Summary

Table of Content

U.S. Veterinary Orthopedic Implants Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

U.S. Veterinary Orthopedic Implants Market Size

The U.S. veterinary orthopedic implants market was estimated at USD 237.2 million in 2024. The market is expected to grow from USD 252.1 million in 2025 to USD 499.2 million in 2034, growing at a CAGR of 7.9% during the forecast period, according to the latest report published by Global Market Insights Inc. As the pet owners increasingly consider pets as family members, there is a growing willingness to invest in advanced veterinary care, including surgical procedures.

To get key market trends

For instance, as per the American Pet Products Association (APPA), pet expenditure in the U.S. reached USD 151.9 billion in 2024 from USD 147 billion in 2023, and is expected to reach USD 157 billion by 2025. These increasing animal healthcare expenditures highlight a growing demand for veterinary care products and services. Thus, a high pet population in the region, coupled with high veterinary expenses, increases the demand for various pet care services, including surgeries, thereby driving the market growth.

U.S. Veterinary Orthopedic Implants Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 237.2 Million |

| Market Size in 2025 | USD 252.1 Million |

| Forecast Period 2025 - 2034 CAGR | 7.9% |

| Market Size in 2034 | USD 499.2 Million |

| Key Market Trends | |

| Drivers | Impact |

| Rising penetration of pet insurance | It improves the affordability of orthopedic procedures, encouraging more pet owners to opt for advanced surgical treatments. |

| Growing incidence of musculoskeletal disorders in animals | High incidence of musculoskeletal disorders has increased the demand for implants to treat fractures, arthritis, and ligament injuries in both pets and livestock. |

| Rising pet ownership and humanization | Rising pet ownership drives spending on veterinary care, especially orthopedic procedures, as pets are increasingly seen as family members. |

| Pitfalls & Challenges | Impact |

| High cost of orthopedic procedures and implants | Limits access for many pet owners, particularly those without insurance or in low-income regions. |

| Post-surgical complications and recovery time | Discourages some pet owners from opting for surgery, impacting overall adoption rates of implants. |

| Opportunities: | Impact |

| Emergence of biodegradable and resorbable implants | Emergence of biodegradable and resorbable implants will reduce the need for secondary surgeries, improving patient recovery and increasing acceptance among veterinarians and pet owners. |

| Expansion of veterinary specialty hospitals and referral centers | Improving access to advanced orthopedic care will boost surgical procedure volume and implant demand. |

| Market Leaders (2024) | |

| Market Leaders |

~32.2% market share. |

| Top Players |

Collective market share in 2024 is ~54.5% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | South Atlantic |

| Fastest Growing Market | West South Central |

| Emerging Zones | North East, Pacific Central, East South Central, East North Central |

| Future outlook |

|

What are the growth opportunities in this market?

Veterinary orthopedic implants are medical devices used for correcting fractures, stabilizing joints, and assisting bone healing in animals. These implants consist of bone plates, screws, pins, wires, and prosthetic joints designed to resist the biomechanical stresses of various species. Key market players such as DePuy Synthes (Johnson & Johnson), B. Braun, Movora (Vimian Group AB), Arthrex Vet Systems, and Veterinary Instrumentation support the overall market growth. They shape the market through innovation in implant materials and design, R&D innovation, and new product launches. Furthermore, their strong distribution network enhances the availability and accessibility of high-quality products across the country.

In 2021, the U.S. veterinary orthopedic implants market was valued at USD 200.8 million and witnessed growth to reach USD 211.4 million and USD 223.5 million in 2022 and 2023, respectively. During this period, the market witnessed increasing use of advanced fixation devices such as locking plates, intramedullary nails, and patient-specific 3D-printed implants. This shift was driven by the growing demand for higher success rates in fracture repair, faster recovery, and the ability to treat complex cases in dogs, cats, and equines.

The COVID-19 pandemic also had a notable impact on pet ownership trends in the U.S. According to APPA, in 2010, about 62% of households owned a pet, including 46 million dog-owning households and 39 million cat-owning households. By 2024, these numbers had increased to 58 million for dogs and 40 million for cats. This rise translates into increased demand for veterinary care, including specialized treatments like orthopedic surgeries.

Veterinary orthopedic implants, typically manufactured from metals such as titanium or stainless steel, play a vital role in restoring function to fractured bones or replacing damaged joints, bones, or cartilage. These implants are essential in managing fractures, joint disorders, and other musculoskeletal conditions in animals.

U.S. Veterinary Orthopedic Implants Market Trends

- A key trend driving the growth of the market is the advancements in implant material, such as titanium alloys and bioresorbable polymers that enhance the strength, durability, and biocompatibility of these implants.

