Home > Automotive > Aftermarket > Aftermarket Parts > Asia Pacific E-commerce Automotive Aftermarket

Asia Pacific E-commerce Automotive Aftermarket Size By E-commerce Retail (Third Party Retailers, Direct To Customer), By Product (Parts [Braking {Brake Pads, Hydraulics & Hardware, Rotor & Drum}, Steering & Suspension {Control Arms, Ball Joints, Tie Rods, Sway Bar Links, Bushings, Bearings/Seals, Coil Springs}, Hub Assemblies, Universal Joints, Gaskets, Wipers, Filters, Lighting, Spark Plug, Tires], Accessories [Interiors, Exteriors]), By Consumer (B2C, B to Big B, B to Small B), Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Analysis

- Report ID: GMI4850

- Published Date: Oct 2020

- Report Format: PDF

Asia Pacific E-commerce Automotive AfterMarket Analysis

APAC third-party retailers market size crossed over USD 9.5 billion in 2019 and is likely to grow at a decent growth rate of 15.2% through 2026. The emergence of online shops, such as Alibaba.com, Amazon, eBay, Mannkando, RockAuto, etc., has enhanced the segment growth.

Fiscal benefits including EMI, return policy, same-day delivery, and availability to compare product specifications will remain the key factors influencing demand. The rising preference for Do-It-Yourself (DIY) among consumers is another factor propelling demand. Increased expenditure by e-retailers due to convenience in online shopping will create lucrative opportunities for industry growth.

Replacement parts segment is projected to captured over 85% of the APAC e-commerce automotive aftermarket share in 2026. The rising trend of lightweight automotive production has led to the installation of enhanced components to improve efficiency of vehicles, which will provide a strong business outlook.

Improved demand for lighting systems, such as lighting mounted or rear side, integrated front side, and signaling, will support the segment growth. An increased consumer spending on e-commerce websites owing to accessibility of automotive components at competitive prices along with features, such as same-day delivery and pick up from the nearest stores, will boost market revenue.

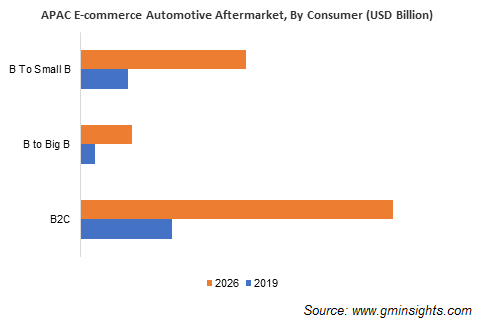

B2C consumers constitute nearly 60% of the APAC consumption. Increasing DIY trend to replace automotive components will subsequently boost the adoption of e-commerce channels. Well-informed customers with advanced technical knowledge on part selection and dimensional standardization is the key factor fueling the industry demand. The industry players are focusing on offering information for part replacement with provision of part replacement manuals and videos on online portals. The availability of low-cost components is a key driving feature of the B2C segment in Asia Pacific E-commerce automotive aftermarket.

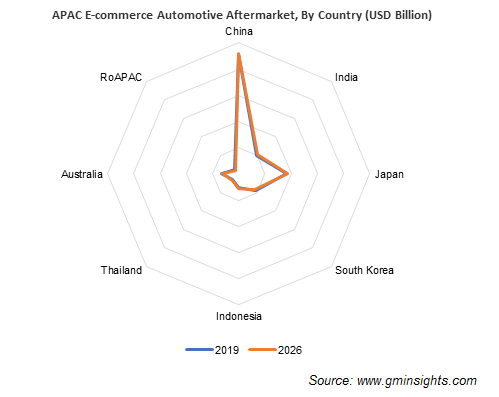

The China E-commerce automotive aftermarket is likely to cross around USD 16.20 billion revenue by 2026. The increasing number of smartphone users, internet connectivity, the escalating automobile industry, and demand for international brands will stimulate the regional demand. Consumers are highly cost-sensitive and thus prefer competitive pricing in automotive parts for repair & maintenance and service of vehicles.

Manufacturers are actively adopting digitalization strategy to offer buyer guides, journals, catalogs, updates on marketing initiatives, and detailed product-related information on the portal. The establishment of e-stores in growing nations, such as Vietnam, India, Indonesia, and Japan, offering various brands via partner-distributor e-commerce portal will further expand industry growth.