Home > Chemicals & Materials > Polymers > Industrial Polymers > Liquid Synthetic Rubber Market

Liquid Synthetic Rubber Market Analysis

- Report ID: GMI4007

- Published Date: Aug 2020

- Report Format: PDF

Liquid Synthetic Rubber Market Analysis

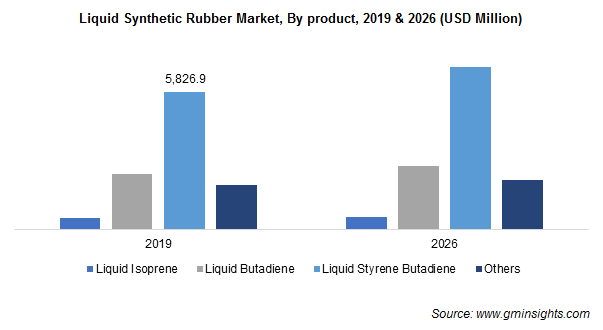

Liquid styrene butadiene rubber will generate around USD 5.8 Billion in 2019 and is attributed to its growing tire production. It offers superior characteristics including low rolling resistance, excellent tensile strength, good resilience, and high abrasion resistance. Further, L-SBR grades provide high flexibility and tensile strength, when used in tires and construction sealants, adhesives, and coatings.

The construction industry is set to hold a strong growth potential for liquid styrene butadiene owing to several possible applications. Buildings tend to experience varied environmental effects on different sections. The experimentation of SBR material as an admixture in high-performance concrete has resulted in improved weather resilience and building quality, opening venues for LSR-SBR in construction industries.

Adhesives application segment will witness over 3% CAGR in the liquid synthetic rubber market through 2026 with its utilization in sealants, production of copolymer of styrene, and coatings. Increasing construction activities across the globe and industrial production challenges are increasing product adoption. The adhesives showcase excellent heat and crack resistance properties and offer superior ageing characteristics.

Polymer modification will witness over 3.5% CAGR in liquid synthetic rubber market through 2026. Polymer modification is the process of modifying, improving, or enhancing certain characteristics of a material. Styrene butadiene rubber is blended or copolymerized with polymers or chemically modified for the enhancement of basic properties. Various characteristics, such as oil resistance, ozone resistance, and processing capabilities, can be modified or improved with addition of liquid synthetic rubber.

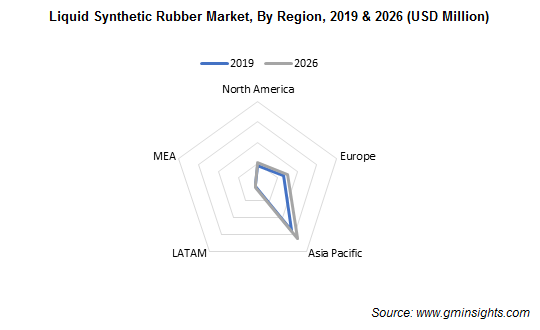

Asia Pacific held over 50% share in 2019 owing to increasing vehicle sales. The region is experiencing increasing presence of manufacturers owing to abundant raw material supply and economical labor costs. Ongoing initiatives by government entities to increase domestic vehicle production and decrease reliance on imports will escalate revenue generation.

The Middle East & Africa market is at a nascent stage and will witness steady growth with public and private sector investments for encouraging building & construction and plastic manufacturing.