Home > Food & Beverages > Processed Food > Convenience Foods > Oyster & Clam Market

Oyster & Clam Market Analysis

- Report ID: GMI6856

- Published Date: Oct 2023

- Report Format: PDF

Oyster & Clam Market Analysis

Based on type, the oyster & clam market is segmented as Oyster type & Clam type. Oyster type held a majority market value of USD 86.90 billion in 2022. The Oyster types, which include Slipper Oysters and Pacific Cupped Oysters, and clam types, which encompass Hard Clams, Taca Clams, and Stimpson Surf Clams. Each type offers distinct flavor profiles and characteristics, appealing to different consumer preferences and culinary applications. Slipper Oysters are prized for their delicate taste and are often enjoyed raw, while Pacific Cupped Oysters are known for their brinier flavor.

On the clam side, Hard Clams are versatile and commonly used in various dishes, while Taca Clams and Stimpson Surf Clams are valued for their unique textures and flavors, making them sought-after ingredients in regional cuisines and seafood markets. This allows producers and consumers to make informed choices based on taste preferences and culinary requirements within the diverse market

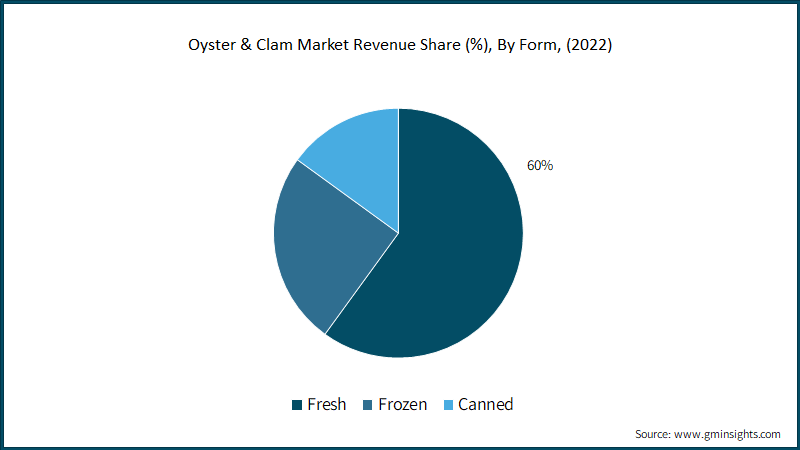

Based on form, the oyster & clam market is segmented as fresh, frozen and canned. Fresh oysters & clam held a dominant market share of around 60% in 2022 and is expected to grow at a lucrative pace by 2032. Fresh oysters and clams collectively hold a substantial market share, prized for their superior taste and versatility in culinary applications. They are favored by restaurants and consumers who prioritize the freshest seafood in their dishes. Frozen oyster and clam products, while holding a significant share, appeal to a broader audience, offering convenience and a longer shelf life without compromising quality.

Canned oysters and clams cater to a niche market segment, mainly those seeking long shelf life and portability, and are often used in recipes like clam chowder and oyster stew. The market segmentation based on form reflects the diverse needs of consumers and emphasizes the importance of offering a variety of options to meet their preferences within the oyster and clam industry.

Based on distribution channel the oyster & clam market is segmented as retail, foodservice and other. Retail held a dominant market share in 2022 and is anticipated to grow at 3.5% CAGR by 2032. Retail channels, which include supermarkets, specialty seafood shops, and online retailers, collectively capture a significant market share as consumers increasingly seek fresh and frozen oyster and clam products for home consumption. Foodservice channels, including restaurants, hotels, and catering services, also play a substantial role, representing a significant market share as consumers continue to enjoy seafood dishes dining out

The "Other" category comprises niche distribution channels like seafood festivals, direct-to-consumer sales from farms, and seafood subscription services, albeit with a smaller market share. This segmentation reflects the diverse ways in which oysters and clams reach consumers, emphasizing the importance of catering to both retail and foodservice sectors within the oyster and clam industry, while also recognizing the potential for innovation and expansion in alternative distribution channels.

Asia Pacific oyster & clam market exceeded USD 52.75 billion in 2022 and is anticipated to expand at a significant pace from 2023-2032. Asia Pacific boasts a wide variety of oyster and clam species consumed across different countries. For example, Japan is known for its preference for Pacific Cupped Oysters and various clam varieties, while countries like China and South Korea favor different species of oysters and clams, including Taca Clams. Several countries in Asia Pacific are major producers of oysters and clams through aquaculture. China, in particular, is a global leader in oyster and clam production, with large-scale farming operations along its extensive coastlines. Producers in countries like China and Vietnam have capitalized on export opportunities, shipping their products to international markets, including the United States and European Union. This has helped boost the regional economy and trade in seafood.