Summary

Table of Content

VCSEL Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

VCSEL Market Size

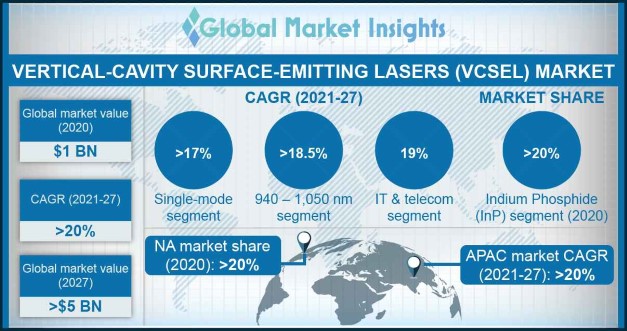

Vertical-Cavity Surface-Emitting Lasers (VCSEL) Market size valued at over USD 1 billion in 2020 and is estimated to grow at a CAGR of more than 20% from 2021 to 2027. The global industry unit shipments will reach 3.5 billion units annually by 2027.

To get key market trends

The increasing adoption of emerging technologies, such as Virtual/Augmented Reality (VR/AR), Artificial Intelligence (AI), and the Internet of Things (IoT), has accelerated data traffic rates in data centers. This will increase the requirement for high-end optical interconnect infrastructure, such as vertical-cavity surface-emitting lasers (VCSEL), to deliver high-speed data rates of up to 400 Gbit/s in data centers. Companies are continuously innovating new products to meet the growing demand for high-speed communication networks, adding an opportunity for the market growth.

The COVID-19 has severely affected the VCSEL market due to a halt in operations of several automotive and consumer electronics facilities. China, India, South Korea, and Taiwan are some of the major regions of semiconductor and electronics production. The COVID-19 outbreak in these regions has led the majority of foreign manufacturers to temporarily shut down their production or relocate their facilities to less affected areas. The decline in consumer buying power along with weakening per capita income has also affected production capabilities, restraining market opportunities for vertical-cavity surface-emitting lasers. However, the increasing trend for work from home and online education has accelerated the demand for computing devices, such as laptops and smartphones, adding an opportunity for the industry growth.

VCSEL Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2020 |

| Market Size in 2020 | 1 Billion (USD) |

| Forecast Period 2021 to 2027 CAGR | 20% |

| Market Size in 2027 | 5 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

VCSEL Market Analysis

The multi-mode segment held 35% of the VCSEL market share in 2020 and is projected to witness 17.5% growth rate through 2027. Multi-mode VCSELs can achieve high-power densities with improved rise time, thus increasing their usage in Time of Flight (TOF), LiDAR, and other high-power applications. The continuous efforts of market leaders to enhance the power & efficiency of vertical-cavity surface-emitting lasers will spur the growth opportunities of the multimode segment.

Learn more about the key segments shaping this market

Gallium Arsenide (GaAs) in the VCSEL market dominated more than 65% of revenue share in 2020 and is expected to attain a CAGR of 20% till 2027. GaAs-based vertical-cavity surface-emitting lasers deliver high-resolution, thin profiles, and larger displays for high-speed data cables that connect a screen to remotely located electronics. These features will increase their opportunities in consumer appliances such as televisions and computer display. The rising demand for high-resolution outputs and improved data rates will positively influence companies to enhance their offerings for GaAs-based VCSELs.

The 850 - 940nm will account for 65% of the VCSEL market share and is poised to expand at 20% CAGR during 2021 to 2027. Growth is credited to the rising adoption in short-reach optical interconnect applications such as High-Performance Computers (HPC) and data communication applications. Continuous technological advancement by companies to improve data rates and temperature stability are propelling the segment growth.

