Home > Professional Services > Thermal Printing Market

Thermal Printing Market Analysis

- Report ID: GMI4774

- Published Date: Jul 2020

- Report Format: PDF

Thermal Printing Market Analysis

Thermal printing supplies and consumables accounted for over 65% industry share. High-quality supplies are crucial to ensure enhanced print quality and reduced wear & tear in printer. Inferior quality thermal ribbons can damage printheads and increase maintenance costs. This has led to the usage of high-quality wax or resin ribbons to ensure improved print quality and durability for withstanding high temperatures or chemical exposures. Different types of labels, such as paper or synthetic, are chosen depending on the requirements. Lower grade receipt papers inserted into thermal printers can hamper the functioning as well as reduce the print readability.

In the U.S. thermal printing market, barcode printer segment is estimated to register growth of around 9% through 2026. Accurate data entry plays a vital role in the operational efficiency of a business. In fast-paced industrial environments, barcoding enables consistent & predictable operations for enhanced productivity by combining several data management functions. Employing standardized barcode compliance labeling & symbology guarantees that the captured barcode data is communicated in a universally understood and accepted manner. Companies are focusing on providing robust barcode printing solutions to cater to the growing demand from industries.

In 2019, mobile thermal printers held around 25% share of the global market shipments. These printers facilitate a range of documentation, labeling, and ticketing tasks from barcodes to RFID tags. Seamless mobility is encouraging new business processes to enhance worker productivity, ensure labeling accuracy, and responsiveness to customer needs. Durable, easy to use, and lightweight mobile printers that can be used in conjunction with mountable, handheld, or wearable computers have gained prominence. Mobile printers can use a wireless network connection to receive label formats, print jobs, and other information from wireless handheld devices or host systems. Developments in wireless technologies, such as Bluetooth and NFC, will further impel the market size.

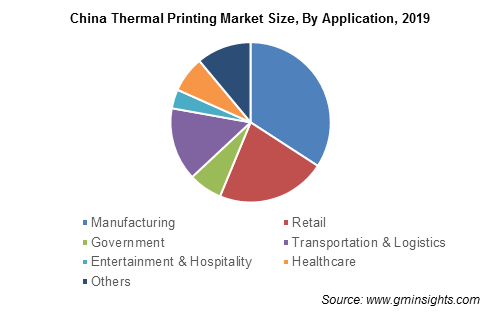

The advent of digitalization in the healthcare sector will fuel the market growth. Several healthcare organizations in China are focusing on providing optimal care that facilitates fast collaboration and communication with staff members. Companies are providing healthcare solutions that connect patient records to medical providers for fast & efficient operations. Barcode, RFID, and other auto ID technologies are being used for accurate identification, enhancing patients' safety and satisfaction. The hospitality sector is also using printer for fast event ticketing and wristband printing for easy & safe check-ins.

Thermal transfer printing incorporates a heated ribbon to produce durable images on a wide range of materials. The printed image is resistant to heat and moisture, making the labels highly durable. Thermal transfer printing produces consistent, high-definition, and reliable printing as the density and color of the printed image are determined by the ribbon and printer resolution. Also, the long-term maintenance cost of thermal transfer printer is low compared to ink jet, dot matrix, and laser printing, influencing its adoption in the market.

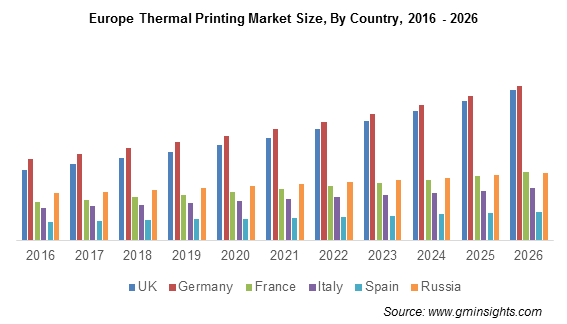

Europe thermal printing market is predicted to expand at a CAGR of more than 6% during the forecast timespan led by developing packaged foods industry in several European countries including the UK, France, and Spain. In 2018, food and drink exports in the UK reached USD 25 billion, playing a major role in the economic growth of the country. This will boost the demand for printers that produce high quality, legible, and smudge-free images on labels of food products in the market. With barcode labels, spoiled food items or expired food products can be easily identified and discarded, thereby saving time, money & potential litigation.