- The several advantages of these materials, such as reduced risk of implant rejection and improved healing by promoting bone integration, encourage veterinarians to adopt new implant technologies, thereby fueling market growth.

- The rise of minimally invasive surgical techniques is also reshaping the market. Veterinarians are adopting implants compatible with smaller incisions, arthroscopic procedures, and faster post-operative recovery. This approach reduces animal discomfort and speeds up rehabilitation, making it more attractive to pet owners.

- The availability of implants specifically designed for minimally invasive use is therefore driving higher acceptance and supporting market expansion.

- Further, as per the North American Pet Health Insurance Association (NAPHIA) 2024 report, in the U.S., total premium volume for pet insurance reached USD 3.9 billion in 2023, with 5.7 million pets insured, a 17% increase from 2022. This growing insurance coverage offers advanced orthopedic treatments and surgeries to pet owners, reducing the financial burden and thereby boosting demand for veterinary implants.

- Moreover, the expanding applications of veterinary orthopedic implants beyond small animals to include large animals represent another key trend reshaping the growth of this market.

U.S. Veterinary Orthopedic Implants Market Analysis

Learn more about the key segments shaping this market

Based on the product, the U.S. veterinary orthopedic implants market is divided into implants and instruments. The implants segment is further sub-segmented into plates, joint implants, bone screws and anchors, pins and wires, and other implants. The implants segment dominated the market in 2024 with USD 167.8 million and is expected to reach USD 358.4 million by 2034.

- The growing population of aging pets is a major factor driving the demand for orthopedic implants. For instance, in terms of the current age distribution of pets in the U.S., MRI-Simmons data shows a long-term increase in the share of dog-owning households with senior dogs (age 7+), rising from 42% in 2012 to 52% as of summer 2022. This means that a total of 26.5 million households own senior dogs.

- These pets are more susceptible to joint problems and bone injuries, driving the demand for veterinary orthopedic procedures requiring implants.

- Additionally, the continuous technological advancements in veterinary orthopedic implant design and materials further fuel the segmental growth.

- On the other hand, the instruments segment accounted for 29.3% of the market in 2024.

- Innovations in surgical instruments, such as electronic bone drills, power saws, and minimally invasive surgical tools, have significantly improved the efficiency and precision of orthopedic procedures, thereby driving their demand.

- Additionally, increased reliance of veterinarians on a wide range of specialized instruments further propels the growth of this segment.

Learn more about the key segments shaping this market

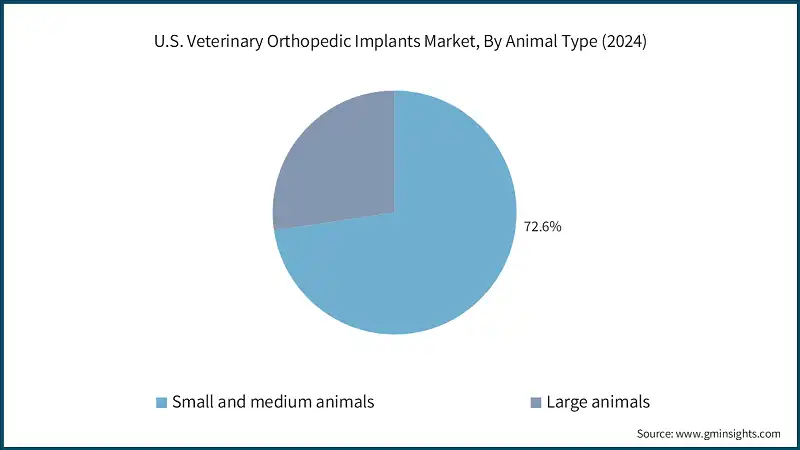

Based on animal type, the U.S. veterinary orthopedic implants market is categorized into small and medium animals and large animals. The small and medium animal’s segment is further categorized into dogs, cats, and other small and medium animals. The small and medium animals segment dominated the market in 2024 with a market share of 72.6%.

On the other hand, the large animal’s segment is poised to grow at a 7.1% CAGR over the analysis period. This growth is driven by the economic importance of large animals like horses and cattle, encouraging producers and breeders to invest in advanced orthopedic care to maintain animal health and productivity.

- The dominance of the small and medium animals’ segment is primarily due to the high pet population, particularly cats and dogs, in the country. As per the 2025 APPA National Pet Owners Survey, 94 million U.S. households own a pet.

- This high pet population demonstrates the regular need for veterinary care products and services, including orthopedic interventions for conditions such as fractures, joint diseases, and degenerative disorders.

