Summary

Table of Content

Climbing Gym Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Climbing Gym Market Size

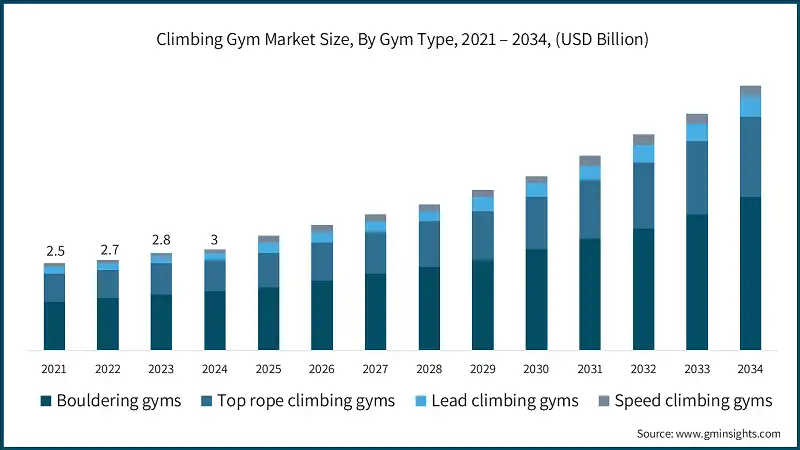

The global climbing gym market was estimated at USD 3 billion in 2024. The market is expected to grow from USD 3.2 billion in 2025 to USD 7.6 billion in 2034, at a CAGR of 9.9%, according to latest report published by Global Market Insights Inc.

To get key market trends

The climbing gym market has experienced substantial growth in recent years, driven by the increasing popularity of indoor climbing as both a recreational activity and a fitness regimen. These facilities provide a safe and controlled environment for individuals of all skill levels, from beginners to advanced climbers, to practice and enhance their climbing abilities. The market has evolved significantly, with climbing gyms now offering a variety of wall designs, including bouldering walls, top-rope and lead-climbing routes, auto-belays, and specialized training areas equipped with campus boards, hangboards, and system walls. This diversification caters to a broad spectrum of climbers, enhancing the overall appeal and functionality of these facilities. Additionally, climbing gyms have become vibrant social hubs, fostering a sense of community among climbers who share experiences, challenges, and achievements.

The climbing gym market is primarily driven by the growing global emphasis on health and fitness. According to the International Health, Racquet & Sportsclub Association (IHRSA), the global fitness industry generated a revenue of USD 337 billion in 2023, reflecting a steady increase in consumer spending on fitness-related activities. Climbing gyms have emerged as a unique alternative to traditional fitness centers, offering a workout that combines physical strength, endurance, flexibility, and mental focus. The Centers for Disease Control and Prevention (CDC) highlights that regular physical activity, such as climbing, can reduce the risk of chronic diseases, improve mental health, and enhance overall well-being. This has encouraged individuals to explore innovative fitness options like climbing gyms, which provide a holistic approach to health and fitness.

Climbing gyms also cater to a diverse audience, including families, children, and corporate groups seeking team-building activities. Many facilities offer tailored programs such as youth climbing leagues, adaptive climbing sessions for individuals with disabilities, and fitness classes that integrate climbing techniques. These initiatives not only broaden the market's appeal but also position climbing gyms as inclusive and community-oriented spaces. For example, Vertical Endeavors, a leading climbing gym operator in the United States, reported a 15% increase in membership in 2023, driven by the introduction of family-friendly programs and corporate packages.

Furthermore, the market benefits from the increasing urbanization and the growing number of millennials and Gen Z individuals seeking unique and engaging fitness experiences. According to the United Nations, 56.2% of the global population lived in urban areas in 2023, a figure projected to rise in the coming years. Urban residents often seek accessible and innovative fitness options, making climbing gyms an attractive choice. Additionally, the rise of social media has played a significant role in promoting climbing as a trendy and adventurous activity, further boosting its popularity.

Climbing Gym Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 3 Billion |

| Market Size in 2025 | USD 3.2 Billion |

| Forecast Period 2025 - 2034 CAGR | 9.9% |

| Market Size in 2034 | USD 7.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising popularity of indoor recreational activities | Indoor climbing gyms benefit from the growing demand for safe, weather-independent fitness and leisure options, attracting urban dwellers and families seeking engaging alternatives to traditional workouts. |

| Olympic inclusion and competitive growth | The inclusion of sport climbing in the Olympics has elevated its visibility and legitimacy, driving interest among youth and aspiring athletes, and encouraging gyms to invest in competition-grade facilities and training programs. |

