Home > Automotive > Automotive Technology > Automotive Digital Instrument Cluster Market

Automotive Digital Instrument Cluster Market Size

- Report ID: GMI4389

- Published Date: Oct 2019

- Report Format: PDF

Automotive Digital Instrument Cluster Market Size

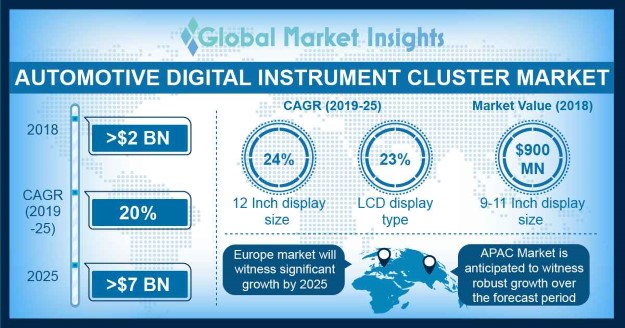

Automotive Digital Instrument Cluster Market size exceeded USD 2 billion in 2018 and is poised to grow at a CAGR of 20% from 2019 to 2025. The global industry shipments are expected to reach 15 million units by 2025.

A digital instrument cluster is a display used to guide the driver with precise information of vehicle functions and parameters, which can be seen in a visually comfortable format. Through this system, consumers can understand the entire vehicle functions at a single glance. The rapid development of intelligent vehicle technologies with the demand for high-end vehicles and intense competition among manufacturers is a major factor impacting the industry expansion. These digital systems are expected to replace analog instrument cluster systems over the forecast years owing to increased visibility, larger displays, and better user interactivity features.

| Report Attribute | Details |

|---|---|

| Base Year: | 2018 |

| Automotive Digital Instrument Cluster Market Size in 2018: | USD 2 billion |

| Forecast Period: | 2019 to 2025 |

| Forecast Period 2019 to 2025 CAGR: | 20% |

| 2025 Value Projection: | 7 Billion (USD) |

| Historical Data for: | 2014 to 2018 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 223 |

| Segments covered: | Display size, display type |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

The industry is expected to witness heavy expansion trend due to increasing implementation in premium & luxury cars. Majority of the vehicles currently include analog instrument cluster systems due to low cost and high availability across all regions. However, advanced user interactivity, customizable features, and control of driving assistance functions offered by these solutions are major factors supporting the industry expansion prospects.

Growing electrification and digitization of newly developed passenger and luxury vehicles are driving the automotive digital instrument cluster market growth. The demand is attributed to the integration of complete reconfigurable clusters into luxury vehicles owing to customizable and safety features. Cluster manufacturers are developing solutions with bigger display sizes owing to customer requirement and vehicle digitization trend. The advanced solutions include improved graphics and displays, providing better information to drivers. Additionally, the changing vehicle designs & interiors to provide better user experience are impacting the global automobile sector, resulting in industry growth. Several OEMs including Audi, Volvo, Jaguar, Kia, Tesla, etc., are installing digital instrument clusters in their vehicles. For instance, in June 2019, Kia Motors announced its plan to launch the new completely digitalized 12.3-inch instrument cluster in the upcoming cars with a resolution of 1920x720 pixels.

The benefits offered by these systems over complex and time-consuming analog alternatives include simple reading and intelligible digital display panel. They also aid in vehicle repair & diagnostics as they offer related information display, offering safety and ease to drivers. Furthermore, the development of autonomous & semi-autonomous vehicles is creating the need for reconfigurable clusters, supporting industry growth. The digital instrument cluster market for automotive is hampered by several operational issues in completely digital clusters deployed in high-end vehicles. Several cluster systems are unable to display high-quality images, lose power frequently, and have misfunctioning gauges due to extreme weather conditions; however, the development of high-resolution graphic display and better connectivity aids in overcoming these issues.