Home > Chemicals & Materials > Polymers > Industrial Polymers > Neoprene Market

Neoprene Market Size

- Report ID: GMI2627

- Published Date: Feb 2019

- Report Format: PDF

Neoprene Market Size

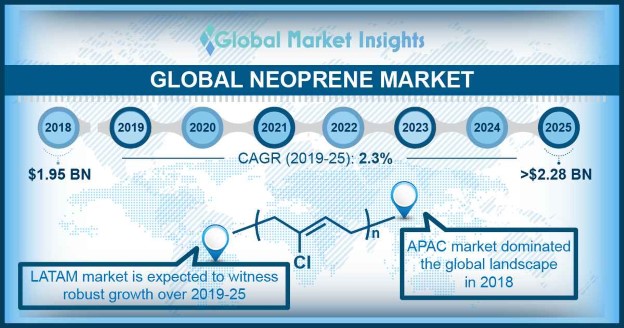

Neoprene Market size was over USD 1.95 billion in 2018 and will witness 2.3% CAGR during the forecast timespan. By product, the neoprene rubber sheet was the largest segment in 2018 and is expected to maintain its dominance throughout the forecast period.

Rapid growth in the building & construction industry especially in Asia Pacific and the Middle East is likely to propel neoprene demand through the forecast period. The growing government participation in private and public infrastructure development in Asia Pacific nations is one of the key factors attributing to the growing product demand. Neoprene exhibits properties such as excellent weather and ozone resistance coupled with enhanced tensile strength, which makes them suitable for its use in window seals, window gaskets, bridge seals, bearing pads and elevator astragals, etc.

The growing application of neoprene in automobile industry is also anticipated to substantially contribute to product demand during the assessment period. It is widely used in the automotive industry, owing to its thermal resistance, tensile strength and durability. Neoprene rubber is highly employed in hose covers, CVJ boots, power transmission belts, vibration mounts, shock absorber seals and steering system components. For instance, the overall automobile production in 2014 was close to 70 million units and surpassed 97 million in 2018, such escalation in automobile sales and manufacturing will subsequently boost neoprene market share by 2025.

However, the prevalence of substitutes to neoprene along with the volatility in crude oil prices are projected to be some of the major downside to neoprene demand in the coming years. Neoprene is a synthetic rubber which is manufactured from petroleum feedstock. Therefore, the price volatility of crude oil can negatively affect the market during the review period. Furthermore, the presence of suitable alternatives such as silicone rubber can also act as restraining factor to neoprene market over the forecast timeframe.

Product demand in construction and automotive sector in North America and Europe is poised to exhibit moderate growth rate whereas countries in Asia Pacific shall hold a largest share in the automotive and construction sector on account of improvement in economic conditions, availability of resources and developing industrial base. Additionally, the growing penetration of neoprene in the electrical and aquatic sports gear industries in Asia Pacific nations will further augment product demand during the review period.

| Report Attribute | Details |

|---|---|

| Base Year: | 2018 |

| Neoprene Market Size in 2018: | 1.95 Billion (USD) |

| Forecast Period: | 2019 to 2025 |

| Forecast Period 2019 to 2025 CAGR: | 2.3% |

| 2025 Value Projection: | 2.28 Billion (USD) |

| Historical Data for: | 2014 to 2018 |

| No. of Pages: | 182 |

| Tables, Charts & Figures: | 295 |

| Segments covered: | Product, End-user and Region |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|