Home > Healthcare > Medical Devices > Therapeutic Devices > Ventricular Assist Devices Market

Ventricular Assist Devices Market Size By Product [Left Ventricular Assist Devices (LVADs), Right Ventricular Assist Devices (RVADs), Biventricular Assist Devices (BiVADs), Percutaneous Ventricular Assist Devices (PVADs), Total Artificial Heart (TAH)], By Application [Destination Therapy, Bridge-to-candidacy (BTC) Therapy, Bridge-to-transplant (BTT) Therapy, Bridge-to-recovery (BTR) Therapy], By Age [Below 18 years, 19-39 years, 40-59 years, 60-79 years, Above 80 years], By Flow [Pulsatile Flow, Continuous Flow {Axial Continuous Flow, Centrifugal Continuous Flow}], By Design (Transcutaneous, Implantable), Industry Analysis Report, Regional Outlook, Application Potential, Price Trends, Competitive Market Share & Forecast, 2019 – 2025

- Report ID: GMI3014

- Published Date: Oct 2019

- Report Format: PDF

Ventricular Assist Devices Market Size

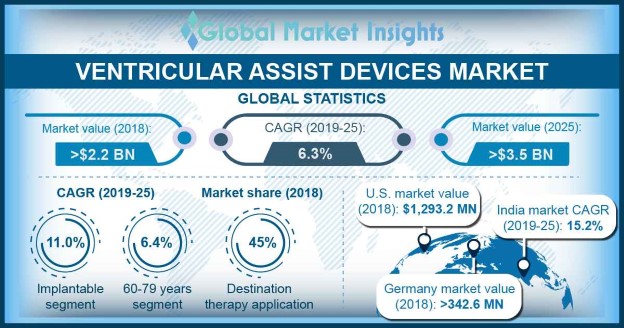

Ventricular Assist Devices Market size exceeded USD 2.2 billion in 2018 and is set to register over 6.3% CAGR up to 2025. Ventricular assist devices, also known as the mechanical circulatory support (MCS) device are implantable mechanical pump that assist in pumping the blood from the lower chambers of the heart to the rest of the body.

The ventricular assist devices are majorly used in patients that have weak heart or are suffering from heart failure. These devices can be placed in either left, right or both ventricles of the heart, however, it is most commonly used in the left ventricle. The major applications of ventricular assist devices are when the patient is waiting for a heart transplant (short-term treatment) or when the patient is not eligible for heart transplant but needs circulatory support (long-term treatment). The procedure involving ventricular assist device implantation often requires open heart surgery and does have several risks associated with it. However, the use of ventricular assist devices can be life saving for a person suffering from several heart failure and other cardiovascular disease.

| Report Attribute | Details |

|---|---|

| Base Year: | 2018 |

| Ventricular Assist Devices Market Size in 2018: | 2.2 Billion (USD) |

| Forecast Period: | 2019 to 2025 |

| Forecast Period 2019 to 2025 CAGR: | 6.3% |

| 2025 Value Projection: | 3.5 Billion (USD) |

| Historical Data for: | 2014 to 2018 |

| No. of Pages: | 300 |

| Tables, Charts & Figures: | 700 |

| Segments covered: | Product, Application, Age, Flow and Design |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

Ventricular assist devices offer several lifesaving therapies to patients that suffer from end-stage heart failure and for whom heart donor is not available. There are a number of ventricular assist devices currently available in the market, however, several challenges and restraining factors such as high cost and health risk affect the adoption rate of the devices. End-stage heart failure affects around 6 million Americans annually and is responsible for heavy healthcare burden on several countries. Despite several advances in healthcare therapies, it is estimated that around one million people will suffer from heart failure with high mortality rates. In the last few years, left ventricular assist devices have transitioned from bridge-to-transplant therapy to destination therapy for the patients suffering from advanced heart failure.

Growing incidence of heart failure will spur ventricular assist devices adoption rate

Rising prevalence of heart failure cases & other cardiovascular diseases and shortage of heart donors across the globe are some of the factors contributing to the growth of business. According to the National Centre for Biotechnology Information (NCBI), in 2017, around 26 million were affected with heart failures across the globe and the number is continuously rising with each passing year. Thus, the demand for ventricular assist devices is expected to grow significantly, since it aids mechanically by pumping blood in patients with weakened heart or heart failures.

