Home > Chemicals & Materials > Adhesives and Sealants > Specialty Sealants > Wood Adhesives And Binders Market

Wood Adhesives And Binders Market Size

- Report ID: GMI1098

- Published Date: Jan 2017

- Report Format: PDF

Wood Adhesives And Binders Market Size

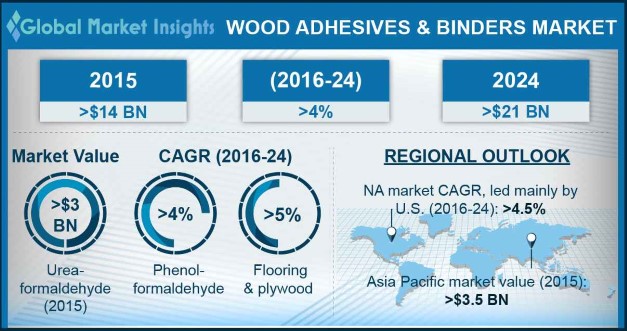

Wood Adhesives and Binders Market size generated more than $14 billion in 2015 and is forecast to witness over 4% CAGR through 2024. Robust growth in the construction industry is analyzed to be the key factor propelling the global market over the projected timeframe.

The product is largely used in the wood products across construction industry for flooring, plywood, cabinets, windows, doors and other structural panels. The global construction industry was valued roughly at over USD 7 trillion in 2013 and is projected to exceed USD 13 trillion by 2024. This trend along with rising demand in order to enhance aesthetic appearance will subsequently propel the wood adhesives and binders market share, particularly for structural bonding applications.

Raw materials required in the wood adhesives and binder market are generally petrochemical feedstock. The product is primarily synthesized from petroleum-based feedstock such as phenols, vinyl acetate, isocyanates, urea, acrylates, polyolefins, styrene butadiene and polyurethanes. These petrochemical and downstream products are dependent on the supply and prices of crude oil.

Oscillating crude oil prices along with the civil unrest in the Middle East have resulted in bottleneck crude oil supply, which also affects the petrochemicals price. This may hamper wood adhesives and binders market price trends over the forecast timeframe. For instance, crude oil price in Dubai was approximately USD 35 per barrel in January 2009 and was close to USD 90 per barrel in July 2014.

| Report Attribute | Details |

|---|---|

| Base Year: | 2015 |

| Wood Adhesives And Binders Market Size in 2015: | 14 Billion (USD) |

| Forecast Period: | 2016 to 2024 |

| Forecast Period 2016 to 2024 CAGR: | 4% |

| 2024 Value Projection: | 21 Billion (USD) |

| Historical Data for: | 2013 to 2015 |

| No. of Pages: | 128 |

| Tables, Charts & Figures: | 165 |

| Segments covered: | Product and Region |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

VOC (volatile organic compounds) emissions during commercial and industrial product applications have associated environmental and health hazards. Prevalence of stringent environmental legislations for VOC emissions may obstruct industry growth by 2024, specially for solvent-based products. For instance, in the U.S., the ARB (Air Resources Board) issued a document for determining RACT (Reasonably Available Control Technology) to keep a check on the pollution caused by adhesive application. These environmental regulations restrict the global wood adhesives and binders market growth, as violation of such government-defined regulations can lead to heavy penalties and losses.

However, emergence of bio-based product has created new growth prospects for the industry participants. For example, polyols, which are bio-derived from soybeans, can be effectively used in polyurethane adhesives formulation. Increasing bio-based product acceptance in the industry owing to its similar characteristics along with environmental and cost benefits will significantly boost the global wood adhesives and binders market by 2024.