Home > Energy & Power > Oil and Gas > Downstream > Asia Pacific Oil Storage Tank Service Market

Asia Pacific Oil Storage Tank Service Market Analysis

- Report ID: GMI4412

- Published Date: Oct 2019

- Report Format: PDF

Asia Pacific Oil Storage Tank Service Market Analysis

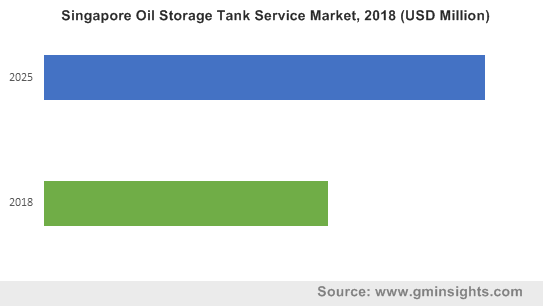

Singapore over the past few years has emerged as one of the leading importers of crude oil and its associated high value petroleum products. The country’s world-class warehouse and refining infrastructure along with the increasing net crude import has uplifted the demand for storage tank and its related services. As per the U.S. EIA, in 2016, Singapore’s government announced to promote long-term growth in refining and its storage capacity to maintain its position as a leading oil-trader. In 2018, the country imported 52 MT and 115 MT of crude oil and petroleum product, respectively. Rise in trade flows coupled with exclusive strategic measures to enhance the existing reserve capacity will stimulate oil storage tank storage service market over the forecast timeline.

Surging crude oil production along with recovering oil prices has significantly favored the upgradation and expansion of various tank farms, depots and terminals. The storage of hydrocarbons is important part of midstream and downstream operations before they are transported to refineries for processing. Growing energy demands of petroleum products is necessitating the expansion and modernization of existing storage facilities which is ultimately impacting the service industry. Moreover, regulators and policy makers across the region are also introducing numerous mandates to maintain the tank safety and security, which will further stimulate Asia Pacific oil storage tank service market growth.