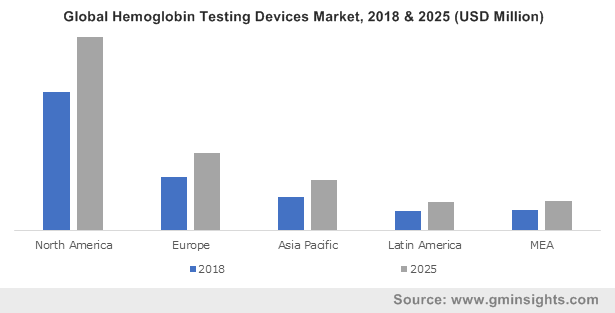

Hemoglobin Testing Devices Market size to exceed $5bn by 2025

Published Date: November 2019

Hemoglobin Testing Devices Market size is set to exceed USD 5 billion by 2025; according to a new research report by Global Market Insights Inc.

Growing demand for rapid and point of care tests for hemoglobin to diagnose various disorders such as anemia and diabetes will drive business growth. Moreover, rising number of R&D activities to develop novel product will foster the market growth during the projection period.

Growing demand for advanced diagnosis of anemia will positively drive industry growth

Anemia is a condition that occurs due to reduction in number of red blood cells that are responsible for carrying oxygenated blood. As per statistics, about 1.6 billion people across the globe are affected by anemia. Major factors that are responsible for anemic conditions include nutritional deficiencies. The disease requires diagnosis at early stages for efficient management and improving the treatment outcome. As anemia is directly corelated to the level of hemoglobin in the blood, it is the gold-standard for diagnosis of anemia. Thus, the need for quick, reliable and accurate diagnosis of anemia will propel the demand for hemoglobin testing and positively drive the industry growth.

Increasing FDA approvals for novel hemoglobin products will create numerous growth opportunities

Get more details on this report - Request Free Sample PDF

Rising number of FDA approvals for novel hemoglobin tests and analyzers will considerably augment market growth. For instance, in February 2019, HemoCue, a subsidiary of Danaher announced that it received clearance from U.S. FDA for its point of care testing product. Also, the same product was launched in number of international markets of Europe, South Africa, Latin America and the Asia Pacific region. Hence, rising number of FDA approvals for novel products will provide lucrative growth opportunities in the future.

Browse key industry insights spread across 160 pages with 286 market data tables & 8 figures & charts from the report, Hemoglobin Testing Devices Market Size By Product (Equipment {Point of Care [Portable, Handheld, Bench-top], Laboratory Analyzers} Consumables), By Technology (Chromatography, Immunoassay, Spectrophotometry), By End-use (Hospitals, Clinics, Laboratories, Home Care Settings, Blood Banks), Industry Analysis Report, Regional Outlook (U.S., Canada, Germany, UK, France, Spain, Italy, Japan, China, India, Australia, Argentina, Brazil, Mexico, South Africa, Saudi Arabia, UAE, Kuwait), Price Trends, Application Potential, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/hemoglobin-testing-devices-market

Automation in laboratory analyzers will be the major growth driver

Product segment for hemoglobin testing devices includes equipment and consumables. Equipment is further bifurcated into point of care and laboratory analyzers. Laboratory analyzers accounted for market share of 18.8% in 2018. Various technological advancements such as automation and compactness will be the major factors driving business growth. Various companies are offering range of products that offer greater efficiency and productivity along with simple touch screen and easy-to-use functionality. Aforementioned advantages of laboratory analyzers will stimulate market growth in the future.

Based on technology, the hemoglobin testing devices market is segmented into chromatography, immunoassay, spectroscopy and other technologies. Chromatography is estimated to grow at 5.3% during the forecast timeframe. Chromatography-based tests are free from complexities such as common interferences of non-glycation modifications, hemoglobin variants and storage-related hemichromes. Other advantages associated with chromatography technique includes high specificity, accuracy, simplicity and cost effectiveness, thus propelling segmental growth.

Hemoglobin testing equipment and consumables are widely used in hospitals, clinics, laboratories, blood banks, and home care settings. Laboratories segment is expected to reach USD 913.6 million by 2025. Awareness among the population of developing nations towards the diagnosis of various blood disorders is increasing rapidly. Also, laboratories offer high throughput screening and carry out tests for multiple samples simultaneously. Moreover, as large number of private practices in rural areas lack the funds to set-up clinical testing facilities, the demand for laboratory tests will increase in the future.

High prevalence of anemia in Japanese women will spur the demand for hemoglobin testing

Japan hemoglobin testing devices market held revenue of USD 114.79 million in 2018 and will witness steady growth in the future. High growth rate is attributable to increasing number of women being diagnosed with anemia. For instance, as per the World Bank report, the prevalence of anemia among Japanese women increased from 19.3% in 2011 to 21.5% in 2016. The rising prevalence trend will be the major factor for market growth. Moreover, several initiatives undertaken by local authorities to distribute free testing kits for HbA1c testing will spur market growth in the future.

Leading companies are launching novel products to capture larger market share

Few of the leading companies such as Abbott, Danaher, EKF Diagnostics, Roche, and Biorad are dominating the overall hemoglobin testing devices market. These companies are adopting various strategies such as new product launch, geographic expansion, mergers, acquisitions and partnerships with leading distributors to sustain the increasing competition. For instance, in June 2019, Abbott announced launch of point of care rapid hemoglobin test that is compatible with its Affinion 2 analyzer. This test will enable in quick diagnosis of patients’ risk of developing diabetes, thereby strengthening company’s market position.