- Additionally, the growing emphasis on animal sports and the significant participation of dogs as military working dogs further boost the growth of this segment.

- For instance, as per the U.S. Army, over 30,000 dogs have served in the military since 1942, with approximately 2,500 active military working dogs currently serving the country. Their active and physically demanding role increases the risk of musculoskeletal injuries, leading to high demand for veterinary orthopedic implants.

Based on the application, the U.S. veterinary orthopedic implants market is categorized into Tibial Plateau Leveling Osteotomy (TPLO), Tibial Tuberosity Advancement (TTA), joint replacement, trauma, and other applications. The joint replacement segment is further sub-categorized into hip replacement, knee replacement, elbow replacement, and ankle replacement. The joint replacement segment held the highest market share of 28.3% in 2024.

- One of the major factors driving the growth of the joint replacement segment is the rising prevalence of degenerative joint diseases such as canine hip dysplasia, osteoarthritis, and elbow dysplasia.

- For instance, as per Morris Animal Foundation, osteoarthritis in pets is a major concern in the U.S., affecting about 14 million adult dogs. This high prevalence of chronic conditions significantly impacts mobility, making joint replacement a highly effective treatment.

- Furthermore, the field of veterinary joint replacement is significantly growing due to the rising adoption of 3D-printed implants improve surgical precision, implant compatibility, and recovery time.

- On the other hand, the trauma segment is anticipated to grow at a CAGR of 8.1% during the forecast period.

- The high occurrence of road accidents, falls, and physical injuries due to the rapid urbanization and increased outdoor activities is driving the growth of this segment.

- Additionally, the critical role of implants, including plates, screws, pins, and external fixators, in stabilizing fractured bones, promoting healing, and restoring mobility further supports the growth of this segment.

Based on the end use, the U.S. veterinary orthopedic implants market is classified into veterinary hospitals and clinics and other end users. The veterinary hospitals and clinics segment accounted for revenue of USD 203.4 million in 2024 and is anticipated to grow at a CAGR of 8.1% over the analysis period.

- Veterinary clinics and hospitals are the primary point of contact for diagnosing and treating musculoskeletal conditions such as fractures, joint disorders, and ligament injuries, thus contributing to the growth of this segment.

- The presence of specialized veterinary surgeons and access to advanced implant technologies improve surgical success rates and post-operative recovery, further contributing to the segment’s growth.

- Furthermore, the continuous increase in the number of veterinary clinics, hospitals, and professionals is significantly driving the expansion of the veterinary hospitals and clinics segment within the veterinary orthopedic implants market.

Looking for region specific data?

South Atlantic Veterinary Orthopedic Implants Market

The South Atlantic zone dominated the U.S. veterinary orthopedic implants market with a market share of 23.6% in 2024.

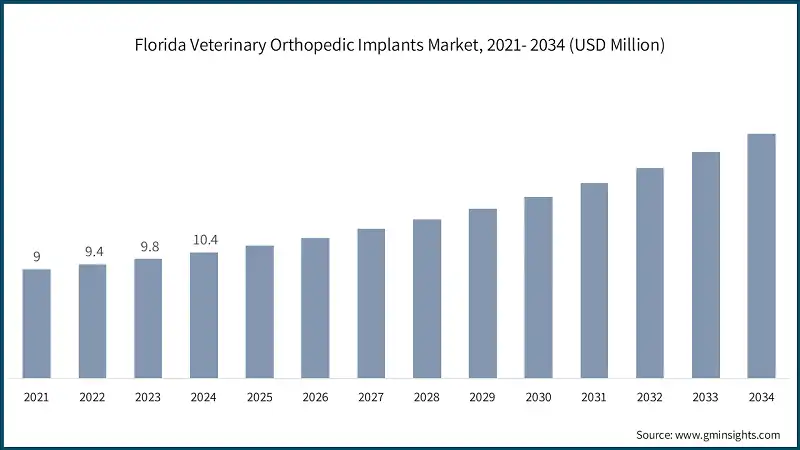

The Florida veterinary orthopedic implants market was valued at USD 9 million and USD 9.4 million in 2021 and 2022, respectively. The market size reached USD 10.4 million in 2024, growing from USD 9.8 million in 2023.

- According to Dogster, in Florida, around 5 million households own at least one pet. Furthermore, it states that Florida has a household pet ownership rate of 56%, of which 39.8% are dogs and 24.2% are cats.

- Growing prevalence of musculoskeletal conditions, injuries, and age-related orthopedic issues in pets necessitates the adoption of advanced surgical procedures, thereby fueling demand for veterinary orthopedic implants.

