Home > Automotive > Automotive Logistics > Freight Logistics > Port Equipment Market

Port Equipment Market Analysis

- Report ID: GMI3288

- Published Date: Jul 2019

- Report Format: PDF

Port Equipment Market Analysis

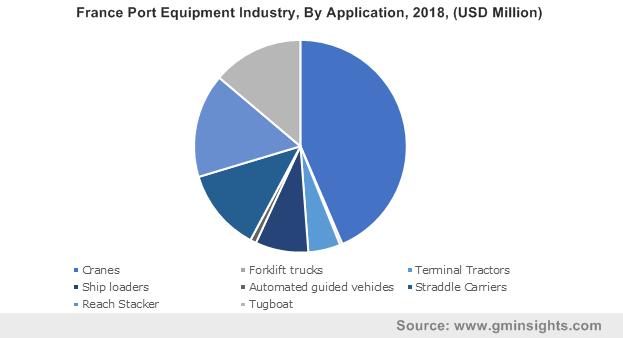

Crane equipment will hold significant share in port equipment market with its demand to decrease cost per move. Cranes allows the port operators to handle wider range of vessels. Port operators are replacing the previous cranes with newer model to reduce noise and carbon emission. For instance, in March 2015, Port of Oslo installed 3 cranes with LED lights for superior efficiency and skew system. Moreover, ongoing port expansion projects to harbour larger number of vessels will escalate industry size.

Ship loaders will showcase considerable growth to flexibility in handling the bulky cargos at higher transfer rate. Several ports across the globe are installing the mobile ship loaders to optimize the operational efficiency. For instance, in June 2018, ELB Engineering Services Ltd received contract from Transnet Port Terminals to design, install and commission two mobile ship loaders at their Saldanha Terminal.

Ship handling segment will hold significant port equipment market share owing to increasing loading and discharging operations. Several countries are investing to install tugs to enhance ship manoeuvring capacity and towage operations. For instance, in February 2019, Timaru Port has installed Azimuth Stern Drive (ASD) tug for improved manoeuvring and side steeping capabilities.

Container handling will witness substantial growth with rising container trade volume across the globe. According to the UNCTAD, in 2018, the container trade increased by over 6% as compared to 2016. Countries are developing shared container terminal ports to support seaborne trade. For instance, in May 2019, India, Japan, and Sri Lanka signed MoU to develop terminal at Colombo Port to allow large container ship to enter in the port.

Diesel segment dominates the port equipment market revenue owing to fuel efficiency, power, performance and reliability. The stringent emission norms mandated by several governments are mandating the ports and equipment manufacturer to develop clean diesel technologies. According to Diesel Technology Forum and the Environmental Defense Fund (EDF), the technology enables the ports to reduce over 80% emission in the marine environment.

Hybrid type equipment will foresee significant growth owing to transformation of ports towards green and clean ports. Several funding projects are initiated across the globe to support the adoption of hybrid technologies. For instance, in September 2018, California Air Resources Board (CARB) announced funding up to USD 205 million to accelerate the adoption of clean freight technology in the state. This includes the adoption of hybrid tugboats at ports in California.

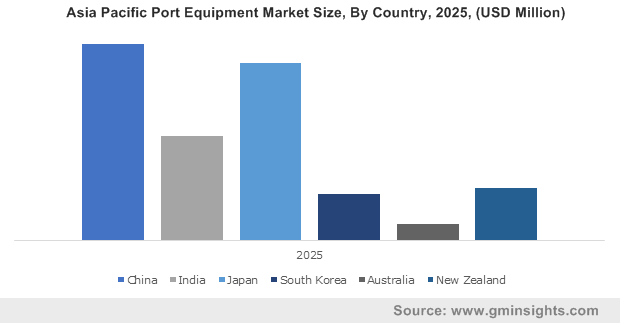

Asia Pacific will dominate the port equipment market owing to increasing infrastructure development activities to support seaborne trade. In 2013, China announced to build an infrastructure estimated USD 1 trillion to support increased trade and economic ties. Establishment of automated terminals will escalate the equipment demand over the study timeframe. For instance, in January 2018, Yangshan Port, China inaugurated automated container terminal port with investment of USD 2.15 billion.

Europe will showcase considerable growth in port equipment market owing to rising bulk cargo trade in countries including UK and Italy. Government emission regulations and green port initiative is escalating the demand for hybrid and electric equipment. Moreover, agreements to develop trade route is inducing significant growth potential in the industry landscape. For instance, in March 2019, Italy signed agreement with China to develop trade infrastructure.