Home > Healthcare > Pharmaceuticals > Disease Specific Drugs > Atrial Fibrillation Drugs Market

Atrial Fibrillation Drugs Market Analysis

- Report ID: GMI3253

- Published Date: Apr 2019

- Report Format: PDF

Atrial Fibrillation Drugs Market Analysis

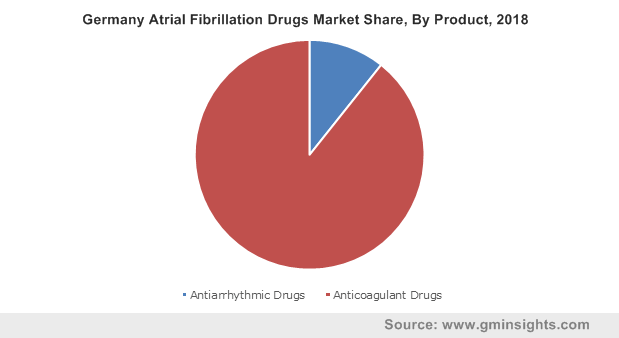

Anticoagulant drugs market is projected to grow at 3.5% over the estimation period. Anticoagulants have been known for many years to produce a declining rate of stroke in individuals suffering from atrial fibrillation. Maximum thromboembolic perturbations of atrial fibrillation are mostly preventable with oral anticoagulants. For over fifty years, the only effective therapeutic option to prevent stroke in atrial fibrillation patients were vitamin K antagonists. Additionally, increasing focus of manufacturers in the development of oral anticoagulants have boosted the product demand. Hence, the aforementioned reasons will augment the growth of anticoagulant drugs market.

Antiarrhythmic drugs market in atrial fibrillation was valued at USD 1,384.4 million and is estimated to witness a considerable decline in the near future owing to its less effectiveness in restoring and maintaining a normal heart rhythm. It is evident that people above age of 65 years often suffer from perturbations associated with heart rhythms and hence, antiarrhythmic drug treatment is the most preferred solution in older population. But, emergence of oral anticoagulants with more effectiveness will gradually replace the use of antiarrhythmic drugs in atrial fibrillation. Thus, antiarrhythmic drugs market in atrial fibrillation will gradually decline in the near future.

The use of atrial fibrillation drugs in paroxysmal condition was valued at around USD 7,095.8 million in the year 2018. Paroxysmal atrial fibrillation occurs when an irregular and rapid heart rate starts suddenly and then stops on its own within a few days. As per the American Heart Association, currently around 2.7 million to 6 million Americans suffer from some form of atrial fibrillation. The likelihood of suffering paroxysmal atrial fibrillation rises with age. Though paroxysmal atrial fibrillation is not life-threatening, but it can cause some critical consequences with time. The most suitable prescribed treatment for paroxysmal atrial fibrillation is blood thinners or anticoagulants thus, augmenting atrial fibrillation drugs market growth.

The use of atrial fibrillation drugs for persistent condition will grow at 3.2% over the forthcoming years. Atrial fibrillation is the most common heart arrhythmia and persistent atrial fibrillation is a condition where erratic and rapid heartbeat last for longer period of time as compared to paroxysmal condition. The most preferable treatment in such cases are antiarrhythmic or anticoagulant drugs that help to restore regular heart beats and prevent blood clots, thus fueling product demand.

Application of atrial fibrillation drugs in heart rhythm control was valued at around USD 3,312.4 million in the year 2018. Many patients suffering from atrial fibrillation require restoration of sinus rhythm to improve their quality of life. Maintenance and acute restoration of sinus rhythm in patients with atrial fibrillation are denoted as rhythm control. Antiarrhythmic drugs are generally suggested as a first-line therapy and drug prescription is done on the basis of absence or presence of structural heart disease or heart failure, renal function, and other comorbidities. It has been identified that increase in geriatric population is boosting the demand of atrial fibrillation drugs, since they are more prone to perturbations associated with heart rhythm.

Application of atrial fibrillation drugs in heart rate control will grow at 4.4% over the forecast period. Heart rate control in atrial fibrillation are to limit symptoms related with excessive heart rates and to avoid tachycardia?related cardiomyopathy. Rate control involves the use of anticoagulant drugs or surgical interventions to decrease the erratic ventricular rate often found in patients suffering from atrial fibrillation. Hence, the increasing prevalence of cardiovascular diseases have augmented the atrial fibrillation growth for heart rate control.

Oral atrial fibrillation drug administration market was valued around USD 10,403.0 million in the year 2018. The prevalence of atrial fibrillation across the globe is increasing at a rapid pace, especially with growing age of the population. Patients with thromboembolic stroke due to atrial fibrillation have higher morbidity, mortality and longer hospital stays compared to patients with other form of strokes. The most prescribed drug therapies for the prevention of atrial strokes are oral drug therapies owing to its effectiveness in prevention of blood clotting thus, augmenting the market growth.

Injectable atrial fibrillation drugs segment is expected to witness a substantial growth at 2.4% over the projected period. The growth is attributed to its extensive use in patients suffering from atrial fibrillation who cannot take drugs orally. Hence, increase in such cases have augmented the segment growth of injectable atrial fibrillation drugs.

Application of atrial fibrillation drugs is highest in hospitals resulting in major market share. The hospitals segment accounted for around USD 6,583.2 million revenue in the year 2018. A substantial proportion of atrial fibrillation drug therapies happen in hospital settings; thus, demand for these drugs are the highest. During the forecast period, the hospital end-use market segment will continue to lead, owing to increasing availability of drug therapies in hospital settings coupled with rising supply agreements of drugs between manufacturing firms and hospitals.

Cardiac centers held significant industry share in 2018, being the most preferred setting in developed as well as developing countries. The cardiac centers segment is forecasted to expand at a healthy CAGR of 3.8% over the forecast period. Hence, adoption of oral drug treatments in cardiac centers should propel industry growth.

U.S. dominated the North America atrial fibrillation drugs market, accounting for around USD 4,933.5 million in the year 2018. The U.S. captured the largest share of the global market due to increasing geriatric population coupled with rising prevalence of valvular diseases among the population. Moreover, increasing number of drug manufacturing companies such as Johnson and Johnson and Bristol-Myers Squibb will further augment the growth of U.S. atrial fibrillation drugs market.

China atrial fibrillation drugs market will observe rapid growth rate of 6.0% over the forecast period. The growth is attributed to development of hospitals and growing acceptance of private clinics in the region. Furthermore, prevalence of cardiac diseases due to sudden transition in lifestyle and increasing instances of binge eating have boosted the industry growth.