Home > Chemicals & Materials > Advanced Materials > Composite Materials > Aramid Honeycomb Market

Aramid Honeycomb Market Analysis

- Report ID: GMI4869

- Published Date: Nov 2020

- Report Format: PDF

Aramid Honeycomb Market Analysis

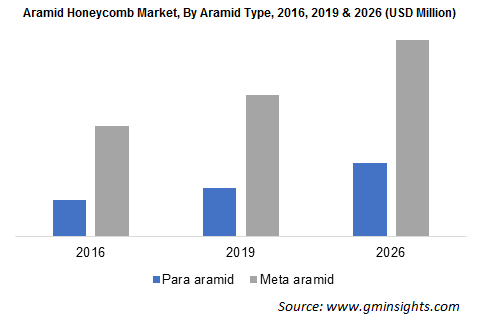

The para-aramid segment, in terms of volume, will grow with around 9.9% by 2026. Para-aramid honeycomb will witness the highest growth owing to its impact resistance. Para-aramid honeycomb such as Kevlar by Dupont has witnessed a sudden rise in demand from the aviation industry. Composites manufactured by para-aramid can withstand extreme pressure and forces, making it ideal for aerospace end users. The increasing production of new-generation lightweight aircraft will drive the aramid honeycomb market demand.

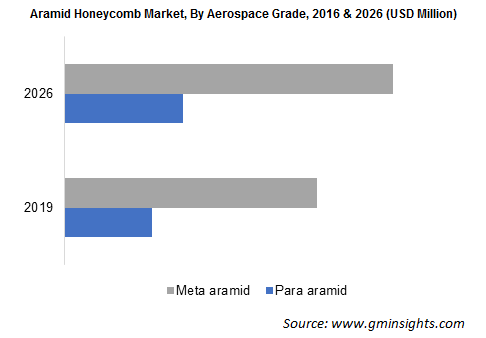

The product is mainly available in two grades, i.e., aerospace commercial grades. It has extensive uses in the aerospace industry such as in aircraft floorings, panels, external body structures, compartments, etc. The growing production of new-generation commercial &V fighter aircraft will majorly drive aerospace-grade product demand. The aerospace grade segment demand share will reach around 75% in 2026.

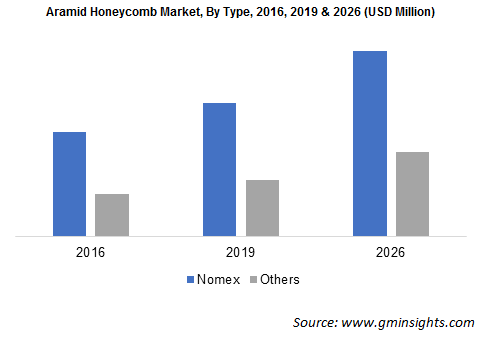

Nomex honeycomb is extensively used in aerospace & defense industries owing to its excellent properties and comparatively low cost. The aramid honeycomb market segment is expected to grow at a CAGR of more than 9% in terms of revenue. Nomex honeycomb provides excellent corrosion resistance, fire resistance, and strength-to-weight ratio, thus is ideal for the defense and aerospace industries. Aircraft manufacturing companies are also increasing the usage of lightweight materials with high-strength in multiple components, propelling product demand.

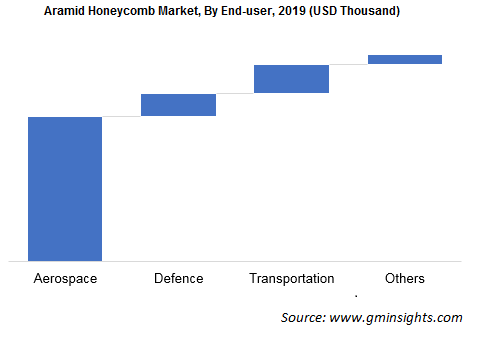

Aviation held a 70% market share by revenue in 2019. The aviation sector dominates the market as aramid honeycomb materials are used in manufacturing aircraft components. The commercial aerospace sector is expected to grow modestly due to the rapid growth in the number of passengers in Asia Pacific and Africa. Additionally, the increasing number of airports in emerging economies is creating a lucrative opportunity for aircraft manufacturers.

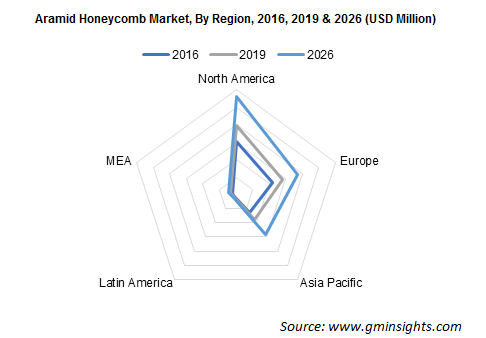

North America held the largest share in 2019, reaching a share of 43% in the overall market volume. The highest demand share is largely attributed to the presence of large aircraft manufacturers in the region. The increasing adoption of electrical automotive by consumers in the region will further propel product demand. The region also has a strong presence of automotive manufacturers, which will further solidify the aramid honeycomb market growth rate.