Home > Healthcare > Pharmaceuticals > Pharma Manufacturing > U.S. Compounding Pharmacies Market

U.S. Compounding Pharmacies Market Analysis

- Report ID: GMI2961

- Published Date: Jun 2022

- Report Format: PDF

U.S. Compounding Pharmacies Market Analysis

The U.S. compounding pharmacies market, based on pharmacy type, is classified into 503 A and 503B. The 503B pharmacy type segment accounted for around 56.5% market share in 2021 and the trend will continue to rise over the forecast years. A 503B is a compounding pharmacy that is registered with FDA as a 503B outsourcing facility. Registration with FDA enables a facility to compound and distribute drugs with or without a patient-specific prescription.

Such facilities can manufacture large batches of drugs to be sold to healthcare facilities for office use only. These pharmacies are allowed to manufacture larger batches of compounded medications to lower their manufacturing costs, thereby passing the savings onto consumers. Such benefits attract patients towards compounded medications and thereby fueling the market progression.

Moreover, according to study conducted by the U.S. Department of Health and Human Services, it was reported that most hospitals, nearly 89% obtained non-patient-specific compounded from outsourcing facilities. Such instances will foster the U.S. compounding pharmacies business.

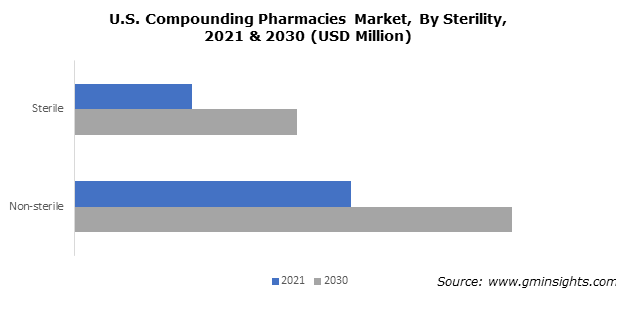

Based on sterility, U.S. compounding pharmacies market are classified into sterile and non-sterile. The non-sterile segment accounted for over USD 3.5 billion revenue in 2021. Non-sterile compounded medications include solutions, suspensions, ointments, creams, powders, suppositories, capsules, and tablets. The major advantage of non-sterile compounding medication is the ability to modify route of administration based on patient convenience.

In addition, customizing strength of dosage, addition of favoring and removal of allergic components from the medication are some other benefits offered by non-sterile compounding medications. Since the regulations around non-sterile compounded medications are less strict than sterile doses, the sale of non-sterile medications is higher contributing to segmental expansion.

Based on product, the U.S. compounding pharmacies market is segmented into oral, topical, rectal, parenteral, nasal, ophthalmic, and otic. Among them, the oral segment accounted for around USD 1.7 billion in 2021. This can be attributed to the rising demand for oral route of drug administration.

Oral drug administration offers several benefits such as self-administration, pain-free, and it is one of safest means of drug administration among other forms. Similarly, availability of several medications in oral form, such as solid preparations that include capsules, tablets, powder, etc. and liquid preparations such as syrups, suspensions, etc. as compared to other dosage forms fuels the segmental outlook.

Based on compounding type, the U.S. compounding pharmacies industry is categorized into Pharmaceutical Ingredient Alteration (PIA), Currently Unavailable Pharmaceutical Manufacturing (CUPM), Pharmaceutical Dosage Alteration (PDA) and others. Among these Pharmaceutical Ingredient Alteration (PIA) recorded over 35.4% market share in 2021.

Pharmaceutical Ingredient Alteration (PIA) offers a major advantage of compounding medication. It allows addition or deletion of specific drugs in a medication to formulate patient specific medicine as per the patient need. This is highly beneficial in substituting certain drugs that the patient might be allergic to. Such benefits of compounded medications enhance the U.S. industry landscape.

Based on application, the U.S. compounding pharmacies market is categorized into pediatric, adult, geriatric and veterinary. The adult segment accounted for over 45.7% market share in 2021. Adults are prone to several lifestyle related chronic diseases owing to their sedentary lifestyle and food habits.

Additionally, increasing number of adults suffer from nutritional deficiencies. Such nutritional deficiencies can be easily tackled with patient specific compounded medications to fulfill nutritional requirements in adults. Therefore, companies are organizing events to aware adults about problems associated with nutrition deficiency.

Furthermore, adults prefer compounded nutritional supplements to avoid their need to take several medications, since a single medication is formulated to meet all their nutritional needs. This accelerates the progression of the U.S. compounding pharmacies industry.

The U.S. compounding pharmacies, based on therapeutic area is classified into hormone replacement, pain management, dermatology applications, specialty drugs, nutritional supplements, and others. Out of these, the pain management segment is expected to grow at a 5.6% CAGR during the analysis period. The segmental growth is high owing to rising prevalence of chronic pain geriatric population as well as adult population.

For instance, as per the National Health Interview Survey, in 2019, 50.2 million adults (20.5%) reported chronic pain on most days in the U.S. The common pain areas were knee, back pain, foot, and hip. Also, compounded medications provide best solution for pain relief. Cream from of compounded medication provides instant relief from pain when applied directly at the site of pain.

Moreover, compounding pharmacy collaborate with a healthcare provider to create customized pain management treatment options and customizable dosages to offer pain management medications. Such scenarios will propel the overall market size.