Home > Construction > Construction Materials > Structural Materials > Redispersible Polymer Powder Market

Redispersible Polymer Powder Market Analysis

- Report ID: GMI4060

- Published Date: Aug 2020

- Report Format: PDF

Redispersible Polymer Powder Market Analysis

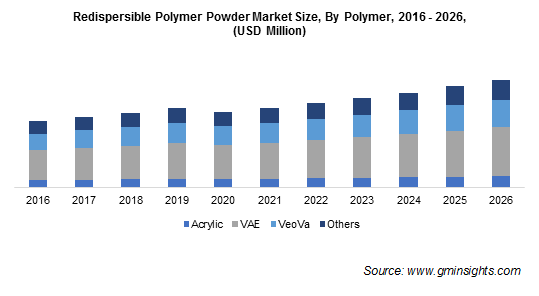

Vinyl acetate ethylene (VAE) will account for over 45% share in the redispersible polymer powder market by 2026 owing to economical cost and superior properties. VAE can meet rheological properties required in mortar and has low volatile organic compound and minimum irritancy odor. It is known for excellent UV resistance, good thermal resistance, and long-term stability.

Vinyl acetate vinegar and ethylene copolymer resin have the widest range of glass transition temperatures. Redispersible polymer powders of different glass transition temperatures should be selected according to the need, environment properties, and characteristics of base mortar material during the preparation of dry mixed mortar.

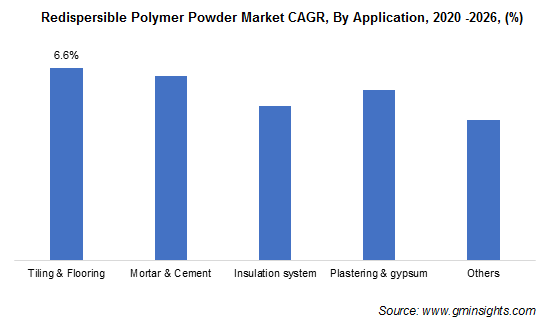

Tiling & flooring applications will witness over 6.5% CAGR with utilization of redispersible polymer powders for residential & industrial flooring, cement based self-levelling compounds & screeds, pumpable hand applied compounds, floor & wall tiling, etc. High quality & flexible redispersible polymer powder with excellent workability & water resistance is recommended for high-quality tile adhesives, large tiles, and outdoor applications.

The product aids in improving surface aesthetics, levelling, abrasion resistance, and flexural & tensile bonding strength. Additionally, it improves wet strength values, plastic behavior, and sag resistance.

Redispersible polymer powder market share from industrial sector will witness over 4.5% CAGR with ongoing industrial development across the globe. Changing paradigm of the manufacturing sector backed by huge financial investments will trigger the construction of production plants, warehouses, and other industrial structures.

The industrial plants and warehouses are exposed to a high level of shock and tremor. Such extreme environments reduce the quality of these structures. The usages of redispersible powder are suitable to enhance the strength of these buildings by improving the chemical properties of mortars and other dry mix products.

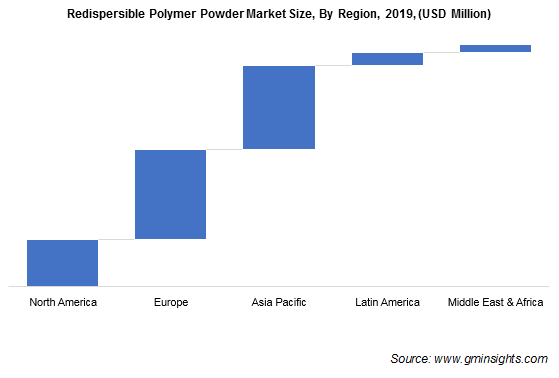

In 2019, North America accounted for around 19% share in redispersible polymer powder market. Favorable trends associated with North America’s construction sector will support the product demand. In the U.S., the construction spending increased over 70% from 2011 to 2019, whereas in Canada, construction spending increased by more than 30% within the same period. Such high investments coupled with rising emphasis on the use of eco-friendly construction materials by builders & contractors will support the regional expansion.

Coronavirus pandemic has changed the North America construction industry rapidly over past few months due to government restrictions, changing job safety protocols, and supply chain uncertainties. Construction output is expected to fall with rapid decline in the demand of new projects and safety regulations associated with COVID-19 pandemic. North America’s construction output is expected to fall by more than 6% in 2020. Many construction projects in North America are carrying operations however future proposals are being cancelled due to uncertain economic conditions.