Home > Healthcare > Medical Devices > Infection Control > Sterilization Equipment Market

Sterilization Equipment Market Analysis

- Report ID: GMI1914

- Published Date: Nov 2019

- Report Format: PDF

Sterilization Equipment Market Analysis

The product segment is divided into heat sterilizers, low-temperature sterilizers, sterile membrane filters, radiation sterilization devices and consumables & accessories. Sterile membrane filters segment accounted for more than USD 1.0 billion in 2018. Sterile filtration is utilized mainly for thermolabile solutions by passage via sterile bacteria-retaining filters including cellulose derivatives, sintered glass and porous ceramic. Normally, the membranes are not larger than 0.22 μm nominal pore size, that effectively filters the particles and microorganisms.

A bubble point or similar test is extensively preferred that employs a prescribed pressure to force air bubbles through the intact membrane, previously wetted with the product. Thus, several such mentioned factors prove beneficial for the overall sterilization equipment market share expansion.

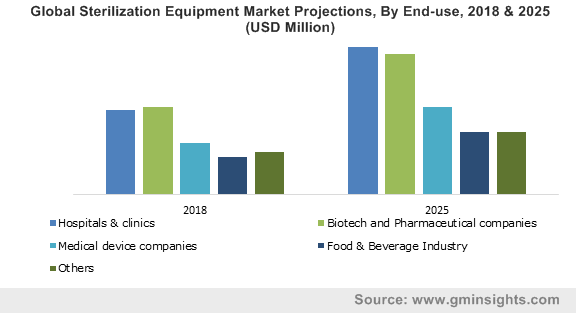

The end-use segment of sterilization equipment market share is fragmented into hospitals & clinics, biotech and pharmaceutical companies, medical device companies, food & beverage industry and others. Biotech and pharmaceutical companies’ segment will witness over 25.0% revenue share in 2018 owing to the growing need for vaccines and sterile injections. Involvement of several biotech companies for the development of biologics, antibodies and cell therapies, thereby augments the segmental demand. In addition, production of biologics and antibodies require maximum level of sterilization to avoid any possibility of contamination. Also, development of innovative and technologically advanced cell therapies benefits the sterilization equipment industry size.

Furthermore, current good manufacturing practices (cGMP) regulations pertaining to quality control and laboratory testing of the finished product. Thus, compliance with these regulations by various pharmaceutical and biotech companies, approved by the U.S. FDA, will further play a major role to spur segmental progress.

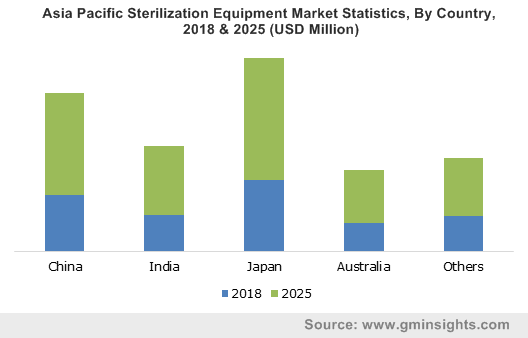

Asia Pacific sterilization equipment market outlook will show more than 8.0% CAGR owing to increasing number of biotechnology and pharmaceutical companies. Regional growth can be attributed to influential foothold of leading biotech and pharma companies coupled with rising R&D investments. Moreover, population in the Asian countries including China and Japan is aging. The geriatric population is more prone to several chronic diseases. Thus, such demographic trend will drive the demand for surgical procedures, that will in turn enhance the need for sterilization equipment.

Indian market size accounted for over USD 200 million in 2018, owing to favourable reimbursement policies and growing healthcare expenditure. Rising number of medical procedures in India accounts for improved sterility equipment that effectively manages patient health. Moreover, various government initiatives for sterilization and disinfection of surgical devices used in healthcare facilities will propel the business growth.