Home > Healthcare > Medical Devices > Diagnostic Devices > Test Strips Market

Test Strips Market Analysis

- Report ID: GMI4196

- Published Date: Sep 2019

- Report Format: PDF

Test Strips Market Analysis

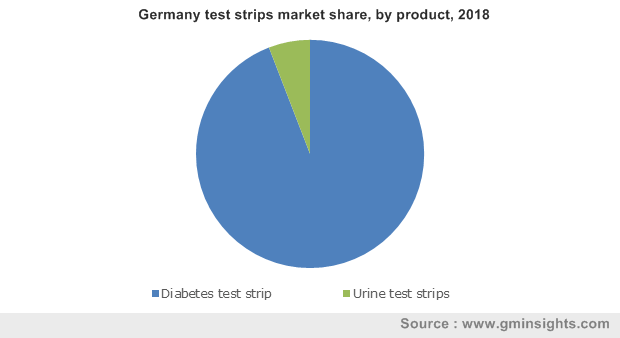

The test strips market is bifurcated into urinary and diabetes test strips. Diabetes test strips segment held major revenue size of USD 8.1 billion in 2018. High growth is attributed to increasing prevalence of diabetes in various developing as well as developed economies of the world. Also, growing preference among the population for point of care testing is another major growth fostering factor.

Glucose test strips are further segmented into thick-film and thin-film, on the basis of technology. Thin-film strips are expected to witness lucrative growth of 4.0% across the forecast years. High growth is attributed to usage of novel nano technology in these test strips. Furthermore, thick-film test strips held the largest revenue share in 2018, owing to presence of major firms manufacturing thick-film test strips.

Urine test strips segment is expected to expand at 3.4% CAGR over the projected period. High growth is attributed to increasing prevalence of urinary tract infections (UTI), mostly in females. Also, rising prevalence of kidney disorders is another major factor boosting product demand, thus fostering business growth. Moreover, increasing number of companies manufacturing urine test strips will further enhance test strips market growth.

Hospitals as an end-use segment held significant revenue of USD 2.5 billion in 2018 with significant growth rate across the forecast timeframe. High growth is attributed to increasing number of diagnostic tests for diabetes as well other chronic diseases. Moreover, availability of required healthcare facilities will further boost segmental growth. Also, increasing number of hospitals in developed as well as developing economies is another major growth augmenting factor.

Home care segment is projected to witness substantial growth of 4.1% across the analysis period. High growth is attributed to increasing number of retail pharmacies across the globe and rising awareness among the population about several point of care testing methods. Also, increasing number of online portals commercialising test strips for personal use is another factor fostering industry growth.

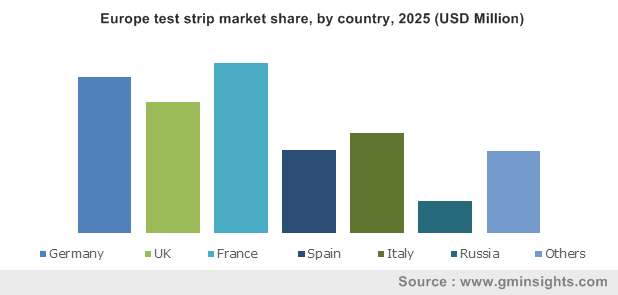

U.S. test strips market is expected to hold considerable market size of 4.9 billion in 2018, owing to increasing number of companies manufacturing diabetes test strips in the U.S. Additionally, growing prevalence of diabetes in North America and rising demand for point of care testing will further augment U.S. market demand.

China is expected to witness favourable growth of 5.1% across the forecast years. China has the maximum number of diabetic patients in the world, followed by India. Hence, rising prevalence of diabetes in the Asian countries will boost product demand, thus propelling business growth. Increasing habit of alcohol intake coupled with lack of physical activities leading to sedentary lifestyle will further fuel diabetes prevalence. Also, increasing incidence of obesity in such countries is another major factor contributing to growth of diabetes, thereby boosting the market revenue.