Home > Energy & Power > Oil and Gas > Upstream > Zonal Isolation Market

Zonal Isolation Market Analysis

- Report ID: GMI766

- Published Date: Jan 2019

- Report Format: PDF

Zonal Isolation Market Analysis

Ongoing development of the existing oil & gas deposits to enhance the production capabilities along with the redevelopment of mature fields will boost the onshore zonal isolation market size. Increasing number of onshore drilling activities coupled with availability of proved oil reserves will further propel the business growth. In 2017, Noble Energy declared to allocate USD 1.8 billion with major focus toward DJ Basin, Eagle Ford and Delaware Basin for drilling and completion in the onshore region.

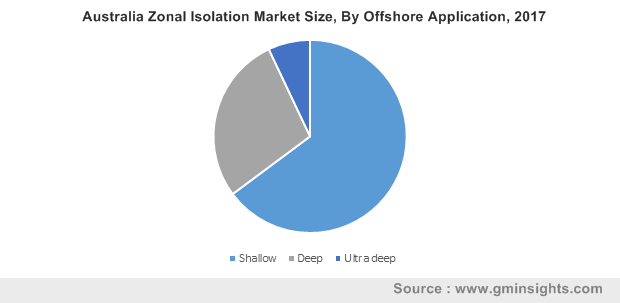

Offshore zonal isolation market will witness growth over 4.5% by 2024. Massive investments toward the exploration & production of oil & gas in the deep and ultra-deep waters will significantly stimulate the business growth. Accelerating government initiatives for potential expansion of drilling activities with regard to availability of larger oil reserves in deeper basins will further propel the industry landscape.

Ability to enable flexibility in pumping & designing stimulation jobs along with favorable deployment economics will drive the mechanical zonal isolation market. Continuous efforts toward optimizing production within the existing oilfields along with reliable operations of these techniques in various environment settings will positively impact the product penetration.

Plug zonal isolation market is expected to grow over 5% by 2024. Ability to provide isolation across perforated intervals during wellbore stimulations, lost circulation control, directional drilling and formation testing will enhance the product penetration. Furthermore, greater applicability of plugs across depleted wells, dry hole formations and exploration wells will propel their adoption.

Chemical zonal isolation market will witness growth on account of its long-term stability and efficiency to operate in wide range of temperatures. The method further finds application across completions, reservoir and well bore problems. Enhanced applicability to isolate water and gas producing zones across the horizontal wells will further encourage the technology adoption.

Rising concerns pertaining to the hazardous impact of materials on the marine life will boost the biopolymer based zonal isolation market. The ability to offer various competencies including stability at higher temperatures, and improved compatibility with drilling fluid & cement are some of the prominent features stimulating the product adoption. Furthermore, its capability to effectively limit cement losses and to provide enhanced hole cleaning prior to the cement placement will propel the industry growth.

The U.S. market, in 2017 was valued over USD 2.5 billion. Enhanced number of matured oil fields across the region along with favorable regulatory measures to permit drilling activities in the protected areas of Arctic & Antarctic will complement the business landscape. In addition, high production potential on account of extensive number of untapped oil reserves will further enhance the industry outlook.

The Middle East zonal isolation market will witness growth on account of increasing oil demand and ramping new drilling projects by countries including Saudi Arabia, the UAE and Qatar. For instance, Saudi Arabia has undertaken several initiatives to enhance its upstream O&G capabilities by signing a joint agreement between Saudi Aramco and Rowan Companies with regard to drilling equipment and services. Presence of large volume of proven oil reserves along with enhanced focus toward enhancing production of mature oil fields will further stimulate the industry growth.