However, certain risk with the implantation of ventricular assist device procedure such as infection, blood clotting, problems with device such as power failure or pumping issues and high cost of the device are expected to impede the growth of ventricular assist devices market.

Ventricular Assist Devices Market Analysis

Bases on product, the ventricular assist device market is segmented as left ventricular assist devices (LVADs), right ventricular assist devices (RVADs), biventricular assist devices (BiVADs), percutaneous ventricular assist devices (PVADs) and total artificial heart (TAH). Left ventricular assist devices (LVADs) market accounted for significant revenue size of USD 910.9 million in the year 2018. The high market share is owing to rising number of implantations of left ventricular devices, growing incidence and prevalence rate of heart failure and cardiovascular diseases is rising at epidemic proportions. According to the American Heart Association, in 2018, around 92.1 million American adults suffered from some of the other form of cardiovascular disease or other effects of stoke. Furthermore, growing number of patients that have reached the end-stage heart failure need left ventricular assist devices has contributed in the segmental market growth.

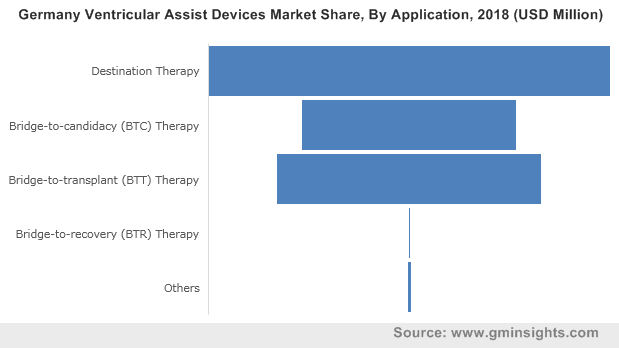

Bases on the application of ventricular assist devices, the market is segmented into destination therapy, bridge-to-candidacy (BTC) therapy, bridge-to-transplant (BTT) therapy, bridge-to-recovery (BTR) therapy and others. Destination therapy market is forecasted to grow at 6.9%% over the estimation period. Heart transplantation is considered as one of the gold standard treatments for patients with end-stage heart failure. However, due to decline in the number of donor heart organs, ventricular assist devices implantation for destination therapy witnessed significant growth. According to the National Centre for Biotechnology and Information, in 2014, around 46% destination therapy ventricular assist devices were implanted. Furthermore, in 2017 Medtronic announced that the FDA has approved its left ventricular assist device as a destination therapy for patients in use that cannot have heart transplants. Thus, destination therapy by left ventricular assist devices emerged as a new era for therapeutic strategy for heart failure, thereby, propelling the market growth positively in the upcoming years.

Based on the age group of patients, the ventricular assist devices market share is bifurcated as below 18 years, 19-39 years, 40-59 years, 60-79 years and above 80 years. The adoption of ventricular assist devices in below 18 years of age group is projected to expand at a CAGR of 5.6% over the forecast period. Continued clinical management and improvements in ventricular assist device (VAD) technology, have formed superior outcomes. For instance, the establishment of implantable continuous-flow devices such as the HeartWare and HVAD HeartMate II has led to physicians favouring VAD support over escalation of medical therapy among the below 18 years age groups.

As a result, VAD therapy is fast becoming the standard of care for intractable heart failure. Indeed, ventricular assist devices is expected to be an alternative to heart transplantation in the future thereby boosting the market growth and is expected to project a lucrative growth over the forecast period.

Based on type of flow, the market is segmented as pulsatile flow and continuous flow. The continuous flow segmented is further bifurcated as axial continuous flow and centrifugal continuous flow. The ventricular assist devices market with continuous flow was valued at around USD 2,113.1 million in 2018. In the last few years, the first-generation pulsatile volume displacement pumps have evolved to become continuous flow pumps. These pumps are a significant step towards the care of patients owing to reduced product weight and size, decrease in adverse events, improved survival, enhanced quality of life, and functional capacity. Hence, the above-mentioned factors have resulted in augmenting the demand and adoption rate of ventricular assist devices, boosting the industry growth in the future.