Learn more about the key segments shaping this market

The VCSEL market for sensing segment captured 75% of revenue share in 2020 and is anticipated to register growth of 25% by 2027. Vertical-cavity surface-emitting laser offers fast scanning, high efficiency, and high resistance to ambient light. These features will increase their acceptance in various sensing applications such as gesture recognition, driver fatigue detection, facial recognition, among others. The rising electrification in vehicles and integration of safety systems will impel market opportunities in the coming years.

Vertical-cavity surface-emitting lasers are adopted for sensing applications in vehicle control systems such as answering/hanging calls, adjusting audio volume, and driver fatigue detection, among others. Several governments are introducing regulations and policies to integrate safety systems in vehicles, driving opportunities for the industry.

Looking for region specific data?

The consumer electronics segment will hold 45% of the VCSEL market share by 2027 owing to the increasing usage of VCSELs in smartphones for proximity sensors and front camera modules, among others. The rising demand for 3D sensing among major smartphone manufacturers, such as Apple, Samsung, and Vivo, among others is leveraging the industry expansion. The growing smartphone manufacturing in developing nations will also influence the industry progression in the coming years.

North America VCSEL market accounted for 20% of revenue share in 2020. In the advent of 5G technology, several telecom providers in the region are planning to invest huge amounts to upgrade their telecom infrastructure, propelling the industry demand. In October 2019, Nokia has rolled out a time-sensitive package switch supporting cloud-native architecture and Time-Sensitive Networking (TSN) for components used in the 5G application. These initiatives will help telecom operators in the region to upgrade their existing network to the 5G cloud and fuel market revenue in the region. Additionally, rising initiatives and funding from the regional governments to accelerate the telecom infrastructure for 5G will impel the industry value.

VCSEL Market Share

Key players operating in the VCSEL market are

- II-VI Incorporated

- Lumentum Operations LLC

- ams AG

- TRUMPF

- Broadcom

- VERTILAS GmbH

- TT Electronics

- OSRAM Opto Semiconductors GmbH

- Leonardo Electronics US, Inc.

Companies are continuously involved in research & development activities and new product innovation to compete against other payers.

The VCSEL market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2016 to 2027 for the following segments:

Market, By Type

- Single-mode

- Multi-mode

Market, By Material Type

- Gallium Arsenide (GaAs)

- Indium Phosphide (InP)

- Gallium nitride

- Others

Market, By Wavelength

- < 850 nm

- 850 - 940 nm

- 940 – 1,050 nm

- > 1,050 nm

Market, By Application

- Sensing

- Data communication

- Industrial heating & laser printing

- Others

Market, By Industry Verticals

- Consumer electronics

- IT & telecom

- Automotive

- Industrial

- Healthcare

- Aerospace & defense

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Latin America

- Brazil

- Mexico

- MEA

- South Africa

- GCC

Frequently Asked Question(FAQ) :

Why is the Gallium Arsenide (GaAs) VSCEL industry size witnessing robust growth?

The revenue from the Gallium Arsenide segment was 65% of the total market share in 2020 and will strike a CAGR of over 20% up to 2027 driven by the across consumer appliances like televisions and computer display.

How is the global market for VCSEL expected to perform through the coming years?

The global VCSEL industry size surpassed USD 1 billion in 2020 and is projected to register a 20% CAGR up to 2027.

What was the share of multi-mode VCSEL market in 2020?

The annual revenue from the multi-mode segment reached 35% of the total VCSEL industry share in 2020 and will rise at a 17.5% CAGR up to 2027 owing to their higher adoption in TOF, LiDAR, and other high-power applications.

How will the sensing applications drive the VCSEL market forecast?

VCSEL uses across the sensing applications contributed to 75% of the industry share in 2020 and is slated to rise at a CAGR of 25% through 2027 with the increasing demand across gesture recognition applications.

What factors will influence VCSEL demand across North America?

The VSCEL industry in North America was over 20% of the global market share in 2020 and will grow with the investments by telecom operators and governments to accelerate 5G network.

VCSEL Market Scope

Related Reports