Home > Automotive > Automotive Technology > Automotive Electronics Control Unit (ECU) Market

Automotive Electronics Control Unit (ECU) Market Size By Capacity (16-bit, 32-bit, 64-bit), By Vehicle Type (Passenger Cars, Utility Vehicles, Commercial Vehicles), By Mode (Autonomous Vehicles, Conventional Vehicles, Semi-autonomous Vehicles), By Propulsion Type (BEVs, Hybrid Vehicles, ICE Vehicles), By Application (ADAS & Safety, Body Control & Comfort, Infotainment & Communication, Powertrain), Industry Analysis Report, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2018 - 2024

- Report ID: GMI109

- Published Date: Sep 2018

- Report Format: PDF

Automotive Electronics Control Unit Market Size

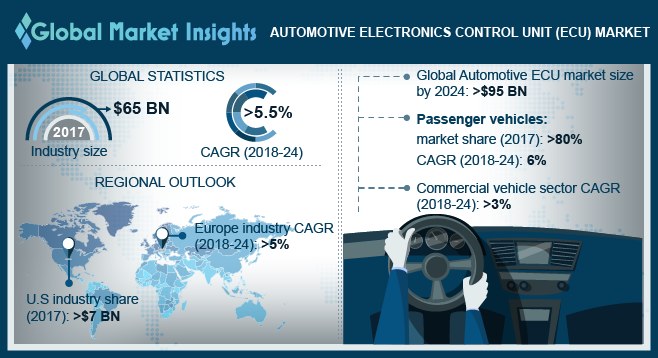

Automotive Electronics Control Unit Market size exceeded USD 65 billion in 2017 and is poised to register around 5.5% CAGR between 2018 and 2024. Increasing demand for energy-efficient cars coupled with technological advancements in the electronics sector is contributing to the market revenue. Awareness about the environmental issues and controlling energy usage across the world are creating development opportunities for energy-efficient vehicles.

The rise in automotive production coupled with increasing safety standards across the globe is anticipated to propel the automotive ECU market growth over the forecast timeline. Various government institutions supporting the expansion of vehicle production and sales are providing an impetus to the industry demand.

Growing instances of control unit failures in several vehicle systems causing unwanted interruptions and serious accidents are hindering the market demand. Furthermore, high repair costs associated with the control units is expected to limit the industry growth. The repair services involve additional labor costs for programming and installing the repaired units in vehicle systems. Technically-advanced electronic control units incorporated into the modern vehicles cost substantially high as compared to the basic control modules.

| Report Attribute | Details |

|---|---|

| Base Year: | 2017 |

| Automotive ECU Market Size in 2017: | 65 Billion (USD) |

| Forecast Period: | 2018 to 2024 |

| Forecast Period 2018 to 2024 CAGR: | 5.5% |

| 2024 Value Projection: | 95 Billion (USD) |

| Historical Data for: | 2013 to 2017 |

| No. of Pages: | 430 |

| Tables, Charts & Figures: | 729 |

| Segments covered: | Capacity, Vehicle Type, Mode, Propulsion Type, Application and Region |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

Automotive Electronics Control Unit Market Analysis

The 32-bit controllers in the market will witness growth of over 6.5% through 2024. The growth can be attributed to the demand of these components on account of benefits such as reduced design complexity and low-energy requirements.

The high-performance offered by the 32-bit units have enhanced the deployment in the engine control systems, automotive power tools, and transmission control units. Growing awareness about ECU miniaturization and consolidation is driving the demand for 32-bit controller due to space saving and flexibility improvement benefits as compared to the conventional controllers.

However, 64-bit controller components are expected to witness growth in the automotive ECU market driven by increased memory support and operating system performance. These components are deployed in advanced automated vehicle functions such as ADAS, traffic control systems, lane management systems, and other control unit functions such as fuel injection, engine control, and transmission control.

The passenger cars segment dominated the market share with more than 80% in 2017 owing to increased implementation of control units in these vehicles. Passenger cars including luxury vehicles have a high number of ECUs as compared to other vehicles due to advanced features offered in the vehicle management systems such as enhanced driver remote functions and vehicle software upgrading. Additionally, the rising popularity of luxury vehicles across the globe led by rising consumer spending capabilities and improved lifestyles is driving the market value.

The commercial vehicle segment is expected to expand at 3% CAGR in the industry due to their requirement in the telematics and IoT-controlled functions. These vehicles deploy high-end and robust ECUs that are easily programmable and offer varied safety measures for the engines and transmission systems.

The autonomous vehicle segment of the automotive ECU market is set to reach USD 7.5 billion by 2024. Due to incorporation of enhanced features such as automated technologies that control the driving and safety systems, the popularity for autonomous vehicle segment is on the rise. Advanced systems developed by manufacturers for automated applications incur ADAS compatible features including the embedded controls platform and advanced situational sensors.

