Home > Automotive > Automotive Technology > Automotive Evaporative Emission Control (EVAP) System Market

Automotive Evaporative Emission Control (EVAP) System Market Size

- Report ID: GMI3222

- Published Date: Apr 2019

- Report Format: PDF

Automotive Evaporative Emission Control System Market Size

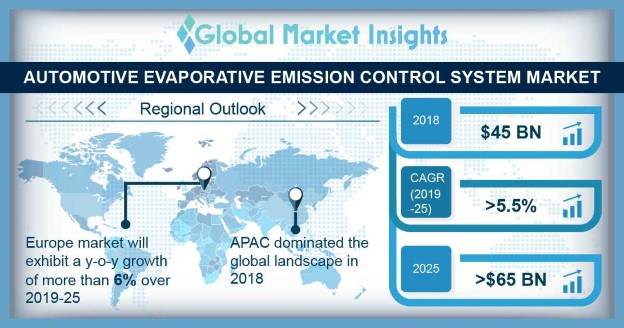

Automotive Evaporative Emission Control System Market size valued at USD 46 billion in 2018 and is estimated to exhibit 5.5% CAGR from 2019 to 2025

Rising solar radiation and ambient temperature across the globe increases the fuel tank temperature. High tank temperature results in the evaporation of petrol with a consistent increment in the internal pressure causing fuel expansion. According to Environmental Protection Agency (EPA), two-wheelers loose around 2%-5% fuel due to high temperature. Rising fuel losses and air pollution owing to evaporative emission will drive the automotive evaporative emission control system market size over the forecast period.

| Report Attribute | Details |

|---|---|

| Base Year: | 2018 |

| Automotive Evaporative Emission Control System Market Size in 2018: | 46 Billion (USD) |

| Forecast Period: | 2019 to 2025 |

| Forecast Period 2019 to 2025 CAGR: | 5.5% |

| 2025 Value Projection: | 65 Billion (USD) |

| Historical Data for: | 2014 to 2018 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 533 |

| Segments covered: | Vehicle, Components, Distribution Channel and Region |

| Growth Drivers: |

|

Stringent government standards focusing on reducing evaporation of volatile organic compounds and tail pipe discharge is propelling the product demand. Regulatory standards such as California Air Resources Board (CARB) are emphasizing on controlling carbon monoxide, hydrocarbons, and nitrogen oxide pollution for improving air quality, leading to automotive evaporative emission control system market expansion.

Regulatory entities such as United Nations Economic Commission for Europe (UNECE) are introducing vehicle testing procedures to check vehicular pollution. For instance, in 2017, UNECE introduced Worldwide Harmonised Light Vehicle Test Procedure (WLTP) to control fuel consumption, pollutant emissions and evaluate on-road performance. Such initiative will induce significant potential in the market size over the forecast timeline.

Emergence of stringent government regulations is leading to development in vehicle fuel system. For instance, in 2015, CARB reduced the running loss (grams per mile) for passenger cars and light-duty trucks to 0.05. Vehicle manufacturers are replacing the Stage II vapour recovery system with onboard refuelling vapor recovery (ORVR) systems for superior monitoring and emission control efficiency.

Automobile manufacturers are extensively investing in R&D to innovate cleaner vehicles technologies driving the automotive evaporative emission control system market share. Industry participants are combining on-board diagnostic sensors with the vehicle fuel system for efficient functioning of the system. Introduction of advanced system integration with EVAP will drive the industry size over study timeframe.

Rising adaption of hybrid and electric vehicles will restrict the market size. Increasing government initiatives such as tax rebate and development of supporting infrastructure is shifting consumer inclination towards the alternate vehicles. Further, ongoing steps to reduce vehicle ownership cost will hamper the automotive EVAP system market growth till 2025.