Home > Animal Health & Nutrition > Feed Additives > North America Specialty Animal Feed Additives Market

North America Specialty Animal Feed Additives Market Analysis

- Report ID: GMI4598

- Published Date: Mar 2020

- Report Format: PDF

North America Specialty Animal Feed Additives Market Analysis

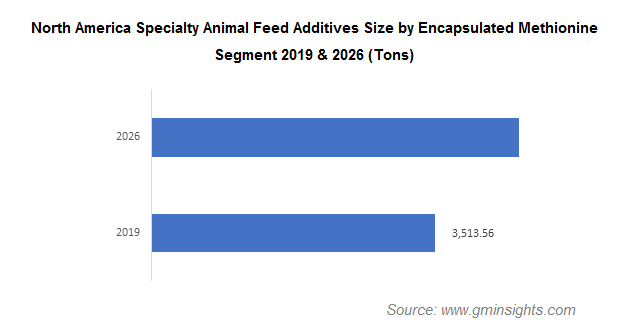

Based on product, the North America market is segmented into encapsulated methionine, sulfate-based products, chromium propionate, tribasic copper chloride and DCAD products. Encapsulated methionine is anticipated to register sales over 3.5 kilo tons in 2019. Methionine in encapsulated form is widely used as an excellent source of rumen bypass and intestinally released methionine for ruminant diets. It is an essential amino acid used as a building block for proteins, thus acting as a fundamental element to the health and wellness of the dairy cattle and beef cattle.

Feedstuffs, dietary intakes and forages are extremely variable in the amount of metabolizable methionine supplied, which can negatively impact milk and milk component production. To overcome this, encapsulated methionine is being increasingly used by feed processors as it combines ruminal escape with high intestinal digestibility, resulting in one of the most cost-effective sources of methionine for dairy cattle and beef cattle. The product also helps to optimize production and allow for greater flexibility when formulating rations.

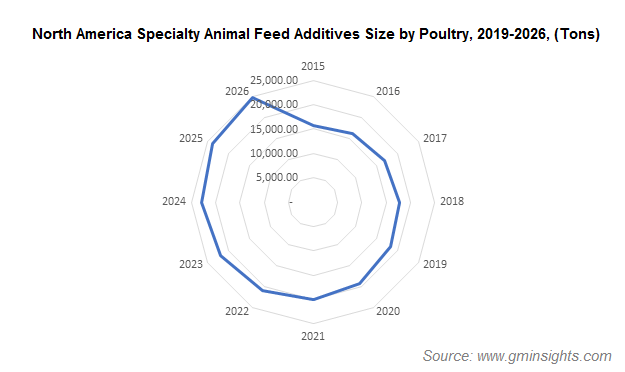

On the basis of livestock, the North America specialty animal feed additives market is segmented into poultry, aquaculture, cattle and pets. Poultry application is anticipated to register CAGR over 4.5% in terms of revenue up to 2026. Animal feed additives plays a vital role in poultry diets to improve laying capacity, growth efficiency and feed utilization. Additives are included in poultry diets to enhance their value for human consumption, which can be achieved by these natural growth supplements that are deposited into meat and eggs. Improved nutrition management techniques along with increasing developments in traditional animal breeding technology is likely to favor industry growth.

As per the industry estimates, the poultry consumption is increasing significantly at a growth rate of over 2-3%. Robust growth is due to the growing meat & egg consumption with an increase in middle-class income. Low product price & production costs and short production cycle are the major driving factors. Demand for traditional delicacies across U.S. and Canada during festive seasons will further propel the North America specialty animal feed additives market statistics.

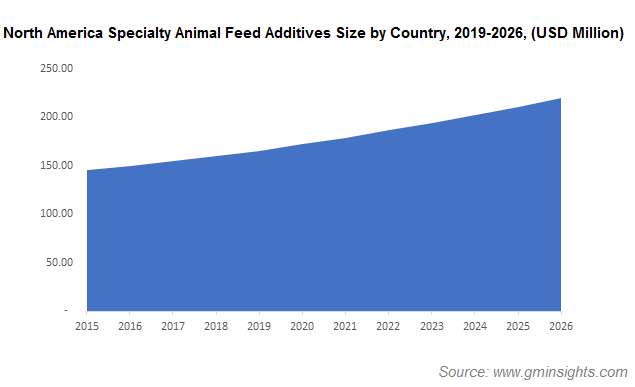

U.S. specialty animal feed additives size is anticipated to surpass USD 215 million by 2026. The country has seen a growth in beef exports in the past two years owing to the increasing demand for beef, providing tremendous opportunities for major exporters to improve their market share. The U.S. produces almost one-third of the total global beef feed in the world. It is also the second highest global pet feed producing country, contributing to around 31.5% of the total global requirement. Poultry and meat producing companies in the U.S. also play an important role in feeding people all around the world through their exports.

The U.S. has exported approximately 147,800 head of cattle majorly to Canada, Russia, and Mexico by November 2018. It has also exported 2.35 billion pounds of beef until November 2018 with a growth of 13.3% from 2017. The top destination of the U.S. beef exports is Japan, followed by Mexico and South Korea. The U.S. meat exports have a zero-tariff market access to both Mexico and Canada under the North American Free Trade Agreement. In 2017, the beef exports to Canada and Mexico contributed to 25% of the total beef market valued at USD 1.8 billion