The Georgia veterinary orthopedic implants market is predicted to witness considerable growth over the analysis period.

- Increasing awareness of available surgical solutions among pet owners and their willingness to invest in such procedures is boosting the growth of the Georgia veterinary orthopedic implants market.

- Additionally, the increased penetration of pet insurance in the state drives the adoption of costly veterinary orthopedic treatments.

- Moreover, the presence of several veterinary schools and specialty clinics in Georgia improves the accessibility of advanced veterinary orthopedic implants, thereby driving market growth.

The veterinary orthopedic implants market in the Pacific Central zone of the U.S. was valued at USD 39.9 million in 2024 and is anticipated to witness significant growth over the analysis period.

- States like California, Oregon, and Washington have a large companion animal population, with pet owners treating their pets as an integral part of the family. This trend boosts the adoption of advanced veterinary care products.

- Further, adoption of pet insurance and a well-established veterinary infrastructure support the growth of this market.

- This zone also benefits from increasing investments in veterinary education, the establishment of modern veterinary hospitals, and the growing presence of key implant manufacturers expanding their operations in the region.

U.S. Veterinary Orthopedic Implants Market Share

The veterinary orthopedic implants market is experiencing significant expansion, driven by the growing incidence of orthopedic disorders in both companion and livestock animals, rising pet ownership, and increasing demand for advanced surgical interventions. This market encompasses leading global healthcare companies, medical device manufacturers, and veterinary-focused firms delivering innovative orthopedic solutions.

The top 5 players, including DePuy Synthes (Johnson & Johnson), B. Braun, Movora (Vimian Group AB), Arthrex Vet Systems, and Veterinary Instrumentation, collectively account for an estimated 52 – 57% of the total market share. These players maintain their competitive edge through a combination of strong brand recognition, broad product portfolios, technological innovation, and extensive distribution networks across the U.S.

Further, technological advancements such as 3D printing, customized implant design, and minimally invasive surgical techniques are revolutionizing veterinary orthopedics. Additionally, growing veterinary infrastructure, strategic collaborations with veterinary hospitals, and investments in research and development are driving market expansion.

U.S. Veterinary Orthopedic Implants Market Companies

Few of the prominent players operating in the U.S. veterinary orthopedic implants industry include:

- AmerisourceBergen Corporation (Cencora)

- Arthrex Vet Systems

- B. Braun

- BlueSAO

- DePuy Synthes (Johnson & Johnson)

- Fusion Implants

- GerVetUSA

- GPC Medical

- Integra LifeSciences

- Movora (Vimian Group)

- Narang Medical Limited

- Ortho Max

- Orthomed

- Rita Leibinger

- Veterinary Instrumentation

- DePuy Synthes (Johnson & Johnson)

DePuy Synthes, a subsidiary of Johnson & Johnson, is a leading player in the veterinary orthopedic implants market, holding approximately 32.2% market share. The company provides a comprehensive portfolio of implants and instruments designed to treat fractures, joint disorders, and musculoskeletal conditions in companion animals. Leveraging advanced technologies such as 3D printing, bioabsorbable materials, and minimally invasive surgical systems, DePuy Synthes enhances implant performance and improves surgical outcomes.

Movora, a subsidiary of Vimian Group AB, operates exclusively in the veterinary orthopedic implants market, offering a dedicated portfolio of implants and surgical instruments. The company emphasizes innovation in orthopedic solutions, including advanced joint replacement systems, fixation devices, and plates specifically designed for companion animals. By engaging in strategic collaborations with veterinary clinics, launching educational initiatives, and partnering with veterinary surgeons, Movora continues to strengthen its market presence.

B. Braun maintains a strong foothold in the U.S. veterinary orthopedic implants market with its broad range of high-quality plates, screws, and surgical instruments for small and medium animals. The company’s precision-engineered implants and comprehensive surgical kits ensure reliable outcomes, driving surgeon preference. Its consistent emphasis on innovation, product safety, and quality has enabled B. Braun to retain a competitive edge within the expanding veterinary orthopedic segment.

U.S. Veterinary Orthopedic Implants Industry News:

- In June 2024, Movora collaborated with Viticus Group to expand veterinary orthopedic education. The partnership focuses on advanced fracture repair techniques, providing hands-on training at the Movora Education Center, strengthening expertise in the veterinary orthopedic implants market.

- In August 2022, Vimian Group’s Movora, acquired New Generation Devices (NGD), a veterinary orthopedic implants firm in New Jersey. This acquisition strengthens Movora’s veterinary orthopedic implants portfolio, including TPLO and fracture plates, while expanding its customer base and product offerings in the U.S. market.

