Home > Construction > Prefabricated Construction > Turkey Construction Market

Turkey Construction Market Analysis

- Report ID: GMI6253

- Published Date: Jul 2023

- Report Format: PDF

Turkey Construction Market Analysis

The residential construction segment held approximately 5% of the Turkey construction market share in 2022 and is anticipated to experience robust growth. According to the Turkish Statistical Institute (TÜ?K), in 2021, 137,401 houses were sold, up from 119,574 in 2020. This factor can give an edge over other construction types. Turkey is experiencing significant urbanization with the growing population moving to cities in search of better employment opportunities and improved living standards. This demographic trend creates a demand for residential properties including housing developments, apartment complexes, and residential infrastructure projects.

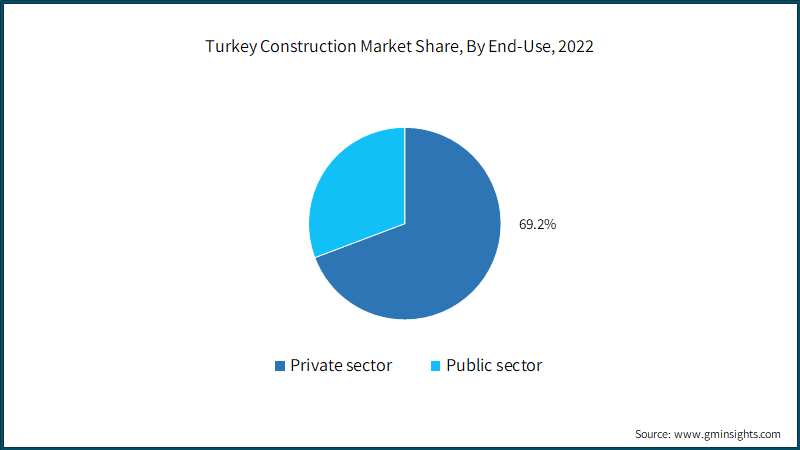

The private sector segment captured about 69.24% share of the Turkey construction industry in 2022 and is poised to observe gains at nearly 4.5% up to 2032. Turkey's growing economy and better employment opportunities have boosted disposable incomes, allowing more people to invest in private construction ventures like buying homes, property renovations, and constructing commercial establishments.

The general contracting segment of Turkey construction market reached USD 25 billion in 2022. Turkey's growing population and urbanization are driving the demand for new infrastructure, residential properties, commercial buildings, and public facilities. General contractors are essential in meeting this demand as they oversee and manage construction projects of various sizes and complexities. Additionally, the Turkish government has been investing significantly in infrastructure development including transportation networks, energy projects, and public services.