Home > Aerospace & Defense > Aviation Technology > Military Drone Market

Military Drone Market Analysis

- Report ID: GMI2484

- Published Date: Apr 2018

- Report Format: PDF

Military Drone Market Analysis

The fixed-wing product segment is projected to exhibit a growth rate of over 5% from 2017 to 2024 due to its widespread adoption for defense operations. These drones are simple in structure, which ensures that the drone is more efficient to aerodynamics, offering the benefit of long flight duration at high speeds. These drones can also carry huge payloads over long-distances due to which the demand for these drones will increase over the estimated timespan.

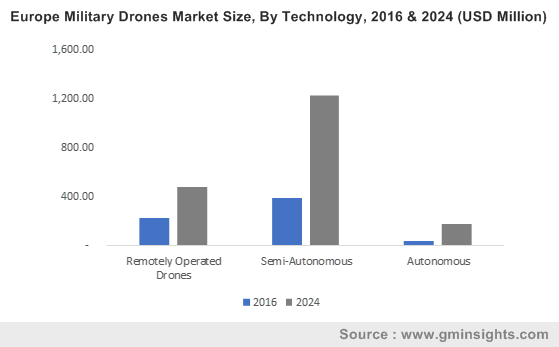

The remotely operated military drone market will hold a market share of above 15% by 2024 due to the extensive usage of such drones in the aviation industry owing to stringent regulations followed by aviation authorities with the protocol of Line of Sight (LOS) employed mandatorily. Remotely operated drones comprise conventional features of operating a machine through remotes. This ensures that the drone is completely under the vision of the operator, making the operator responsible for the operation of the drone in the air.

The Visual Line of Sight (VLOS) market is estimated to hold a market share of over 25% by 2024 due to the rising use of VLOS drones by various government applications including police operations, traffic monitoring, and firefighting & disaster management applications. Regulatory authorities globally are introducing various VLOS regulations regardless of whether drones are used for recreational or commercial purposes which will contribute to market growth. However, the growing inclination toward the Beyond Visual Line of Sight (BVLOS) drones as they bring efficiency and speed up the data collection process will hamper the VLOS market growth.

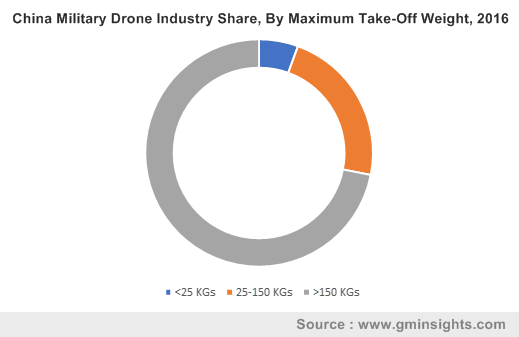

The market for the maximum take-off weight of more than 150 Kgs is estimated to grow at a CAGR of around 10% over the forecast timeline. The rising adoption of drones with a high payload capacity to support critical missions including search & rescue operations, surveillance, and traffic monitoring will fuel military drones market growth. The growing need among military organizations for High Altitude Low Endurance (HALE) drones will also augment market growth.

The government application segment is expected to witness the fastest growth rate due to the increasing usage of drone technology for managing administrative functions and public services to ensure accelerated service delivery to citizens. In this segment, the firefighting & disaster management application is projected to hold a market share of above 5% by 2024. Aerial imaging platforms are being extensively used for disaster response applications. For example, in September 2016, the emergency services in Italy used high-tech drones provided by the European Commission-run project for conducting search & rescue operations of damaged towns.

Asia Pacific will account for more than 15% of the military drone market share by 2024 due to growing investments in new drone technologies for developing high-tech drones to support military applications. Countries including China, Japan, India, and Australia are witnessing huge adoption of drones for the defense and government sector. For instance, in December 2017, the Chinese Military deployed reconnaissance-attack drones, Yilong-2 for spying purpose. The market growth in the region is also supported by the presence of various number of drone manufacturers who are continuously investing in advanced technologies to develop drones.