Home > Industrial Machinery > HVAC > Filters > Food & Beverages Air Filters Market

Food & Beverages Air Filters Market Analysis

- Report ID: GMI4867

- Published Date: Nov 2020

- Report Format: PDF

Food & Beverages Air Filters Market Analysis

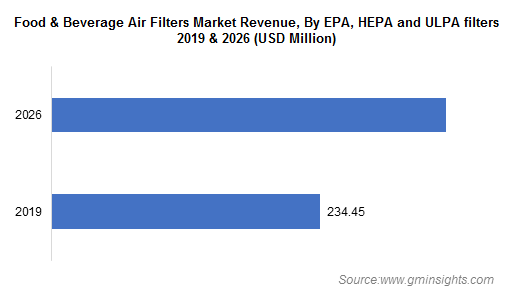

The food & beverage air filters market based on the product spectrum is segmented into dust collector, mist collector, cartridge collector, EPA, HEPA and ULPA filter and baghouse filter. EPA, HEPA and ULPA filter segment was valued at over USD 230 Million in 2019 and is expected to witness remarkable 7.3% CAGR over the assessment period. This is mainly attributed to the high filtration efficiency offered by these filters.

HEPA filters can eliminate 99.97% of contaminant particulate matter of diameter of 0.3 μm. The laminar airflow ensured by these filters are likely to raise the product demand in the coming years. ULPA filters are capable of removing 99.9% of contaminants which are 0.12 μm or larger in diameter.

The ability of HEPA and ULPA filters to function efficiently in adverse, sensitive and moisture-prone areas is likely to raise product demand. The numerous attributes offered by ULPA filters such as larger media area, longer service life, ability to operate in a low pressure drop and lower energy consumption make it a cost-effective option for food processors. Increased consumer awareness regarding food safety and purity may foster food & beverage air filters market statistics.

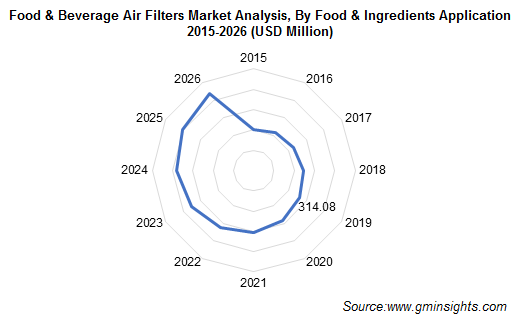

Based on application, the food & beverage air filters market is divided into food & ingredients, dairy, bottled water, brewery and non-alcoholic beverages. The food and ingredients segment dominated the global food & beverage air filters market in 2019 with a market value of USD 310 Million. The high use of air filters in food & ingredient manufacturing is ascribed by the high rate of dust particle emission from spices and flavors used in its manufacturing.

The high level of particulate matter and spores released into the air while manufacturing bakery and confectionary products poses the need for better quality filtration systems for consumer safety, thus boosting the market share. Moreover, grain factories involve grain separation and sieving stages, which releases a lot of dust into the air, raising the demand for high efficiency filters.

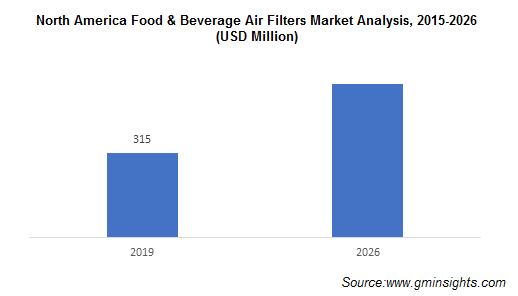

North America food & beverage air filters market is expected to witness considerable growth owing to changing consumption patterns of consumers and their inclination towards the consumption of healthy, convenience foods. Rising health consciousness coupled with increased prevalence of illnesses such as diabetes, obesity, heart problems and cholesterol in North America are compelling food and beverage manufacturers in the region to adopt hygienic manufacturing practices and clean label requirements.

Extremely cold temperatures in the region together with the increasing disposable income of people are expected to encourage the consumption of wine and other brewery products, thus raising product demand from the beverage industry. Favorable regulatory scenario by the U.S. Food & Drug Administration to promote the manufacturing of food products in a hygienic environment may fuel the market outlook.