 37% during the forecast timeline due to the increasing adoption of luxury car features in the mid-range car segment, which is attributed to the rising need for personalization in various mid-range vehicles. The automakers are providing drivers with in-built vehicle personalization features such as infotainment system (sound and display configuration), setting of air condition, lights, and target destination. The lower power consumption of the NFC technology is another aspect, promoting the incorporation of NFC technology in mid-range vehicles.

The low-end automotive NFC market will grow substantially during the forecast timeframe. As the demand for high-end vehicles in increasing at a rapid pace particularly in countries such as China and India due to the rising per capita income in the emerging economies, low-end car manufacturers are operating in these regions are intensifying their efforts to provide drivers with a connected driving experience. The lower end car manufacturers are leveraging on NFC technology across various smart device offerings to allow users to establish a connection between users and cars.

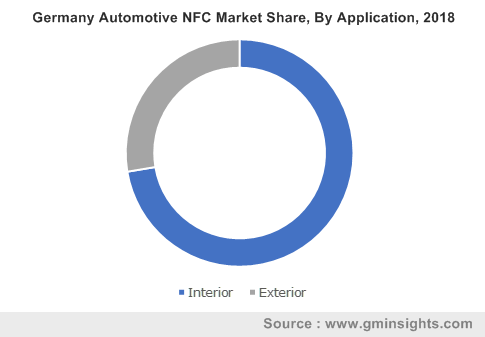

The interior application held over 70% share in the automotive NFC market in 2018. The interior market includes infotainment system, air-conditioning, engine access, and ADAS communication interfaces. The NFC technology is extensively adopted in various automotive components ranging from low-end to luxury cars. The technology simplifies the pairing mechanism, reducing the overall response times and the number of processing cycles. The inexpensive nature of the technology has been helping its incorporation across various automotive segments. Moreover, the technology requires lower power consumption and has enhanced compatibility with a wide range of interior automotive accessories, promoting its usage across various third-party manufacturers, OEMs, and automakers.

The exterior application will grow at a CAGR of over 35% during the projected time period. The exterior automotive NFC market only includes car access. The automakers are using NFC technology-enabled cards or smartphones to offer a safe & secure option for car owners to access their cars. The prominent automakers, such as BMW and Hyundai, are moving away from traditional car keys and are progressively replacing them with NFC technology as it allows them to distinguish their premium automobiles from the mainstream ones. The use of NFC technology for car access requires automobiles to have an advanced inbuilt cybersecurity architecture, which has been limiting the use of NFC technology for car access application in low-end and mid-range automotive. However, technological advancements in the automotive NFC landscape is expected to progressively drive the use of NFC technology for car access application in lower range automobiles over the forecast timeline.

The Europe region dominated the automotive NFC market with a industry share of approximately 35% in 2018. This is attributed to the presence of various large auto manufacturers, such as BMW, Audi, and Mercedes, increasing investments aimed at accelerating innovations in the automotive NFC landscape. The higher sales volume of premium cars also has been adding to the growth of the market. The road safety bodies operating in the region have also introduced regulations mandating the incorporation of ADAS systems in cars, promoting the use of NFC technology in automobiles.

The Asia Pacific automotive NFC market will attain a CAGR of over 35% during the forecast time period due to the increasing sales of luxury vehicles, particularly in China and India. The gradually rising per capita income in economies including India and China has further spurred the size of the market. The availability of several cost-effective third-party automotive accessories, such as in-car infotainment systems, has supported the incorporation of NFC technology in low-end vehicles. In addition, the presence of stringent government guidelines mandating the use of ADAS solutions is expected to increase the usage of NFC technology in cars across the region. For instance, in September 2017, the Government of India passed a regulation mandating all the heavy vehicles and passenger cars to be fitted with ADAS systems, which can automatically apply brakes if it suddenly detects any objects on the road.