Home > Chemicals & Materials > Specialty Chemicals > Custom Synthesis > Tartaric Acid Market

Tartaric Acid Market Size

- Report ID: GMI1673

- Published Date: Feb 2018

- Report Format: PDF

Tartaric Acid Market Size

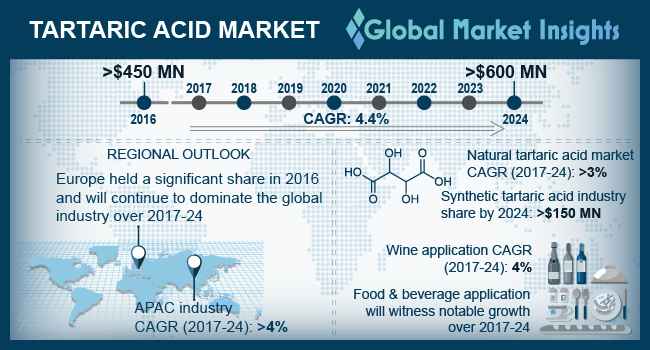

Tartaric Acid Market size was valued over USD 450 million in 2016, and the industry will grow at a CAGR of 4.4% up to 2024. Rising consumption of nutritional drinks and bars, coupled with the development of beverages with different fruit flavors, will enhance the product demand over the projected period.

Tartaric acid is an organic acid, which can be manufactured from both natural and synthetic sources. Grapes, and sun-dried raisins are the natural sources of tartaric acid. It can also be generated from the residue left after the production of wine. Synthetic tartaric acid can be made from maleic anhydride.

Natural tartaric acid is produced in all countries, where wine production is predominant, while the synthetic tartaric acid is manufactured majorly in the developing nations of Asia Pacific, particularly in China.

Usually, tartaric acid occurs naturally in grapes and sun-dried raisins. Tartaric acid finds a vast number of end-user applications such as wine, food & beverage, pharmaceutical, construction, and in FMCG products such as cosmetics & personal care products. It can be used as a raw material to produce emulsifiers, as an acidulant in manufacturing wine and beverages, as a buffering and excipient agent in pharmaceutical products.

Growing wine consumption is leading to the increasing demand for tartaric acid, especially in the countries of the Asia Pacific and Latin America. The wine consumption in Argentina was 1,030 million liters in 2015 and is predicted to grow at a CAGR over 3.5% till the end of 2018. The wine and F&B sectors are the most significant consumers of tartaric acid.

| Report Attribute | Details |

|---|---|

| Base Year: | 2016 |

| Tartaric Acid Market Size in 2016: | 450 Million (USD) |

| Forecast Period: | 2017 to 2024 |

| Forecast Period 2017 to 2024 CAGR: | 4.4% |

| 2024 Value Projection: | 600 Million (USD) |

| Historical Data for: | 2013 to 2016 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 218 |

| Segments covered: | Type, Application and Region |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

Tartaric acid acts as a buffering and excipient agent for drug delivery systems. The demand for these agents is increasing at a significant growth rate, which will drive the tartaric acid market growth over the forecast period. Tartaric acid also finds applications as an anti-solidifying and set-retardant agent in cement production, and as an anti-caking agent in the processing of gypsum. The construction industry growth in some parts of Europe, and the Asia Pacific accelerated the need for construction chemicals, which would further stimulate the demand for tartaric acid in these regions.

The prices of natural tartaric acid are higher as compared to synthetic tartaric acid globally. Moreover, these prices fluctuate, as per their availability which depends upon seasons. The global tartaric acid is further restrained by the restricted consumption of synthetic tartaric acid for food & beverage, pharmaceutical, and wine production. Moreover, tartaric acid market share faces a moderate threat from growing citric acid demand, as it also finds competitive applications as an acidulant in many applications.