Major applications of these control units in the automated vehicle technology include ADAS owing to the requirement in controlling driving operations. However, the conventional vehicles segment in the market deploys several control units to control the basic engine and fuel injection systems. These vehicles are experiencing a high adoption owing to the growing demand from emerging economies followed by the affordability and price variance by several manufacturers, boosting the adoption of these vehicles.

The battery electric vehicles in the automotive electronics control unit (ECU) industry accounted for over USD 20 billion in 2017. BEVs are witnessing a high demand in the automotive sector impelled by growing consumer awareness levels for energy-efficient vehicles coupled with government initiatives to reduce pollution. The government policies and initiatives have been the strongest in Europe, which is a major adopter of vehicles with alternative fuel solutions.

Moreover, the hybrid vehicle segment is gaining a rapid popularity and is predicted to witness growth in the market. These vehicles offer a long driving range, better fuel efficiency, and low emission levels, driving the demand in several countries.

Advanced driver assistance systems (ADAS) & safety applications have created several growth opportunities for the automotive ECU market. The ADAS segment is slated to grow at 6.9% CAGR from 2018 to 2024. They provide highly-automated driving specifications, intelligent tire control functions, and telemetry data analysis in the autonomous and semi-autonomous vehicles. Additionally, favorable government initiatives coupled with the need for reduction of carbon emissions are driving the consumption.

Moreover, infotainment and communication applications are growing in popularity in the passenger vehicles, further driving the market revenue. These systems comprise control units that provide enhanced internet and vehicle bus system connection to enable improved communication between the vehicle, driver, and the outside world.

The U.S. automotive ECU market size was over USD 7 billion in 2017. The country is experiencing high demand propelled by increasing customer preferences for luxury and hybrid vehicles. The strong presence of global players in the U.S. manufacturing these systems is contributing to the industrial demand. The luxurious vehicle segment is experiencing a high adoption in the U.S. owing to the rise in living standards and increased consumer purchasing power. Moreover, early technological adoption in the region is also a factor responsible for the market growth.

Asia Pacific automotive electronics control unit market is expected to gain traction during the next few years due to increasing penetration of automobile manufacturers in countries like China and India. Increasing sales of BEVs and Plug-in Hybrid Electric Vehicles (PHEV) in China are expected to drive the adoption of ECUs in the automotive sector. Additionally, government support and initiatives for carrying out innovative manufacturing processes and permits for driver-less vehicle testing in China are contributing to the industry size.

Automotive Electronics Control Unit Market Share

Prominent players in the automotive ECU market include:

- Delphi Technologies

- Bosch Group

- Continental AG

- Denso Corporation

- Hitachi Automotive Systems

- ZF Friedrichshafen

- Hyundai MOBIS

- Johnson Control

- Lear Corporation

- Mitsubishi Electric Corporation.

Key participants are adopting product development and production process innovation strategies to provide highly-efficient control solutions for OEMs. To achieve the targeted profit margins, companies are adopting innovative business models focusing on the value creation and provision, long-term supplier & customer partnerships, and leading technology solutions.

Increasing awareness related to the vehicle safety to prevent road accidents and unwanted transport interruptions is driving the automotive ECU industry growth. Additionally, the rise in the production of autonomous and semi-autonomous cars is a key factor creating several growth opportunities in the industry.

Rising popularity of driverless and semi-autonomous vehicles owing to advantages offered such as increased safety & efficiency and low energy consumption, is compelling the companies to develop highly advanced control units.

Industry Background

The automotive ECU market is highly fragmented due to the presence of several major and small players across the globe. The growing awareness for road safety and comfortable & luxurious automobile functions has driven the demand for these products.

The market needs to comply with stringent government regulations and standards related to the unit production process and controlling carbon emissions. The industry players are investing highly on R&D to develop technically-equipped products in areas related to infotainment, powertrain, chassis, and related technologies.

Established players and OEMs in the marketplace possess significant purchasing power, allowing them to purchase control unit systems in large number, negotiate favorable pricing, warranty, and other terms with vendors. The market dynamics is characterized by high competition with the presence of major players with operating facilities in major regional markets, sales force strength, and efficient distribution channels.

The automotive electronics control unit market research report includes an in-depth coverage of the industry with estimates & forecasts in terms of revenue in USD and volume/shipments in units from 2013 to 2024, for the following segments:

Click here to Buy Section of this Report

By Capacity

- 16-bit

- 32-bit

- 64-bit

By Vehicle Type

- Passenger Cars

- Utility Vehicles

- Commercial Vehicles

By Mode

- Autonomous

- Conventional

- Semi-autonomous

By Propulsion Type

- BEVs

- Hybrid Vehicles

- ICE Vehicles

By Application

- ADAS & Safety

- Body Control & Comfort

- Infotainment & Communication

- Powertrain

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Poland

- Sweden

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Malaysia

- Indonesia

- Australia

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Middle East & Africa

- South Africa