Home > Automotive > Automotive Parts > Exterior Parts > Automotive Spring Market

Automotive Spring Market Analysis

- Report ID: GMI2334

- Published Date: Oct 2023

- Report Format: PDF

Automotive Spring Market Analysis

The automotive springs market from coil springs segment dominated around USD 1 billion revenue in 2022. Coil springs are an integral part of the automotive suspension system, and a key trend in this segment is the growing demand for advanced materials and design techniques. Further, with the rise of electric and autonomous vehicles, coil spring manufacturers are developing specialized solutions to cater to the unique requirements of these vehicles, such as designing springs to accommodate the weight distribution and driving characteristics of electric powertrains and autonomous driving sensors.

Based on material, the automotive spring market is segmented as steel springs, composite springs, plastic springs. Steel springs have been a longstanding and widely used material in the automotive industry due to their excellent mechanical properties and affordability. A notable trend for steel springs is the continuous development of high-strength and lightweight steel alloys. Automakers and spring manufacturers are constantly exploring new steel compositions and heat treatment processes to enhance the permaterialance of springs while reducing their weight. This trend aligns with the industry's focus on fuel efficiency and reducing vehicle emissions.

Based on vehicle type, the automotive spring market is segmented as passenger cars, Light Commercial Vehicles (LCVS), Heavy Commercial Vehicles (HCVS), two-wheelers. In the passenger car segment, a key trend in the market is the focus on enhancing ride comfort and handling while reducing vehicle weight. Manufacturers are developing advanced suspension systems with improved coil springs and shock absorbers to deliver a smoother and more refined driving experience for passengers. Additionally, with the growing popularity of electric and hybrid vehicles, there is a demand for specialized springs that can accommodate the unique weight distribution and characteristics of these powertrains.

Based on end-uses, the automotive spring market is segmented as suspension system, engine valves, clutch assemblies, and transmission system. The suspension system segment to show tremendous growth through 2032, driven by the increasing adoption of advanced suspension technologies in passenger cars and light commercial vehicles. Manufacturers are developing innovative springs, such as air springs and adaptive dampers, to enhance ride comfort and handling for both conventional and electric vehicles. Moreover, the growth of the luxury and premium vehicle segments further drives the demand for high-permaterialance springs that cater to the demands of discerning customers seeking superior driving experiences.

The sales channel trends for the automotive springs market with Original Equipment Manufacturers (OEMs) as the primary customer segment are characterized by close collaboration and customization. As OEMs strive to differentiate their vehicles and meet stringent permaterialance requirements, they demand tailored suspension and engine valve solutions from spring manufacturers.

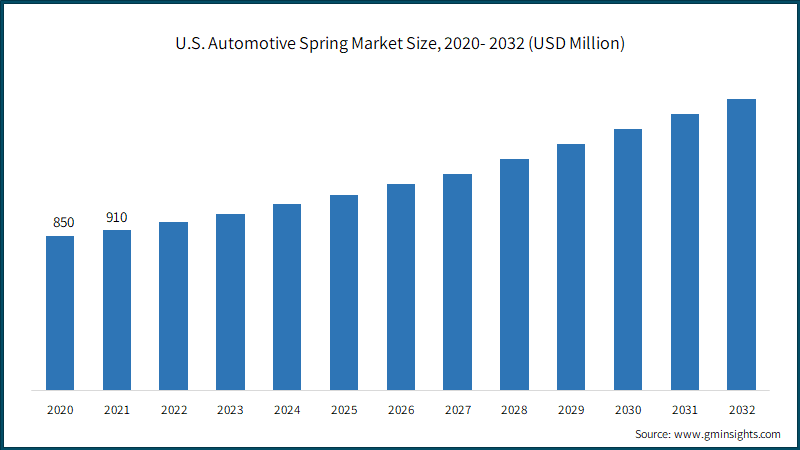

U.S. automotive spring market size held over USD 950 million in 2022. In North America, a key trend driving the market is the emphasis on permaterialance and customization. The region has a strong automotive enthusiast culture, with a significant market for high-permaterialance and sports cars. As a result, there is a growing demand for permaterialance-oriented springs that enhance vehicle handling, ride comfort, and responsiveness. Customization options, such as lowering springs and adjustable coilovers, are also gaining popularity among enthusiasts looking to personalize their vehicles' suspension systems.