Home > Industrial Machinery > Personal Protective Equipment > Hand Protection > U.S. Safety Gloves Market

U.S. Safety Gloves Market Analysis

- Report ID: GMI4845

- Published Date: Oct 2020

- Report Format: PDF

U.S. Safety Gloves Market Analysis

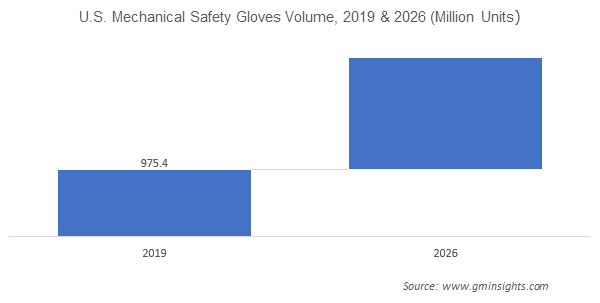

Mechanical safety gloves contributed nearly major revenue share in 2019. Mechanical gloves provide excellent protection from cuts, backhand impact protection along with offering oil resistance. Cut-protection gloves account for over 40% share of the U.S. mechanical safety gloves market. Whereas, back-hand impact protection mechanical gloves are anticipated to be the fastest growing sub-category, anticipated at nearly 11.5% CAGR from 2020 to 2026.

Upgradation in ANSI standards pertaining to impact & cut-protection along with wide application outlook across sectors such as mining, oil & gas, commercial construction, automotive, and transportation are escalating the U.S. safety gloves market segment share. The oil & gas industry has a strong requirement for mechanical gloves in the upstream as well as the downstream industry.

Chemical & liquid protection products are anticipated to grow at a substantial pace between 2020 to 2026. Single use chemical & liquid protection gloves hold over 70% the segment revenue share owing to large demand from the U.S. medical & healthcare and the food & beverage sector. These gloves offer hand protection from varied chemicals, and microorganisms while handling diverse applications.

Key properties such as water resistance, reduced allergies, and improved grip are also projected to drive the segment growth. Workers especially from the oil & gas, petrochemical, and chemical industries are exposed to hazardous chemicals and liquids for daily operations boosting the U.S. safety gloves market demand. Along with the high risk of chemical burns, a strong grip on wet conditions is instigating the demand for chemical protection safety gloves products.

Nitrile gloves are expected to witness the highest revenue growth at over 6% CAGR through 2026. They offer exceptional tactile sensitivity, chemical resistance, puncture resistance, comfort, and dexterity when compared to vinyl and rubber gloves. They are majorly used in manufacturing, chemical, and automotive industries. They possess superior flexibility owing to the use of elastic materials in the product.

Nitrile gloves are easier to remove due to innate resistance to friction, can be worn beneath a pair of gloves to create waterproof hand wear, and provides enhanced comfort as it reacts with body temperature to conform to the shape of the hand.

Natural rubber gloves hold the highest market share at over 45% in terms of volume. Latex naturally offers resistance against most acids, bases, formaldehyde, iodine, and chlorine. Industrial grade natural rubber gloves are widely used in food processing, manufacturing, and automotive applications. They provide high durability, comfort and dexterity.

Good resistance to alcohols, ketones, and organic acid is among the key factors propelling market growth. Cost-effectiveness and environmentally friendly nature is likely to boost the U.S. safety gloves market expansion.

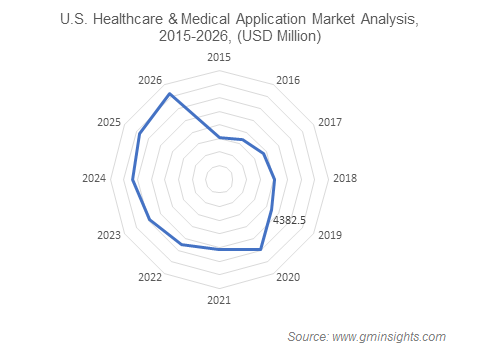

The healthcare segment contributes over 65% share to the U.S. safety gloves market revenue in 2019. Healthcare workers face various hazards on the job, including harmful exposures to hazardous drugs, chemicals sharps injuries, latex allergy, and back injuries. In order to mitigate such risks for gaining superior protection for workers, the major types of products used in this industry include chemical & liquid protection.

The types of materials used to produce these types of gloves include nitrile, natural rubber, vinyl, neoprene, and polyethylene. Rising prevalence of COVID 19 in the country has forced industry players to take stringent measures to contain the virus outbreak by providing superior protective equipment to their employees which in turn helps to run their business in full swing. The WHO has predicted a rise in demand for healthcare gloves by 40% in 2020.

Rising oil and gas exploration activities in the country owing to surging innovations in drilling operations including horizontal drilling which makes it easy to extract shale oil & gas should boost upstream chemicals demand. The upstream sector in oil & gas safety gloves is projected to be the fastest growing sub-segment at nearly 16% CAGR from 2020 to 2026. Increasing government focus towards energy import independence and to upsurge the number of oil exports to become the world’s largest oil producers should further boost upstream chemicals demand.