| Advancements in climbing wall technology and safety equipment | Innovations like modular walls, auto-belays, and smart tracking systems enhance user experience and safety, making climbing more accessible to beginners and boosting retention rates for gyms. |

| Pitfalls & Challenges | Impact |

| High initial investment and maintenance costs | Setting up a climbing gym requires substantial capital for infrastructure, equipment, and safety systems, which can be a barrier for new entrants and limit expansion in smaller markets. |

| Limited accessibility and space constraints | Urban space limitations and zoning regulations can restrict the size and location of climbing gyms, affecting scalability and the ability to offer diverse climbing formats under one roof. |

| Opportunities: | Impact |

| Expansion in Tier 2 and Tier 3 cities | As awareness of climbing grows beyond metro areas, gyms entering smaller cities can tap into underserved markets with rising disposable incomes and interest in alternative fitness. This geographic diversification can drive overall market growth and brand visibility while reducing saturation in urban centers. |

| Integration of digital platforms for engagement & training | Offering mobile apps for booking, route tracking, virtual coaching, and gamified challenges enhances user experience and retention. It also opens up new revenue streams through online memberships and remote training, making climbing more accessible and scalable. |

| Market Leaders (2024) | |

| Market Leaders |

2% market share |

| Top Players |

The collective market share in 2024 is 12% |

| Competitive Edge |

|

| Regional Insights | |

| Largest market | Asia Pacific |

| Fastest growing market | North America |

| Emerging countries | Germany, China, UK, India |

| Future outlook |

|

What are the growth opportunities in this market?

Climbing Gym Market Trends

Climbing gyms are increasingly adopting hybrid fitness models by integrating complementary services such as yoga, strength training, and wellness programs. This approach caters to a broader demographic, enhancing member retention and engagement.

- According to the International Health, Racquet & Sportsclub Association (IHRSA), fitness facilities offering diverse services report a 20% higher retention rate compared to single-service gyms. By positioning themselves as lifestyle hubs, climbing gyms are transitioning from niche facilities to comprehensive wellness centers, appealing to fitness enthusiasts seeking a holistic experience.

- Additionally, the hybrid model allows gyms to diversify revenue streams, reducing dependency on climbing-specific memberships and creating a more sustainable business model.

- The inclusion of climbing as an Olympic sport in 2020 has significantly boosted its popularity among younger demographics. Climbing gyms are leveraging this momentum by introducing structured youth programs, forming partnerships with schools, and organizing junior competitions. For instance, the Climbing Business Journal reported a 15% year-over-year increase in youth participation in climbing gyms in 2023.

- Youth programs also contribute to the development of essential skills such as teamwork, problem-solving, and physical fitness, making them attractive to parents and educators alike.

- As environmental awareness grows, climbing gyms are prioritizing sustainability in their facility designs and operations. Many gyms are incorporating recycled materials, energy-efficient lighting systems, and low-impact construction techniques to reduce their carbon footprint. According to the U.S. Green Building Council, buildings with sustainable designs can reduce energy consumption by up to 30%.

- Technological advancements are transforming the climbing industry, enhancing user engagement and personalization. Smart climbing walls equipped with sensors can track performance metrics such as speed, grip strength, and route completion. Additionally, app-based route planning and virtual coaching are gaining traction, particularly among tech-savvy urban climbers. According to a 2023 report by the Outdoor Industry Association, 40% of climbers used digital tools to enhance their climbing experience.

Climbing Gym Market Analysis

Learn more about the key segments shaping this market

Based on gym type, the market is segmented into bouldering gyms, top rope climbing gyms, lead climbing gyms and speed climbing gyms. The bouldering gyms segment held the major market share, generating a revenue of USD 1.7 billion in 2024.

- Bouldering requires minimal equipment, such as climbing shoes and chalk, eliminating the need for harnesses or ropes. This simplicity not only reduces operational costs for gym operators but also makes it a cost-effective and accessible option for climbers. According to the International Federation of Sport Climbing (IFSC), bouldering has seen a consistent rise in participation rates, with an estimated 20% year-on-year growth globally over the past five years.

- The appeal of bouldering extends beyond its cost-effectiveness. Its intense and dynamic nature attracts a broad demographic, ranging from beginners seeking an introduction to climbing to advanced climbers looking for challenging problems. This inclusivity fosters a welcoming environment, encouraging participation across various skill levels.

- Additionally, the social aspect of bouldering plays a pivotal role in its popularity. Climbers often collaborate to solve problems, share techniques, and build a sense of community, which enhances the overall experience. A report by the Climbing Business Journal highlights that over 70% of climbers prefer bouldering gyms due to their community-driven atmosphere and shorter climbing routes, which allow for quicker sessions compared to other climbing styles.

