Home > Media & Technology > Next Generation Technologies > Fintech > Payment Processing Solutions Market

Payment Processing Solutions Market - By Technology (Near-Field Communication (NFC), QR Code, EMV), By Deployment Model (In-store, Online, Mobile), By Mode of Payment (Credit Cards, Debit Cards, E-wallets), By Organization Size, By End-user & Forecast, 2022-2028

- Report ID: GMI3597

- Published Date: Apr 2022

- Report Format: PDF

Payment Processing Solutions Market Size

Payment Processing Solutions Market size exceeded USD 80 billion in 2021 and is poised to expand at over 10% CAGR between 2022 and 2028. The market growth is attributed to exponentially increase in use of card and digital payments, since the start of COVID-19 pandemic.

The payment processing solutions market is witnessing a significant market disruption with the increasing availability of VoLTE and the rapid proliferation of inexpensive smartphones. It is estimated that by 2025, smartphones will account for over 77% of the internet-connected devices. Technology players and banking establishments are developing multiple proprietary mobile wallet applications for smartphones, spurring demand for payment processing solutions.

| Report Attribute | Details |

|---|---|

| Base Year: | 2021 |

| Payment Processing Solutions Market Size in 2021: | USD 80 Billion |

| Forecast Period: | 2022 to 2028 |

| Forecast Period 2022 to 2028 CAGR: | 10% |

| 2028 Value Projection: | USD 180 Billion |

| Historical Data for: | 2018 to 2020 |

| No. of Pages: | 270 |

| Tables, Charts & Figures: | 395 |

| Segments covered: | Technology, Mode of Payment, Deployment Model, Organization Size, End-user, and Region |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

Payment Processing Solutions Market Analysis

In the U.S., NFC-based payment processing solutions market held a revenue share of over 40% in 2021, attributed to the growing use of digital payment channels. Such payment processing solutions offer a quicker & safer payment experience compared to traditional paper payments. Proliferation of smartphone-based wallets is also encouraging the use of NFC-enabled payment modes, such as Apple Pay, Google Pay and Samsung Pay.

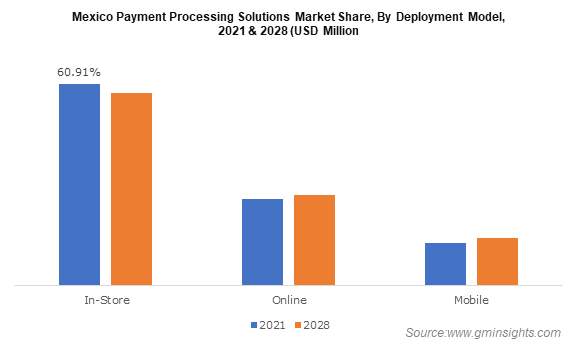

The in-store segment accounted for 60% Mexico payment processing solutions market share in 2021. Mexico is witnessing a surge in POS systems and mobile wallet-based payments across grocery stores, shopping centers, coffee shops, and travel agencies, among others. These stores widely use prepaid cards or credit cards to promote contactless payment methods and avoid the hassle of loose money.

In the UK market, the credit card segment is set to attain a CAGR of nearly 10% through 2028, as credit cards are one of the most used payment methods among consumers to make online purchases in the country. Multinational companies, such as Discover, MasterCard, Maestro, American Express, and Visa, ensure a safe payment process between vendors and issuing banks through payment processing solutions. This allows global users to make purchases using their interoperable and branded credit cards.

The large enterprises segment in China payment processing solutions market will witness growth rate of around 15% during the forecast period, owing to high integration of payment processing solutions in large-scale firms. Large organizations need a safer & highly secured mode of transaction using standard encryption and solutions that protect the sensitive data of merchants and consumers efficiently.

Germany retail & e-commerce sector is anticipated to grow at a steady rate between 2022 and 2028, due to rapidly growing online transactions and the rising demand for payment processing solutions in retailing. The shift from cash to cashless payments, online & mobile banking, and e-wallet payments have made payment processes easier for consumers. Retail stores or e-commerce retailers are integrating payment processing solutions and accepting payments from consumers via Apple Pay, Samsung Pay, and PayPal.

Asia Pacific payment processing solutions market revenue was over USD 15 billion in 2021. Countries in the region, including China, India, and Japan have been early adopters of cashless payment technology and have been contributing high to e-commerce retailing. The region largely utilizes NFC and QR code payment technologies.

China is also one of the biggest markets in the region and has transformed the payment industry by using WeChat Pay and AliPay. The use of these digital and mobile wallets at physical stores is leading the China payment sector.

Payment Processing Solutions Market Share

Some of the key players operating in the payment processing solutions market include:

- ACI Worldwide Inc

- Adyen N.V

- Authorize Net

- Due Inc

- Dwolla Inc

- Fidelity National Information Services Inc (FIS)

- First Data Corporation

- Fiserv Inc

- Flagship Merchant Services

- Global Payments Inc

- Jack Henry & Associates Inc

- Mastercard Incorporated

- PayPal Holdings Inc

- Paysafe Group Limited

- PayU

- Square Inc

- Stripe Inc Visa, Inc

The market has also witnessed several strategic alliances between key players to launch new and innovative solutions with added functionalities to maintain revenue share and profitability. For instance, in January 2022, PayPal and Salesforce joined together to provide merchants with direct access to PayPal Commerce Platform while using Salesforce payments.

The payment processing solutions market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2018 to 2028 for the following segments:

Click here to Buy Section of this Report

Market, By Technology

- Near-Field Communication (NFC)

- QR Code

- EMV

Market, By Deployment Model

- In-store

- Online

- Mobile

Market, By Mode of Payment

- Credit Cards

- Debit Cards

- E-wallets

Market, By Organization Size

- SMEs

- Large Enterprises

Market, By End-user

- Tourism and Hospitality

- Retail & E-commerce

- Healthcare

- BFSI

- Government and Public Sector

- Others

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- Japan

- Australia & New Zealand

- India

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Chile

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Egypt