Home > Packaging > Consumer Goods Packaging > Food Packaging > Spout & Non-Spout Liquid Pouch Packaging Market

Spout & Non-Spout Liquid Pouch Packaging Market Analysis

- Report ID: GMI2832

- Published Date: Aug 2018

- Report Format: PDF

Spout & Non-Spout Liquid Pouch Packaging Market Analysis

Spout liquid pouch packaging market will witness gains at over 8% in terms of revenue up to 2024. Development in pouring valves ensuring optimal hygiene, safety and waste reduction has stimulated the product penetration in recent years. Strong outlook from food & beverages and industrial applications due to ease in consumption and closure will provide lucrative opportunities for the spout & non-spout liquid pouch packaging market demand.

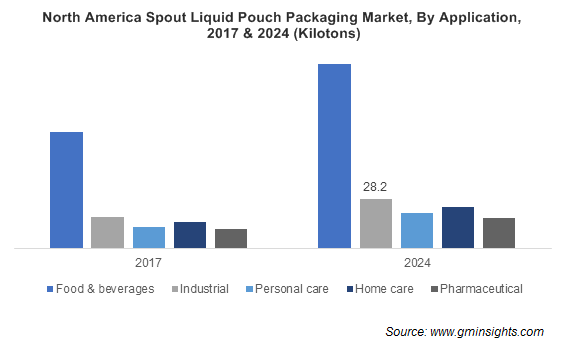

Food & beverages accounted for more than 50% of the spout & non-spout liquid pouch packaging market in 2017. Strong outlook in food applications including juices, dairy products, beverages, wine & spirits and water due to improved shelf life and protection against impurities will propel industry growth. Shifting consumer focus on hygiene maintenance coupled with rising consumption of ready-to-eat food will fuel the application scope.

Personal care application in spout liquid pouch packaging market is anticipated to grow at over 7% from 2018 to 2024. Rising demand for anti-ageing skin cosmetics among adult & geriatric population is among key factors fostering industry growth. Moreover, upsurge in the novel in-store shopping experience demand particularly among women will further enhance the spout & non-spout liquid pouch packaging market expansion.

Non-spout liquid pouch packaging market from 200ml sizes will value over USD 2.5 billion by 2024. Increasing consumer preference for small packages along with strategic packing quantity for FMCG are major factors positively influencing the segment demand. Surging millennial population coupled with rapid urbanization and busy schedules are among major factors driving the spout & non-spout liquid pouch packaging market demand.

750ml size spout liquid pouch packaging market will witness CAGR at over 8% in terms of revenue up to 2024. Consumer inclination towards products offering value for money, adequate content and easy consumption will boost the business expansion. Advancement in material science along with emergence of multi-layer polymers has enhanced the product demand for larger quantities.

Four-layer segment accounted for over USD 1.5 billion in 2017. Four-layer laminates provide superior versatility and offer substantial properties including excellent barrier, superior sealing to avoid leakages & machine losses, puncture resistance for safer shipments and economical usage. In addition, features such as microwave friendly for food items, high quality protective barrier against light & moisture, and convenience for frozen applications will propel the spout & non-spout liquid pouch packaging market revenue.

Three-layer spout & non-spout liquid pouch packaging market is anticipated to register over 350 kilotons by 2024. Superior gas barrier, enhanced moisture proof & vapor isolation along with effective bacteria resistance properties will stimulate the business expansion. Moreover, improved transparency and glossy appearance provides positive outlook for product scope in consumer goods and pharmaceutical applications.

Asia Pacific is anticipated to witness CAGR over 6% from 2018 to 2024. Rising flexible package demand from food & beverages industry in developing countries including China, India, Thailand and Indonesia will stimulate the product demand. Growth in household care industry due to changing lifestyles and increased hygiene awareness has enhanced the product demand.

Europe market was valued over USD 2 billion in 2017. Changing demographic and income trends influencing shift in trend towards packaged food and cosmetic products will drive the regional demand. Presence of notable packaging manufacturers along with innovations to improve convenience are among major factors fueling the spout & non-spout liquid pouch packaging market growth.