- In December 2021, DePuy Synthes acquired Israeli-based OrthoSpin, which develops automated strut systems used in bone deformity correction. This acquisition strengthens DePuy Synthes' orthopedic and veterinary orthopedic implant offerings with advanced, digitally enabled fixation solutions.

- In October 2021, Arthrex, an orthopedic technology innovator, announced a USD 100 million investment to expand its operations in Anderson County, South Carolina, aiming to create 500 new jobs. The expansion includes constructing a 210,000-square-foot manufacturing facility, enhancing the company's capacity to produce surgical devices and veterinary orthopedic implants.

- In June 2021, Veterinary Instrumentation expanded into the U.S. market, aiming to strengthen its presence in North America. This strategic move is expected to drive significant growth and broaden access to its veterinary orthopedic implants and instruments portfolio.

The U.S. veterinary orthopedic implants market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 – 2034 for the following segments:

Market, By Product

- Implants

- Plates

- TPLO plates

- TTA plates

- Trauma plates

- Specialty plates

- Other plates

- Joint implants

- Bone screws and anchors

- Pins and wires

- Other implants

- Plates

- Instruments

Market, By Animal Type

- Small and medium animals

- Dogs

- Cats

- Other small and medium animals

- Large animals

Market, By Application

- Tibial Plateau Leveling Osteotomy (TPLO)

- Tibial Tuberosity Advancement (TTA)

- Joint replacement

- Hip replacement

- Knee replacement

- Elbow replacement

- Ankle replacement

- Trauma

- Other applications

Market, By End Use

- Veterinary hospitals and clinics

- Other end use

The above information is provided for the following zones and states:

- North East

- Connecticut

- Maine

- Massachusetts

- New Hampshire

- Rhode Island

- Vermont

- New Jersey

- New York

- Pennsylvania

- East North Central

- Wisconsin

- Michigan

- Illinois

- Indiana

- Ohio

- West North Central

- North Dakota

- South Dakota

- Nebraska

- Kansas

- Minnesota

- Iowa

- Missouri

- South Atlantic

- Delaware

- Maryland

- District of Columbia

- Virginia

- West Virginia

- North Carolina

- South Carolina

- Georgia

- Florida

- East South Central

- Kentucky

- Tennessee

- Mississippi

- Alabama

- West South Central

- Oklahoma

- Texas

- Arkansas

- Louisiana

- Mountain States

- Idaho

- Montana

- Wyoming

- Nevada

- Utah

- Colorado

- Arizona

- New Mexico

- Pacific Central

- California

- Alaska

- Hawaii

- Oregon

- Washington

Frequently Asked Question(FAQ) :

Who are the key players in the U.S. veterinary orthopedic implants market?

Key players include AmerisourceBergen Corporation (Cencora), Arthrex Vet Systems, B. Braun, BlueSAO, DePuy Synthes (Johnson & Johnson), Fusion Implants, GerVetUSA, GPC Medical, Integra LifeSciences, Movora (Vimian Group), Narang Medical Limited, and Ortho Max.

What are the upcoming trends in the U.S. veterinary orthopedic implants market?

Key trends include advancements in implant materials like titanium alloys and bioresorbable polymers, the rise of minimally invasive surgical techniques, and the increasing availability of implants designed for such procedures.

Which region leads the U.S. veterinary orthopedic implants market?

The South Atlantic zone led the market with a 23.6% share in 2024, driven by a high concentration of veterinary practices and pet ownership in the region.

Which application segment held the highest market share in 2024?

The joint replacement segment held the highest market share of 28.3% in 2024.

What is the projected value of the implants segment by 2034?

The implants segment is expected to reach USD 358.4 million by 2034.

What is the market size of the U.S. veterinary orthopedic implants in 2024?

The market size was USD 237.2 million in 2024, with a CAGR of 7.9% expected through 2034, driven by advancements in implant materials and the increasing adoption of minimally invasive surgical techniques.

What is the projected size of the U.S. veterinary orthopedic implants market in 2025?

The market is expected to reach USD 252.1 million in 2025.

How much revenue did the implants segment generate in 2024?

The implants segment generated USD 167.8 million in 2024, dominating the market.

What is the projected value of the U.S. veterinary orthopedic implants market by 2034?

The market is expected to reach USD 499.2 million by 2034, fueled by innovations in implant technology and growing investments in advanced veterinary care.

U.S. Veterinary Orthopedic Implants Market Scope

Related Reports