Home > Aerospace & Defense > Aircraft Parts > Aircraft Propulsion System Market

Aircraft Propulsion System Market Size

- Report ID: GMI7024

- Published Date: Oct 2023

- Report Format: PDF

Aircraft Propulsion System Market Size

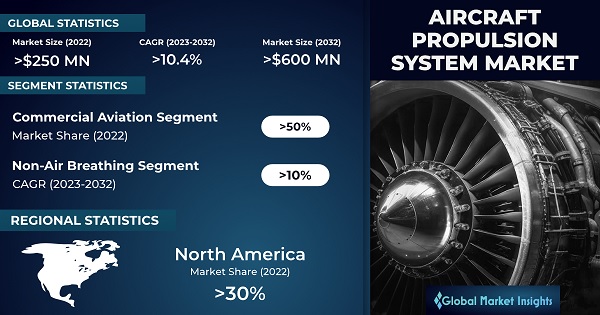

Aircraft Propulsion System Market was valued at over USD 250.7 million in 2022 and is anticipated to grow at a CAGR of over 10.4% between 2023 and 2032. The market for aviation propulsion systems is expanding due to the rising trend of electrification in aircraft propulsion. There are various benefits to electrification as it is consistent with international environmental goals and drastically lowers greenhouse gas emissions. In addition to being quieter, electric propulsion technologies improve passenger comfort and lessen noise pollution in the vicinity of airports.

As they require less maintenance and are energy-efficient, they minimize running costs. The need for electric propulsion systems is growing as aviation aims to become more economical and environmentally friendly, thus encouraging innovation and investment in the aircraft propulsion business. For instance, in June 2023, Japan’s Nidec Corporation and Brazil’s Embraer signed an agreement to establish a joint venture company called Nidec Aerospace LLC to develop electric propulsion systems for the aerospace sector. The transaction combined the complementary synergies and distinct areas of expertise of both companies to spearhead a new era of air mobility.

| Report Attribute | Details |

|---|---|

| Base Year: | 2022 |

| Aircraft Propulsion System Market Size in 2022: | USD 250.7 Million |

| Forecast Period: | 2023 to 2032 |

| Forecast Period 2023 to 2032 CAGR: | 10.4% |

| 2032 Value Projection: | USD 600 Million |

| Historical Data for: | 2018 to 2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 279 |

| Segments covered: | Type, Application, End-use Industry & Region |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

An aircraft propulsion system is a mechanism that generates thrust to propel aircraft forward. It typically includes engines, such as jet engines or propellers, which convert fuel into mechanical energy, producing the necessary thrust for flight. These systems are essential for the movement an control of aircraft in various aerospace applications.

Longer timescales may cause delays in the adoption of cutting-edge propulsion technologies, which will make it more difficult for the sector to adapt to the changing efficiency and environmental requirements. Prolonged development periods also raise research and development costs, which have an impact on manufacturers' total profitability. In the fiercely competitive aviation sector, protracted manufacturing schedules can cause businesses to lag or lose market share to rivals. Furthermore, due to lengthier timescales, it is difficult to adjust to quickly shifting market and regulatory conditions, which are crucial in the aviation industry.