- While other segments, such as top rope climbing, lead climbing, and speed climbing, cater to specific niches within the indoor climbing market, they lack the widespread appeal and versatility of bouldering. Top rope and lead climbing require more extensive equipment and safety measures, which can deter casual climbers. Speed climbing, though gaining traction due to its inclusion in competitive events like the Olympics, remains a specialized discipline with limited recreational adoption. In contrast, bouldering's adaptability and lower barriers to entry have positioned it as the most popular form of indoor climbing.

- Furthermore, the growth of bouldering gyms is supported by the increasing urbanization and demand for recreational activities in metropolitan areas. According to the United Nations, 56.2% of the global population resided in urban areas in 2023, a figure projected to rise steadily. Urban dwellers often seek accessible and engaging fitness options, and bouldering gyms meet this demand effectively. The compact design of bouldering gyms, which requires less vertical space compared to rope climbing facilities, makes them ideal for urban settings where real estate is at a premium.

Learn more about the key segments shaping this market

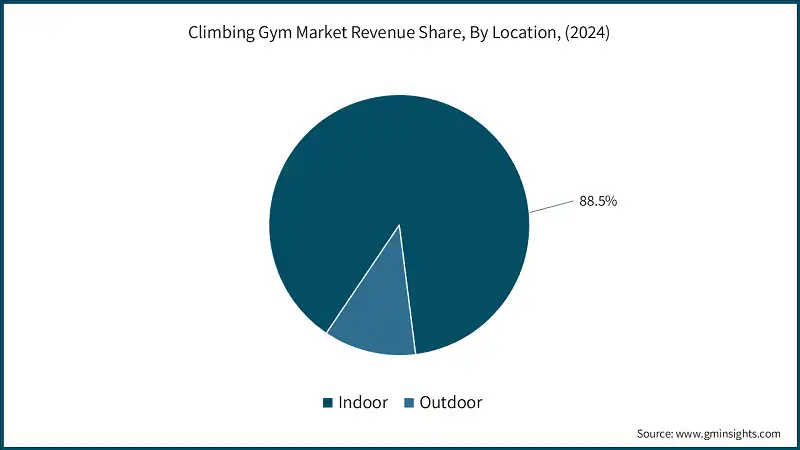

Based on the location, the climbing gym market is segmented into indoor and outdoor. The outdoor segment held the largest share, accounting for 88.5% of the global market in 2024.

- This segment's prominence is driven by several key factors, including its ability to provide year-round accessibility, regardless of weather conditions. Indoor climbing gyms offer a controlled and safe environment, which is particularly appealing to a diverse demographic, including beginners, families, and individuals seeking a secure introduction to climbing activities.

- According to the Climbing Business Journal, the number of indoor climbing gyms in the United States surpassed 600 facilities in 2023, reflecting a steady annual growth rate of approximately 6% over the past five years. This growth aligns with the increasing popularity of climbing as a recreational and competitive sport, further fueled by its inclusion in the Olympics since 2020. The controlled environment of indoor gyms allows operators to design diverse and challenging climbing routes, catering to climbers of all skill levels, from novices to advanced athletes. This adaptability has been a significant factor in attracting a broader customer base.

- Additionally, the urban-centric locations of many indoor climbing facilities enhance their accessibility and convenience for city dwellers. Urban gyms often integrate modern amenities, such as fitness centers, yoga studios, and cafes, creating a comprehensive recreational experience. According to the International Federation of Sport Climbing (IFSC), the global climbing community has grown to over 35 million participants, with indoor climbing accounting for a substantial portion of this figure. This trend underscores the increasing demand for safe, accessible, and versatile climbing options, which indoor facilities are well-positioned to meet.

- Furthermore, advancements in climbing wall technology and safety equipment have contributed to the indoor segment's growth. Manufacturers are increasingly investing in innovative materials and designs to enhance the durability and functionality of climbing walls. For instance, the use of modular climbing panels allows gyms to frequently update and customize routes, keeping the experience engaging for regular visitors.

Looking for region specific data?

