Home > Food & Beverages > Food Additives > Texturizers and Thickeners > North America Gluten Free Bakery Mixes Market

North America Gluten Free Bakery Mixes Market Analysis

- Report ID: GMI4800

- Published Date: Aug 2020

- Report Format: PDF

North America Gluten Free Bakery Mixes Market Analysis

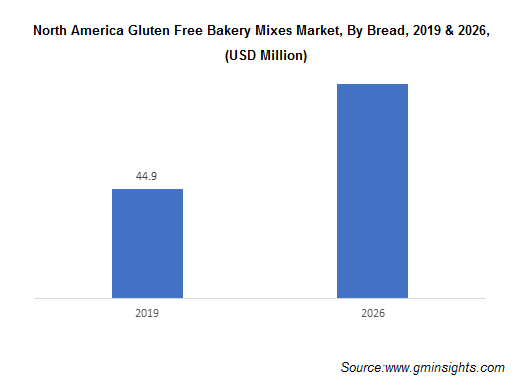

The North America gluten free bakery mixes market is segmented by product into bread, pizza bases, cake, hamburgers, muffin and others. Bread segment is expected to witness a CAGR of above 10% through 2026 as it is a commonly consumed bakery product in the region. According to the American Baker’s Association, bakery products constitute about 2.1% of the total GDP of the U.S., with bread constituting about 32% of the total baked products.

Moreover, increasing consumption of fast foods such as pizzas and hamburgers, especially among young population is likely to raise the demand for gluten free bakery mixes in the years to come. The growing trend of consumption of healthy bread products which are gluten free without compromising on the taste and quality of products is expected to raise the demand for gluten free bakery mixes.

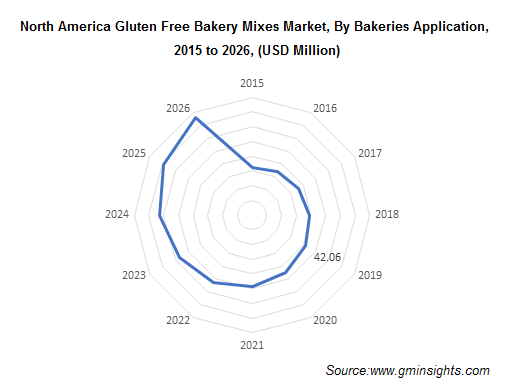

North America gluten free bakery mixes market by application is bifurcated into restaurants, households, confectionary and bakeries. Bakeries segment is expected to grow at a CAGR of 9.2% between 2020 & 2026. This high growth rate is mainly attributed to the increasing number of bakeries in the United States since the past few years. The U.S. bakery industry includes nearly 6,000 retail bakeries and around 3,000 commercial bakeries.

The bakery industry in the U.S. is highly fragmented due to the presence of many small bakery retailers, with three producers including Grupo Bimbo, Flowers Foods and Campbell Soup Co. accounting for about 55% of the total commercial bakery revenue. According to The American Baker’s Association, the revenue generated by retail bakeries was valued at over USD 3 billion annually and commercial bakeries sales were approximately USD 31 billion annually in the U.S.

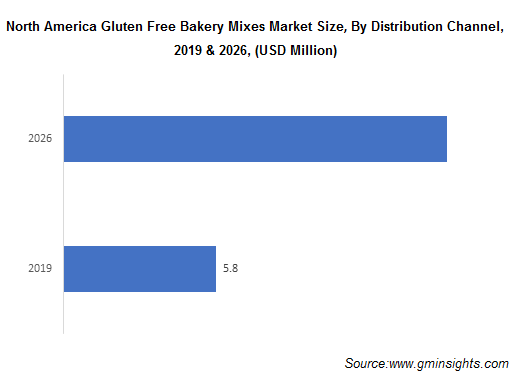

North America gluten free bakery mixes market is classified into grocery stores, convenience stores, supermarkets/hypermarkets, and online stores. Consumers are showing increasing preference towards purchase of gluten free bakery mixes from convenience stores on account of ease of purchase and customer friendly nature of local convenience store owners since the past few years.

However, purchase of gluten free bakery mixes from online stores is expected to gain traction during the forecast period owing to the ease of transaction, interesting offers on products and direct delivery of products to doorstep. The pandemic of coronavirus is expected to further encourage the purchase of gluten free bakery mixes through online stores in upcoming years.