Home > Packaging > Industrial Packaging > Alcohol Packaging Market

Alcohol Packaging Market Analysis

- Report ID: GMI2796

- Published Date: Apr 2022

- Report Format: PDF

Alcohol Packaging Market Analysis

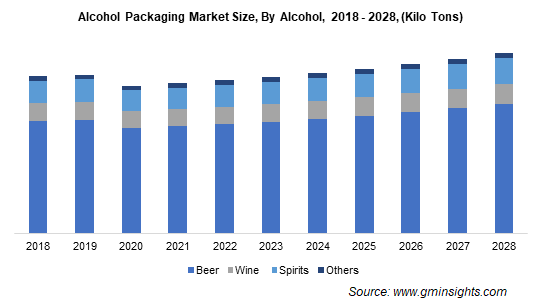

The beer segment will generate a demand of over 60 million tons packaging material by 2028. Beer is one amongst the oldest and highly consumed alcoholic beverage. It is the third most popular drink after tea and coffee. Beer is a celebration drink among millennials. It is an important factor in feasts, facilitating the cohesion of social groups.

Beer is more nutritious compared to any other alcoholic drink. It contains huge amounts of antioxidants, proteins, and vitamin B. Drinking beer reduces the risk of developing kidney stones. The other benefits of beer are the presence of soluble fiber in beer reduces bad cholesterol or LDL and it makes human bones stronger owing to its high silicon content.

The paper segment will generate around USD 3 billion by 2028. Paper packaging provides functional packaging and convenient storage, which are appealing and easy to carry. Paper bottle is usually put around a food-grade liner for holding the wine or spirit. Paper-based alcohol packaging provides a sustainable, healthy & safe environment. Paper and cardboard packaging looks more attractive and offers superior protection to alcohol. Paper containers are produced from renewable sources such as paper & paperboard that offer distinct environmental sustainability benefits.

The alcohol packaging market from primary packaging is projected to rise at a CAGR of 2.9% through 2028. Primary alcohol packaging involves materials that are in direct contact with the alcohol. It is also known as consumer or retail packaging. Primary alcohol packaging is done to protect, preserve, and provide information to the consumer.

When employed in the packaging of beer, the bottle containing the liquid and the label can be considered primary packaging. Primary packaging eases the way a consumer handles alcohol and makes the beverage appealing. Glass bottles, aluminum cans, tin cans, and PET bottles are some of the instances of primary packaging. Primary alcohol packaging protects the alcohol from spilling and exposure to elements that may lead to its deterioration.

The Asia Pacific is projected to achieve over 30% market share by 2028 driven by the increasing consumption of beer and spirits in the region. The shifting manufacturing preferences for sustainable packaging will augment the alcohol packaging market in Asia Pacific. The presence of highly populated countries such as China & India together with increased disposable incomes and rising acceptance of alcohol consumption will also favor the market growth. Besides these, rising awareness with respect to environmental safety among consumers will prove to be fruitful for the development of alcohol packaging in the long run.