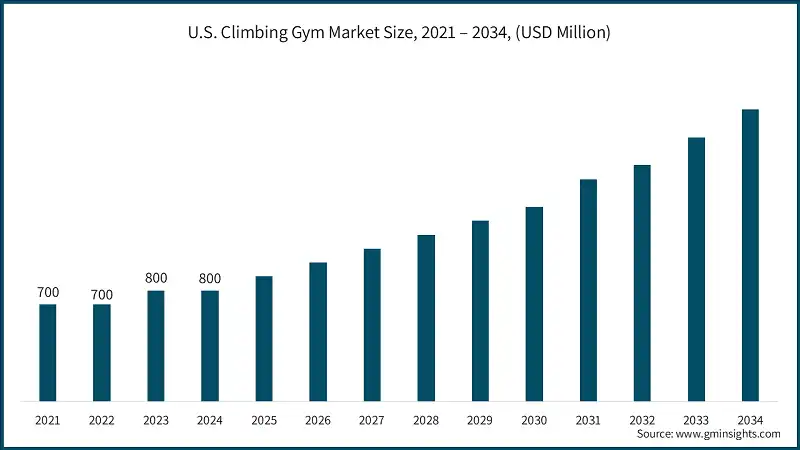

North America Climbing Gym Market In 2024, the U.S. contributed significantly to the market growth in North America, accounting for 72.1% share in the region. Asia Pacific market is expected to grow at 9.8% during the forecast period. Europe market is expected to grow at 9.1% during the forecast period. Major players operating in the climbing gym industry are: MetroRock’s competitive advantage stems from its strong focus on athlete development and competitive climbing. With elite training programs, mock competitions, and personalized coaching, MetroRock caters to climbers aiming for national-level performance. Their Rodeo Series and private training sessions simulate high-level competition environments, attracting serious athletes. This performance-oriented model, combined with multiple locations across the northeastern U.S., positions MetroRock as a hub for both recreational and competitive climbers. Housed in a transformed Victorian water pumping station in London, Castle Climbing Centre has historical architecture with contemporary climbing features. Its strength is its vast array of climbing options—boasting over 700 routes spanning indoor and outdoor bouldering, top-rope, lead, and auto-belay. The centre champions sustainability and community, highlighted by its vegetarian café, community garden, and inclusive training. With its esteemed reputation and prime location, it stands as a cultural beacon in the UK climbing community, drawing both novices and experts alike. Go Nature carves a niche in the Asia-Pacific arena by curating a lively, family-oriented climbing atmosphere in Hong Kong. Boasting two decades of experience, the gym serves a broad audience from kids to adults offering climbing lessons, birthday celebrations, corporate training, and social gatherings. Prioritizing safety and inclusivity, it serves as a welcoming entry point for climbing newcomers.Asia Pacific Climbing Gym Market

Europe Climbing Gym Market

Climbing Gym Market Share

Climbing Gym Market Companies

Climbing Gym Industry News

The climbing gym market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Billion) from 2021 to 2034, for the following segments:

Market, By Gym Type

- Bouldering gyms

- Top rope climbing gyms

- Lead climbing gyms

- Speed climbing gyms

Market, By Location

- Indoor

- Outdoor

Market, By Course

- Beginner

- Advanced

Market, By Membership Model

- Monthly/annual memberships

- Pay-per-visit (drop-in)

- Punch passes

- Corporate memberships

- Others (trial memberships, student memberships, etc.)

Market, By End Use

- Adult

- Children

- Corporate/Group Training

- Schools & Educational Institutions

- Therapeutic/Rehabilitation Use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the climbing gym market?

Key players include Brooklyn Boulders, Walltopia, MetroRock, Castle Climbing Centre, Go Nature H.K. Limited, BETA BOULDERS, Boulderklub Kreuzberg, Climb So iLL, CopenHill, Klattercentret, Momentum Climbing, Sputnik Climbing Centre, The Glasgow Climbing Centre, and Walltopia.

Which region leads the climbing gym market?

In 2024, the U.S. contributed 72.1% of the market share in North America. The region's dominance is supported by a strong climbing culture and significant investments in gym infrastructure.

What are the upcoming trends in the climbing gym industry?

Key trends include the integration of digital platforms for engagement and training, modular climbing wall designs, and the growing popularity of competitive climbing post-Olympic inclusion.

What was the valuation of the outdoor climbing gym segment in 2024?

The outdoor segment held 88.5% of the global market share and generated significant revenue in 2024.

How much revenue did the bouldering gym segment generate in 2024?

The bouldering gym segment generated USD 1.7 billion in 2024, holding the largest market share among gym types.

What is the market size of the climbing gym industry in 2024?

The market size was USD 3 billion in 2024, with a CAGR of 9.9% expected through 2034, driven by increasing urbanization, health consciousness, and the sport’s rising popularity post-Olympic inclusion.

What is the projected value of the climbing gym market by 2034?

The market size for climbing gym is expected to reach USD 7.6 billion by 2034, fueled by geographic expansion into Tier 2 and Tier 3 cities and advancements in climbing wall technology.

What is the current climbing gym market size in 2025?

The market size is projected to reach USD 3.2 billion in 2025.

Climbing Gym Market Scope

Related Reports