Home > Energy & Power > Electrical Equipment > Boilers > U.S. Boiler Market

U.S. Boiler Market Analysis

- Report ID: GMI4391

- Published Date: May 2023

- Report Format: PDF

U.S. Boiler Market Analysis

The natural gas segment was valued at over 2 billion in 2022. Natural gas is a widely available and relatively affordable fuel source in the U.S. It is a cleaner-burning fuel when compared to other fossil fuels, resulting in lower emissions of greenhouse gases and pollutants. The environmental advantages of natural gas make it an attractive option for industries and commercial sectors. The ongoing shift towards cleaner energy sources and the paradigm shift toward energy efficiency will foster the U.S. boiler market expansion.

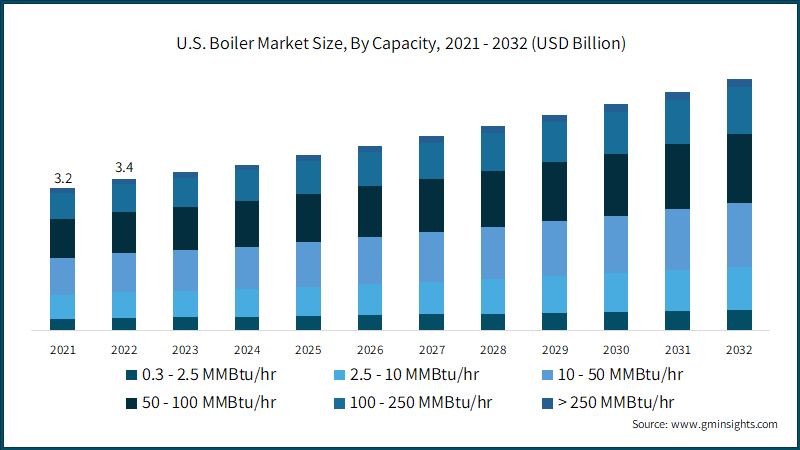

The 0.3 – 2.5 MMBtu/hr capacity boiler industry is expected to cross a valuation of USD 450 million by 2032 driven by the continuous development of commercial establishments including retail stores, offices, nursing homes, and educational institutions. This growth is further accelerated by shifting trends towards the consumption of processed food and beverages.

The condensing technology is projected grow at a rate of 10.4% till 2032. This technology allows for higher energy efficiency compared to traditional non-condensing boilers. The growing emphasis on energy efficiency and environmental sustainability is driving the adoption of these units. The introduction of stricter energy efficiency standards and building codes in commercial sector will further institute a favorable outlook for boiler market in the United States.

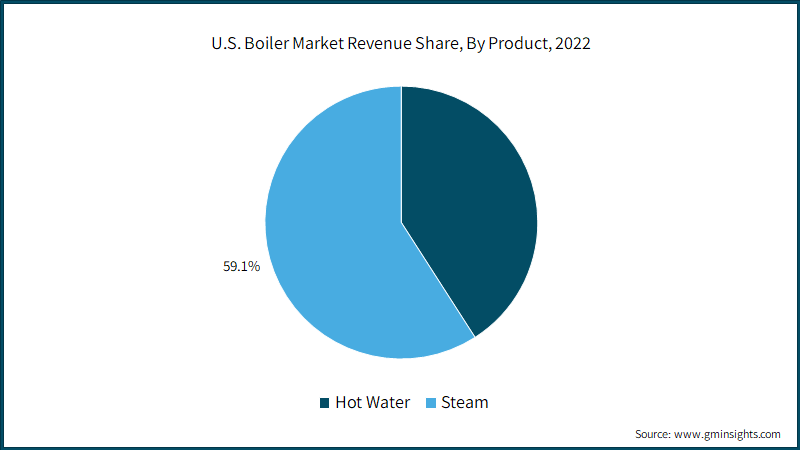

The hot water boiler product type holds industry share of about 40% in 2022. The industry will witness an upsurge owing to increasing population index and urbanization rate. Rising construction activities, particularly in the commercial sector, are driving the product demand. Increasing urbanization rate coupled with the introduction of stringent emission norms to deploy advance heating systems will positively impact the business landscape.

Steam boiler market is projected to grow on account of its surging demand from various industries including power generation, chemical, food and beverage, and manufacturing plants. The demand has received an impetus from the increased replacement activities across commercial spaces and industries. Ongoing technological advancements boiler design that enables the use of natural gas, shale gas and electricity as the preferred feedstock will drive the industry growth.

The commercial boiler industry reached USD 1.6 billion value in 2022. The favorable outlook toward the healthcare sector's expansion coupled with the increasing demand for diagnostic centers will foster the business statistics. Government regulations aimed at transitioning towards zero-emission buildings have led to the replacement of existing heating units, which in turn will offer significant growth opportunities. Additionally, there is a growing emphasis on reducing the adverse effects of carbon emissions, which has increased the demand for energy-efficient boilers.

The East North Central boiler market is expected to witness growth rate of 5.1% during 2023-2032. The ongoing economic development and increasing investments towards upgradation of industrial facilities will augment the industry landscape. The rising per capita income and growing demand for food processing units will further boost the adoption of boilers. In addition, increasing investments across the chemical sector will further complement the industry growth. The growing space heating demand, low winter temperatures, and upgradation of the existing commercial facilities are some of the key parameters which will complement the market growth.