Home > Consumer Goods & Services > Personal Care > Eyewear > Luxury Eyewear Market

Luxury Eyewear Market Analysis

- Report ID: GMI4381

- Published Date: Oct 2019

- Report Format: PDF

Luxury Eyewear Market Analysis

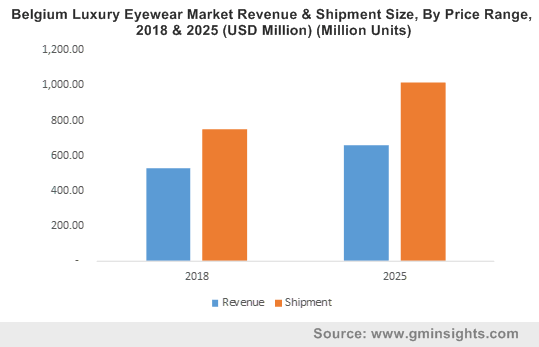

The segment growth is attributed to rapid urbanization, increasing disposable incomes, rise in spending capabilities of millennials, and celebrity fashion influence. For instance, Belgium had about 1.07% HNWI from a total of 11.4 million population in 2018. The HNWI population in the country grew at 7.09% from 2016 to 2018. This has created a potential market for luxury eyewear brands. The willingness to buy luxury eyewear strengthens consumer confidence (more than 70%) predominantly among millennials in the region will drive the luxury eyewear market growth. The increasing standard of living in the country is also contributing to market growth.

The market players are focusing on their distribution channels through targeted store openings, refurbishments, and relocations as well as store closures to increase their revenue and to expand geographical presence. Additionally, market players are optimizing their existing store network according to changing customer traffic patterns. For instance, in January 2017, Luxottica Group acquired Óticas Carol, a prominent optical franchisor in Brazil with approximately 950 locations. This helped Luxottica Group extend its business through BrazilSome companies are collaborating with celebrities from various fields (sports and entertainment) and reshaping their distribution channels to increase market demand across the globe. For instance, Antonio Banderas, an actor for Spy Kids and Zorro, was the brand ambassador for Police eyewear and started his designer eyewear in 2016 for the Opticalia Eyewear chain (about 700 stores between Spain and Portugal).

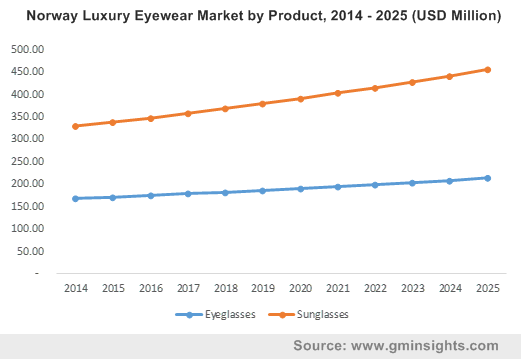

The macro-economic outlook, socio-political upheaval, tourism, and fluctuations in foreign exchange are the prominent factors fueling the market growth in European countries. Countries, such as Luxembourg, Belgium, and Norway, have high living standards and act as potential markets for the luxury eyewear market. For instance, Norway has a huge rich population, which spends heftily on luxury goods and follows high-level fashion sense. Millennial Norwegians have a 13% rise in disposable household income in real terms compared to Generation X (born between 1966 and 1980) when they were the same age. According to the IMF report published in April 2019, Norway had the third-highest GDP per capita (USD 79.73 thousand) in Europe due to less population (approximately 5 million) and rich economy. High living standard of Norwegians and high purchasing power due to high wage rates are burgeoning luxury eyewear market growth.

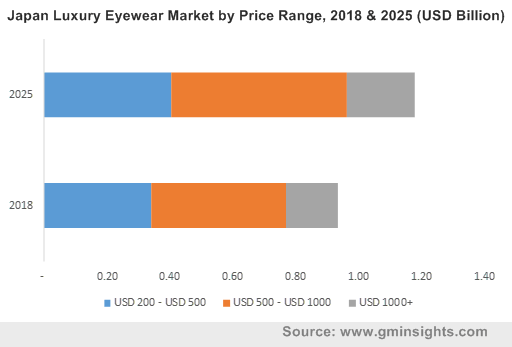

Asia Pacific is expected to exhibit a surge in the luxury eyewear market share due to the increasing HNWI population, rapid digitization, and the rising number of e-commerce platforms selling luxury eyewear. The presence of millennial entrepreneurs and celebrities in the region is also contributing to market growth. In the region, the countries including China, India, and Japan have more than 6 million millionaires. The High-Net-Worth Individual (HNWI) population of these countries possesses high spending capabilities, which will drive market growth. Also, Thailand tourism and Thai consumers are driving the popularity of athleisure, further contributing to market.