Home > Automotive > Aftermarket > Tools and Equipment > Automotive Torque Tools Market

Automotive Torque Tools Market Analysis

- Report ID: GMI3311

- Published Date: Jun 2019

- Report Format: PDF

Automotive Torque Tools Market Analysis

Nutrunner will witness strong growth in the automotive torque tools market size owing to its ability to achieve torque capacity at an optimum speed. The tool offers high durability and requires low maintenance thereby increasing the product demand. Ongoing product developments such as angle-lever nutrunner for assembly of heavy-duty trucks will support the industry proliferation. For instance, in May 2019, Stanley Engineered Fastening launched B44L angle-lever nutrunner with 60-volt DEWALT Flexvolt battery.

Torque wrenches will witness significant revenue share in the market share owing to its increasing usage in tightening nuts and bolts. In addition, the development of new battery powered wrenches will offer optimum power to weight ratio along with automatic shutoff facility when target value is reached. For instance, in March 2016 ITH Bolting Technology launched battery powered torque wrench for bolted connections bigger than M16 used in heavy construction machineries.

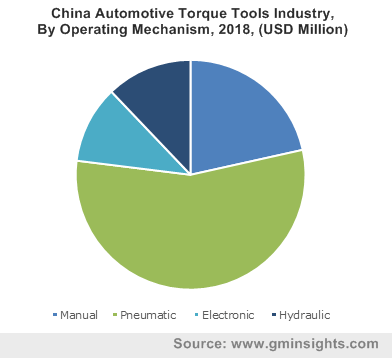

Electronic torque share will witness over 6% CAGR owing to benefits provided by these tools such as easier handling capabilities coupled with quick operations. Additionally, lower pressure requirements on these electronic tools along with installation of electronic chips for evaluating records further accelerates the automotive torque tools market share over the study timeframe.

In 2018, the hydraulic torque segment accounted for around USD 100 million on account of easy availability of hydraulic products. In addition, these tools are available in several profiles including W-series low profile hexagon models and S-series square drive to enhance productivity and operator safety.

Corded type will lead the automotive torque tools market size with its ability to provide higher torque capabilities. The toll offers more precise control on amount of torque applied to a bolt without losing any capacity. Further, the tools generate minimum vibration and offer quieter and safe work environment.

Codeless segment will witness significant growth in automotive torque tools market size owing to development of new products with compact size and improved power capacity. The industry participants are launching new product with advanced features such as power selection display to know which setting is selected and impact is in forward or reverse mode. In addition, these tools are incorporating thermo plastic rubber in handle to provide firm grip. For instance, in June 2018, Chicago Pneumatic launched cordless wrench with 2 shut-off position and display.

Adjustable tool will showcase a substantial growth in the automotive torque tools market on account of providing greater torque and easy handling. The requirement of large tools for service and maintenance of heavy vehicles along with control and consistency provided by these products will enhance market penetration. The industry participants are frequently launching adjustable tools to expand their market presence. For instance, in January 2019, BIW Industrial launched adjustable torque wrench that cover a range up to 1,000 Nm.

Pre-set tools segment will account for considerable growth in the market size. This can be attributed to reduced bolting time & cost and improved accuracy for critical joints. OEMs are expanding their pre-set tools range by introducing new products. For instance, in May 2015, Ingersoll Rand expanded series of pre-set power tools by launching high torque angle wrench for assembly.

North America will exhibit a significant growth in the automotive torque tool market size over the projected timeframe owing to technological advancements in automotive parts & components. Growing investments by domestic players in designing and manufacturing automotive tools and machinery will drive the industry growth.

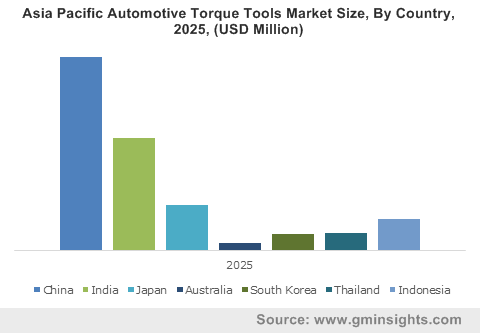

Asia Pacific will hold the dominance in the automotive torque tools market size on account of increasing automotive production. Higher concentration of automotive manufacturers such as Toyota, Honda, and Suzuki increase the tools demand. Additionally, establishment of manufacturing plants in China, Japan and India along with rising preference for personal vehicles are escalating the regional share. For instance, in May 2019, SCS Concept opened a new manufacturing facility in China to offer direct customized solutions to customers for installation, quote, maintenance and repair, and calibration.