Home > Aerospace & Defense > Aircraft Parts > Winglets Market

Winglets Market Analysis

- Report ID: GMI4516

- Published Date: Jan 2020

- Report Format: PDF

Winglets Market Analysis

Blended type will account for over 25% share of global winglets market throughout the forecast time span. These are widely used by several aircraft manufacturers including Boeing, Gulfstream Aerospace Corporation, Falcon, among others.

Additionally, usage of these products as standard equipment in aircrafts such as Boeing 737-900ER are supporting the movement towards sustainability. These winglets play a major role in reducing CO2 emission, and increasing the aircraft fuel efficiency. Presence of several authorized service providers that offer retrofit services across the globe will further support the product penetration over the forecast timeframe.

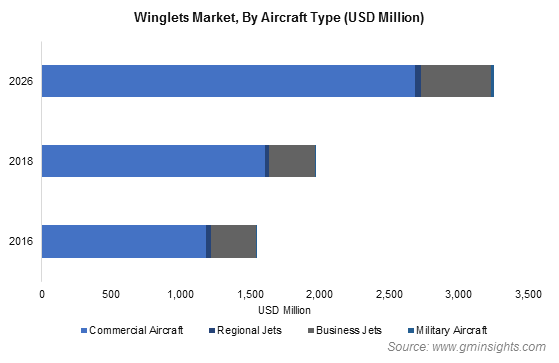

Commercial aircrafts are expected to have substantial market share over the projected time period, accounting for USD 1.6 billion in 2018. Narrow-body aircrafts accounted for over half of the market revenue share owing to rising presence of low-cost carriers across the globe.

Rising domestic air travels across emerging economies such as India and China and improving Revenue Passenger Kilometres (RPK) of airlines are expected to enhance narrow body aircraft sales. RPK has been estimated to account for around 36% of overall air passengers market in 2019, which will further grow at considerable rate over the study period.

A320 family will account for the highest market share of more than 30% through 2026 owing to adoption of new technologies such as low noise and efficient engines. A320neo which is newer version of A320 family are using sharklets as a standard equipment.

Growing demand for A320neo from several airlines across the globe is further supporting the market penetration. Sharklets enable A320 family aircrafts to payload capacity up to 450 kg with annual CO2 emission reduction by over 1,000 tonnes.

Retrofit segment will showcase considerable growth owing to adoption of the product by several airlines such as Air Asia, Qatar Airlines, Volaris, Interjet, Airarabia, among others. Stringent emission norms coupled with ability of product to enhance overall aircraft performance is driving the revenue generation. Additionally, aircraft manufacturers such as Boeing and Airbus have initiated retrofit programs for in service aircrafts which further supports the winglets market value.

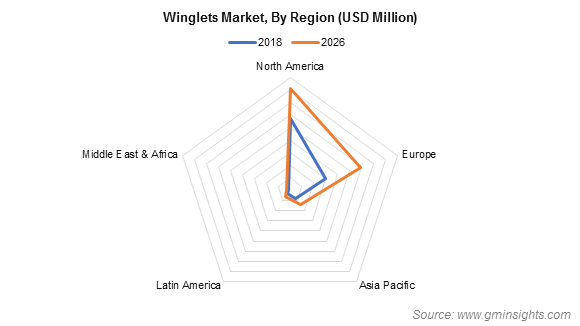

North America winglets market will account for the highest share of more than 50% among all the regions between 2019 and 2026. Growing production of new aircrafts in North America will be the key driving factor behind the market growth.

Prominent presence of aircraft manufacturers such as Boeing, Airbus, Bombardier among others along with growing aircraft production capacity will support the industry growth. Rising domestic air passengers demand coupled with increasing effort for limiting carbon emissions will create need for safe and efficient aircrafts, which will again stimulate market penetration.