Home > Chemicals & Materials > Specialty Chemicals > Custom Synthesis > Sulfosuccinate Market

Sulfosuccinate Market Size

- Report ID: GMI841

- Published Date: Nov 2016

- Report Format: PDF

Sulfosuccinate Market Size

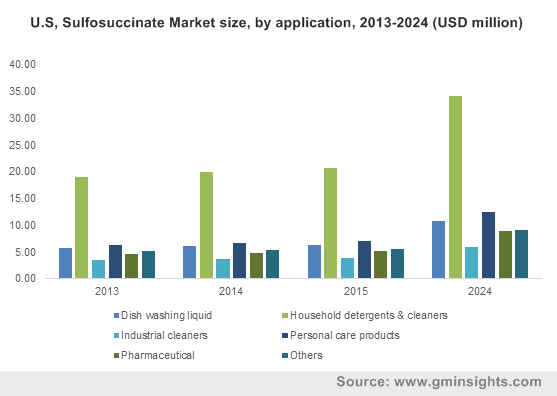

Sulfosuccinate Market size was valued over USD 284 million in 2015 and is forecast to experience 6% CAGR by 2024.

Increasing personal care products demand is analyzed to be the key factor propelling the global sulfosuccinate market size over the projected timeframe. The global skincare business generated revenue close to USD 100 million in 2013 and is projected to exceed 150 million by 2024. In addition, the hair care industry was valued roughly around USD 70 million in 2013 and is estimate to touch USD 100 million over the forecast timeframe. The product offers excellent emulsifying, wetting, and dispersing properties, which makes it ideal for its applications in personal care products including cleaners, baby shampoos, and bubble baths. These are present in shampoos and cleansing products that are used on sensitive and oily skin. Changing lifestyle and increasing consumer disposable income, particularly in the BRIC nations will complement the overall industry growth by 2024.

The global household detergents market size in 2013 was more than 30 kilo tons and will surpass 60 kilo tons over the forecast timeframe. The product is an anionic surfactant and is extensively used in detergents. It is also used as solubilizers and dispersants. The primary function of the product as detergents is soil removal from fabrics and suspend the soil in the wash water. In addition, it is also used as cleansers for dry cleaning, glass and floor cleaners, and carpet shampoos. They are also used in leather and fur industries. Growing health & wellbeing industry will boost the specialty detergents & cleaning agent’s business growth, which in turn would proliferate the sulfosuccinate market share in the near future.

| Report Attribute | Details |

|---|---|

| Base Year: | 2015 |

| Sulfosuccinate Market Size in 2015: | 284 Million (USD) |

| Forecast Period: | 2015 to 2024 |

| Forecast Period 2015 to 2024 CAGR: | 6% |

| 2024 Value Projection: | 475.7 Million (USD) |

| Historical Data for: | 2012 to 2014 |

| No. of Pages: | 115 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | Application and Region |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

Bio-based alcohol ether sulfate (AES) can replace petroleum-based AES. These bio-based surfactants contribute similar desirable properties to personal care products and detergents as petroleum-based surfactants. Thus, these surfactants are extensively used as the product substitutes in personal care and detergents industries. This may hamper the overall sulfosuccinate market size over the forecast timeframe. Additionally, sulfosuccinates face challenging regulatory, environmental and consumer pressure pertaining to the production, packaging, transporting, use and its disposal owing to obstruct industry growth. For instance, surfactants product registration and their formulated products are strictly regulated and directed by the EPA. and REACH. However, the product can be used to drill and produce oil, natural gas and coal bed methane. An aqueous surfactant formulation is injected into a mature oil reservoir. Recovering oil & gas industry is likely to create new growth avenues to the industry participants.