On the basis of design, the market is segmented as transcutaneous and implantable. The implantable ventricular assist devices industry is estimated to expand at a CAGR of around 11.0% over the forecast period. Increase in number of people suffering from heart failure and several other cardiovascular diseases has resulted in rise in ventricular assist devices implantation. The use of implantable devices for long-term treatment in patients that are not eligible for heart transplant will enhance the segment growth in the near future.

U.S. dominated the North America ventricular assist devices market and was valued at around USD 1,293.2 million in the year 2018. According to the Center for Disease Control and Prevention (CDC), around 610,000 people die of heart disease in the U.S. every year. Increase in number of people suffering from cardiovascular disease, recent technological advancements and favorable reimbursement policies in the country will boost the demand and adoption rate of ventricular assist devices, augmenting the market growth in the country.

India market is estimated to grow substantially at a CAGR of 15.2% during the projection period. Growing geriatric population in the country will result in high cardiovascular disease prevalence leading to high heart failure rates. Also, rise in awareness among the patients about the treatments related to cardiovascular diseases and heart failure will increase the demand for ventricular assist devices in the country.

Ventricular Assist Devices Market Share

Some of the leading ventricular assist devices market players include :

- Abbott

- Abiomed

- Berlin Heart

- Bivacor

- CardiacAssist, Inc

- Evaheart

- Jarvik Heart

- Medtronic

- Terumo Corporation

. These companies focus and implement important strategic decisions such as mergers, acquisitions, partnerships and collaborations in order to expand their product portfolio and geographic reach. Also, new product launches and product innovation will benefit the companies in strengthening their market position.

Recent industry developments:

- In July 2018, Medtronic announced the approval and launch of a new left ventricular assist devices HVAD System in the U.S., that is less invasive and more beneficial to the patient.

- In August 2017, Abbott announced the FDA approval for its HeartMate 3 left ventricular assist device (LVAD). The device offers a novel option for physicians to treat advanced heart failure patients. For instance, in the U.S. according to Abbott more than 5.7 million people suffer from heart failure and approximately 915,000 patients are diagnosed with disease each year. Thus, the adoption of LVAD among patients with weekend heart witnessed the significant growth.

The ventricular assist devices market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue in USD and volume in Units from 2014 to 2025, for the following segments:

Click here to Buy Section of this Report

Ventricular Assist Devices Market By Product

- Left ventricular assist devices (LVADs)

- Right ventricular assist devices (RVADs)

- Biventricular assist devices (BIVADs)

- Percutaneous Ventricular Assist Devices (PVADs)

- Total Artificial Heart (TAH)

By Application

- Destination therapy

- Bridge-to-candidacy (BTC) therapy

- Bridge-to-transplant (BTT) therapy

- Bridge-to-recovery (BTR) therapy

- Others

By Age

- Below 18 years

- 19-39 years

- 40-59 years

- 60-79 years

- Above 80 years

By Flow

- Pulsatile Flow

- Continuous Flow

- Axial Continuous Flow

- Centrifugal Continuous Flow

By Design

- Transcutaneous

- Implantable

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

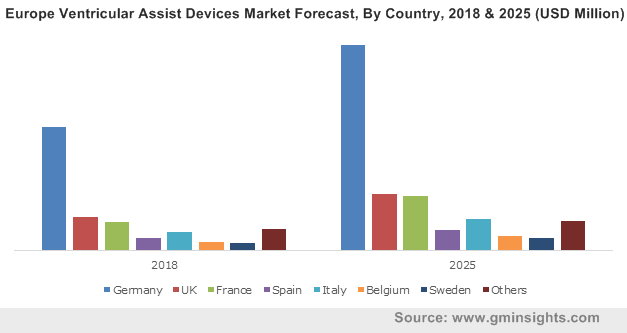

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Belgium

- Sweden

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- South Africa

- Saudi Arabia