Home > Energy & Power > Electrical Equipment > Turbines > Hydropower Turbine Market

Hydropower Turbine Market Analysis

- Report ID: GMI257

- Published Date: Jun 2019

- Report Format: PDF

Hydropower Turbine Market Analysis

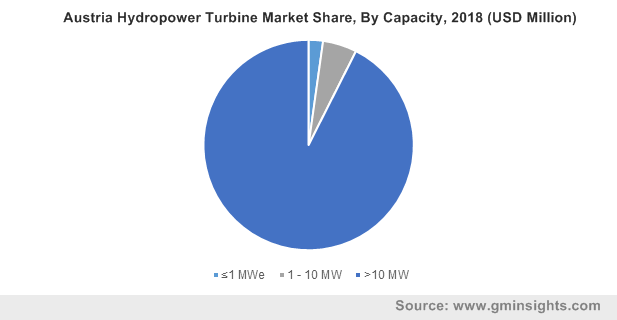

1 MW to 10 MW installation in 2018, accounted for over 5% of global hydropower turbine industry revenue share. Growing demand for the continuous power supply from local communities in off grid areas will enhance the product adoption over the forecast period.

ongoing efforts to sustain peak load demand coupled with rising concerns pertaining to security of supply will stimulate >10 MW hydropower turbine business growth. Long life span, improved efficiency, less operation & maintenance cost and high reliability are some of the prominent features which will encourage the product adoption.

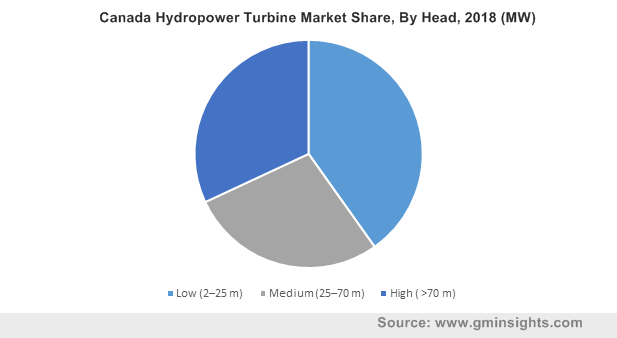

Low head hydropower turbine industry is anticipated to witness growth over 7% by 2025. Low maintenance & construction cost, minimal ecological & environmental complications and reduce risk of flash flood are some of the prominent features which will drive the product demand.

High head hydropower turbine market is projected to surpass USD 600 Million by 2025. Paradigm shift from coal fired power generating plants in line with initiatives toward clean energy utilizations will encourage the product demand.

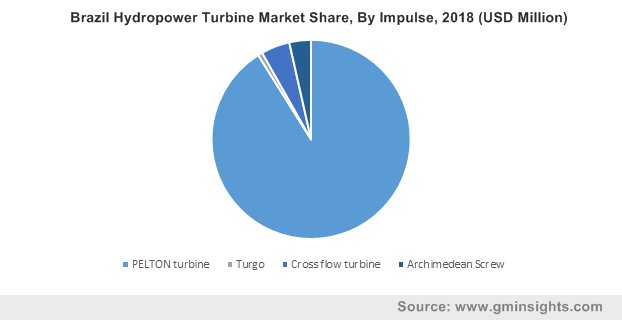

Impulse hydropower turbine market is anticipated to grow over 7% by 2025 owing to wide applicability across low flow and high head applications. Simple design, cost effectiveness and low maintenance requirement are few indispensable parameters driving the adoption over other technologies.

Reaction water turbine market will witness substantial growth on account of rising demand for small and medium scale hydropower projects to cater the surging energy needs. Abundant availability of run of river resources along with growing electricity demand across developing economies are some of the vital factors complementing the industry landscape.

The U.S. market will expand on account of favorable government measures to promote the adoption of renewable technologies. Soaring investments to refurbish the existing hydropower facilities will further compliment the business growth. In 2017, the U.S. Department of Energy (DOE) announced to offer USD 30.6 million in Recovery Act funding for seven hydropower projects with an aim to modernize existing facilities.

Rapid adoption of sustainable generation technologies to supplement the nation’s nuclear baseload will stimulate the France hydropower turbine market. For instance, Government of France has set target to enhance the hydropower capacity by at least 3GW by 2020.

Angola market is predicted to exceed 1 GW by 2025. Continually surging electricity demand along with the government’s efforts to diversify the power generation mix will stimulate the industry growth. For instance, in September 2018, Sustainable Energy Fund for Africa (SEFA) has funded USD 1 million to Independent Power Producers (IPPs) in Angola, enhancing private investment in renewable energy.