Home > Chemicals & Materials > Specialty Chemicals > Custom Synthesis > Ethanolamines Market

Ethanolamines Market Analysis

- Report ID: GMI737

- Published Date: Aug 2016

- Report Format: PDF

Ethanolamines Market Analysis

Despite various challenges, the diethanolamines product segment is likely to be the most attractive product segment globally, with revenue of more than USD 1 billion in 2015, with growth forecast of more than 4% between 2016 and 2024./p>

Triethanolamines was the largest product segment 2015 and is expected to grow with a favorable CAGR over the duration of the forecast period due to the wide range of applications it caters to. DEA is likely to surpass the ethanolamines market segment in terms of both volume and revenue by 2024./p>

Surfactant applications led the ethanolamine market share and accounted for over 25% of the global revenue in 2015. Chemical intermediates and herbicides accounted for over 40% of the ethanolamines market size with moderate gains forecast by 2024. Growing agrochemicals industry arising due to a growing demand from agricultural activities and demand from various cleaning processes in numerous end-user industries are some of the reasons for these markets to exhibit the quickest growth numbers over the forecast period.

Although the current ethanolamines market exhibits overcapacity, various regions have been reported to show increased market growth in the near future with development and installation of new production plants. The Sadara Chemical manufacturing plant proposed in 2016 is one such example and is an outcome of a demand-supply gap existing in the region.

Diethanolamines can attribute its growth to the herbicides market while the (MEA) monoethanolamines market is likely to grow due to strong demand for ethyleneamines and triazines.

On the other hand, the demand for ester quats is expected to boost triethanolamines (TEA) revenue. The demand for MEA can be attributed to the rising demand for acid gases removal such as H2S from natural gas, olefins cracker products, and refinery streams.

Asia Pacific, particularly, China and India ethanolamines market size, generated over USD 1 billion in revenues in 2015 and this region is likely to see strong growth based on domestic consumption.

APAC and Middle East & Africa (MEA) are forecast to be the most favorable regions for the by 2024. Together, these regions have surpassed Europe, as the EU is likely to witness a dip in demand due to the European Commission ban on DEA in cosmetics. Cosmetics has been one of the leading application segments in the past decade and such a ban are likely to affect the ethanolamine industry in the long run.

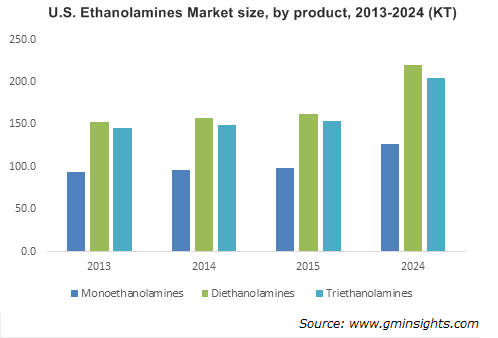

Europe ethanolamines market continues to explore alternates to substitute the growing demand for other applications. North America and Latin America are expected to display a favorable growth pattern in coming years. U.S. ethanolamines market which was over 400 kilo tons in 2015 presently accounts for over 84% of all North America revenue.