Home > Chemicals & Materials > Specialty Chemicals > Custom Synthesis > Methyl Ethyl Ketone (MEK) Market

Methyl Ethyl Ketone (MEK) Market Analysis

- Report ID: GMI180

- Published Date: Mar 2016

- Report Format: PDF

Methyl Ethyl Ketone Market Analysis

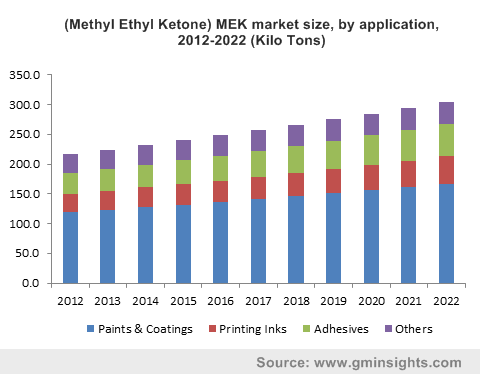

Paints & coatings application dominated with revenue generation exceeding by USD 1.2 billion in 2014. This application is likely to witness significant gains up to 2022. Paints & coatings include powder coatings, waterborne coatings, solvent borne technologies and specialty coatings. Increasing demand for powder coatings from automobiles and electronics industry is expected to drive methyl ethyl ketone market demand./p>

Printing inks application accounted for over 14% of the total volume in 2014 and is likely to witness significant growth rate up to 2022. Methyl ethyl ketone (MEK) is extensively used and preferred solvent in printing industry owing to advantages offered such as excellent drying times, adhesion with substrates such as plastics, metals & glass and allowing formulation of specialized inks. Growth of end-use industries such as food processing, pharmaceuticals and cosmetics are anticipated to drive the methyl ethyl ketone market demand for printing ink applications./p>

APAC market size was dominant with China being the largest consumer base in 2014. China accounts for more than 35% of the total installed capacity. Growth of end-use industries such as construction, automobiles and electronics is likely to drive the methyl ethyl ketone market share in the region.

North America industry was majorly driven by the U.S. and occupied a share of over 18% in 2014. North America is likely to witness moderates growth rates during the forecast period owing to recovery of industries post the recession coupled with emphasis on using green solvents driven by strict environmental norms.

MEA occupied a smaller chunk of the global share with countries such as Saudi Arabia, Qatar, Bahrain and UAE methyl ethyl ketone market expected to witness an increase from paints & coatings demand owing to growth of construction industry.