Home > Energy & Power > Oil and Gas > Upstream > FPSO Market

FPSO Market Analysis

- Report ID: GMI785

- Published Date: Jan 2019

- Report Format: PDF

FPSO Market Analysis

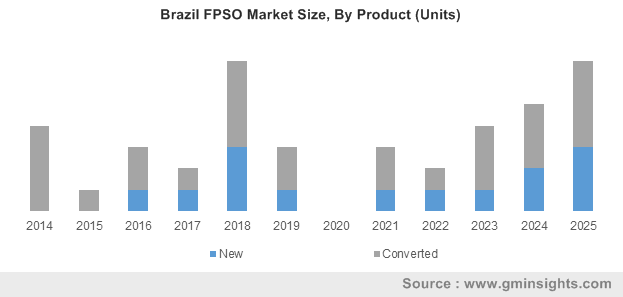

Converted FPSO market size, in 2018 recorded an annual deployment of 7 units. Relatively lower capex, shorter construction schedule and enhanced flexibility are some of the key parameters that will accelerate the vessel deployment. Moreover, the minimal use of resources associated with the conversion coupled with ease of availability of retired FPSOs and oil tankers will further complement the business growth. The capital expenditure of a converted FPSO is approximately one third of that of a new built vessel of comparable specifications.

New built FPSO market size will witness growth on account of positive outlook toward deep and ultra-deep water exploration and production activities. Lower operating cost, flexibility for field life extension and optimal design in conjunction with modern safety features are some of the factors that will augment the product adoption. Furthermore, advancements in offshore technologies, including the introduction of cylindrical hull designs, double hull design and separable turret will continue to attract investors across the oil & gas sector. However, longer project schedules and much higher capital expenditure may hamper the deployment of new built units.

Shallow depth FPSOs in 2018, accounted for over 15% of the global market capex share. Proximity to onshore support and easy transfer of processed hydrocarbons are the prime factors that will propel the product demand. However, susceptibility to bad weather, higher risk of rollover and low level of damping will offer resistance to these projects.

Shifting trends toward ultra-deep exploration activities and advancing seismic and drilling technologies along with availability of larger oil reserves in deeper basins will drive the ultra-deep FPSO market size. As per the U.S. Energy Information Administration (EIA), Brazil has increased oil production from ultra-deep water from 1.3 million barrels per day in 2005 to 2.2 million barrels per day in 2015.

Increased capital spending by oil & gas companies toward exploration and development of deep-water projects along with depleting onshore and shallow water oil fields will drive the deep-water FPSO market growth.

Latin America market capex, in 2018 was valued over USD 18 billion. Discovery of vast oil reserves in pre salt geological layers along with favorable government policies and growing investments will boost the industry growth. According to Petrobras, Santos and Campos basins of Brazil contain over 16 billion barrels of pre-salt oil reserves. Moreover, the introduction of new local content regulations in Brazil, implying simpler & lower requirements with reduced fines for E&P contracts will effectively boost the deployment of FPSOs in the country.

The Europe market growth is largely driven by new project implementations in the UK and Norway. The market expansion is largely attributed to the region’s stringent commitment to emission reduction targets and growing significance of diversifying energy supplies.

The Middle East & African market is characterized by large capacity new-build and highly customized vessels, adequate for oil fields located in deep and ultra-deep waters primarily across the offshore regions of Nigeria, Angola and Ghana. Furthermore, a multitude of relatively lower-capex floating solutions appropriate for the shallower oil fields and comparably less severe weather conditions prevalent in the region will drive the Asia Pacific FPSO market growth.